This post may contain affiliate links. Please read our disclosure for more information.

Come the end of this year, Mrs. Groovy and I will join the ranks of the early retired. This means we’ll enter 2017 without employer-provided health insurance. For the first time in decades, we’ll be responsible for protecting our assets from the ravenous jaws of the healthcare industry. Hello Obamacare.

The nice thing about Obamacare subsidies is that they are based on income, not wealth. The less you earn, providing you remain above the Medicaid eligibility threshold, the more substantial your subsidy.

Once Mrs. Groovy and I retire, we’ll be income poor and entitled to an Obamacare subsidy. How large will that subsidy be? Here’s the calculation.

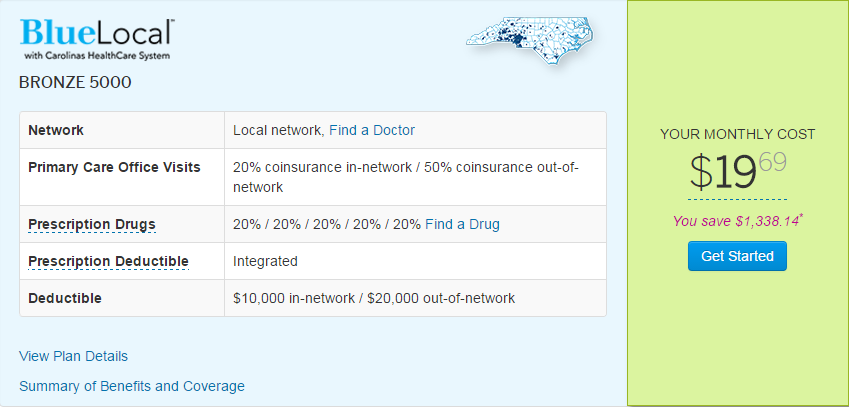

Between my pension and dividends from our brokerage accounts, our income for 2017 will be around $33K. But any money you contribute to a health savings account (HSA) is subtracted from your income for Obamacare purposes. Mrs. Groovy and I are big fans of HSAs and plan on contributing $4K each to our HSAs in 2017. This will bring our Obamacare income down to $25K. I then plugged this number into the subsidy calculator provided by Blue Cross Blue Shield of North Carolina, my state’s largest healthcare insurer. The results were shocking.

For the cheapest, high-deductible HSA eligible plan in 2016, Mrs. Groovy and I would be entitled to a monthly subsidy of $1,388. That’s over $16K for the year. And remember, this is the subsidy for 2016. The subsidy in 2017 will likely be larger.

Now, maybe I’m insane, but this bothers me. The taxpayers, many of whom can barely handle an unexpected expense of $400, will be giving Mrs. Groovy and me more than $16K. We, on the other hand, will be contributing, via property and income taxes, maybe $4K to the public good. This will make us net-takers to the tune of over $12K.

Is this right? Shouldn’t Obamacare subsidies also be based on one’s wealth? Or am I over thinking this? Mrs. Groovy certainly thinks so. She feels we have no choice but to take advantage of a system that is being shoved down our throats. For now, though, I can’t look at that net subsidy of over $12K and not think of myself as a soon-to-be teat-sucking layabout.

What are your thoughts?

Yeah the system is rigged, but what can you do? Consider the household earnings several hundred thousand $/yr with a mega-million dollar mortgage. How do you like handing over many tens of thousands to them in mortgage interest subsidies?

Public housing for the richest! 🙂

Great point. In New York, mortgage interest payments and property taxes are high. I keep in touch with my last supervisor from New York. Get this: he currently pays $36K a year in property taxes! So yes, the mortgage interest deduction and the property tax deduction are subsidies for those with big mortgages and big appetites for local government. If I had my druthers, I’d pretty much end all subsidies (including healthcare) for the middle-class and rich. But my fellow Americans have other ideas. They love trying to get something for nothing. Sigh. Thanks for stopping by, Justin. You reminded me of another misguided use of the federal government.

Thanks so much for at least acknowledging the moral dilemma here. It’s not reasonable to expect people to say no to legal subsidies, but I agree that they don’t make a lot of sense and I’d feel icky about it too.

Having some skin in the game makes a huge difference in people’s choices. If they’re not paying for anything, they want everything. If they have to pay, then they reconsider the risks and benefits of each test and procedure. Even if it’s only 5 or 10%, it reframes the question.

Unfortunately, costs are not at all transparent, and as a healthcare provider I still can’t tell you how much you’ll be billed for any given procedure because it depends on so many factors and I have no influence.

Excellent points, Julie. Price is not the enemy. Imagine if the automobile market lacked price transparency as well. How much would auto insurance cost if it covered routine maintenance and repairs and consumers neither knew nor cared about price? Two years ago during my wellness examine, the physician assistant suggested it was time for an ear cleaning. I agreed. “What’s another $20-$25 on my bill,” I thought to myself. Big mistake. When I got the bill, the ear cleaning, which took all of five minutes, cost $120. Never again. Now I ask what everything costs. And I won’t do anything until I get an answer. There’s a hospital in Oklahoma that has a price-list online for every procedure it performs. Here’s the link. Price transparency and competition might go a long way towards solving the healthcare crisis in this country. I wish more doctors and hospitals would give it a try.

And, yes, Julie, I have a lot of moral qualms about Obamacare subsidies. On the one hand, I shouldn’t be getting them. On the other hand, though, I want to stick it to the cool people. They wanted Obamacare, and they vilified anyone who didn’t want it. To them, anyone who wasn’t on-board with more federal control of health care was stupid, mean-spirited, and probably racist. So right now I’m going to stick it to the cool people. I don’t like it, but it’s the only way I know I can fight back. Perhaps I’ll have better options in the future.

We’ll be joining you as “teat-sucking layabouts” a year later, so we understand the concern. The hard thing is that Democrats who pushed Obamacare wanted a single payer option which would be far less of a drain on taxpayers (akin to Medicare), and which would have included means testing. It was Republicans who now fight Obamacare who said no to means testing and no to a single payer plan. Sigh. We just have to remind ourselves that we’ve paid loads and loads and loads in taxes while working, so even though we won’t be contributing much to the tax rolls as retirees, it’s not like we’ll have never contributed. The only other option that we see is moving abroad and being health care tourists, which we’re not quite ready for.

Hey, ONL. Thanks for stopping by. Excellent points. I’m definitely biased here. I worked for government for over twenty years. I’ve seen how the sausage is made. And I just don’t think the government, be it at the federal or state level, can do anything well or cheaply. So I’m very leery of single payer. But the current business model sucks the big one. So we got to keep plugging away and experimenting. Perhaps one day we’ll stumble upon a solution that’s satisfactory to all. And I think you’re on to something with medical tourism. The world is catching up and you can get excellent care at very affordable prices in Ecuador, India, and Singapore. Mrs. Groovy and I have definitely put medical tourism on our radar. Like you, we’re not quite ready to jump in. But we’re also not quite ready to be bankrupted by a relatively standard procedure (e.g., a knee replacement or a bypass surgery).

I’m a small business owner(53 years old) and have been self employed my entire working career.No paid health insurance, pension or company matching 401k plan.We stopped buying health insurance for the 3 of us when the premiums hit 780.00 a month.That’s a lot of dough so we terminated the coverage.We went four years without health insurance.

Fast forward to last year.It became mandatory to have health insurance so I contacted Covered California to see what they could.Next thing I know they put us in a plan that costs us zero ! I’ve had a colonoscopy, regular check ups, and eye glasses, my wife has had a colonoscopy,endoscopy,mammogram,eye glasses and other assorted preventive procedures.Our son has had a couple of check ups.The doctors and facilities have been excellent. The total out of pocket cost was zero. Awesome !

I don’t feel bad about this at all.I did what was required to do by law. Covered California put us in the plan.Besides,I spent many years paying super high health insurance premiums.I don’t feel guilty one bit.

As far as dental goes our plan covers some things but not others. My wife needed to have 2 root canals and crowns on back molars, but they are not covered. We found a great dentist in Tijuana that did an excellent job for 800.00 per tooth.Dentists here in San Diego charge about 1800.00 per tooth for a root canal and crown.Saved 2000.00 !

Hey Bobby, I agree with what you say. Health care is such a mess. Trying to manage it without subsidies will bankrupt you. (Thank God nothing happened to you during those four years you didn’t have coverage.) Mrs. Groovy and I are very interested in medical tourism. It makes so much sense and I think we’re going to see more of it. Glad to know there are affordable options so close. Our pharmacist’s father goes back to India for dental work! Thanks again for stopping by. Talk to you soon.

Medical tourism is the way to go. I’ve had dental and medical work done in Mexico and The Philippines. My wife is originally from Manila so I’ve been there many times.The doctors and dentists I’ve seen have been excellent.Same thing in Tijuana.

Here is an excellent dentist I use in Tijuana that you and your readers may be interested in http://www.ilovemydentist.com.mx/

Dr. Guevara opened his practice about two years ago. Previously he worked for many years in Boston(Dorchester). He’s taught at Tufts and Boston University too.He decided to open his own practice in TJ rather than San Diego, due to the high costs of owning and operating a dental practice in SoCal.He gives excellent personalized care for half of what it costs in SD.His office is an easy 5 minute drive from the border.

Geographic arbitrage is a great way to reach financial independence 🙂

Hey, Bobby. This is awesome. Thanks for the information. I’m working on a post and an ebook on medical tourism and this is a big help. Price transparency and competition would go a long way toward solving the ridiculous cost of healthcare in this country. During my 2014 wellness exam, I agreed to have my ears cleaned. I knew I would have to pay for it myself. I have a high-deductible policy. But I figured why not. How much could they charge for a tech to take five minutes and flush out my ears with a big syringe? $15 or $20? Wrong. $125! Never again. I always ask what a service costs now. And if they can’t give me an answer, or their charge is absurd, I’ll try another provider.

I used to feel bad about governmental systems that were designed in a way that people could use “loopholes” in them. I used to feel it was unfair for the people who don’t have time to think about abusing the system or deal with that kind of headache. Then I realized it was my own fault to not try and understand how taxes work because I was too lazy.

I have overpaid taxes for years because I didn’t want to bother. I think people on the path to ER “deserve” to take advantage of this kind of benefits because they spent significant time and effort trying to understand how the whole tax system works. At least I know this happened to me. Past me was whining about the “loopholes”, but did not take the time to look into how he could make the situation better for himself… well, until he did and became present me.

Now I feel they’re not “loopholes” anymore. They are the rules, and there are ways to follow the rules in a clever way if you make the effort to understand them.

Hey, Mr. Stockbeard. You are so right. Congress is the Santa Claus of everybody, not just the evil 1 percent. Obamacare is a prime example. The ability to be asset rich but still entitled to lavish healthcare subsidies is a “loophole” tailor-made for the middle-class, especially those from the ER crowd. Here’s another one. A married couple with an AGI of less than $74,900 faces a zero percent capital gains tax. So if Mrs. Groovy and I have a $100,000 capital gain in 2017, we will owe the federal government nothing for that bounty. The real divide in America is now between the lazy and the energetic. The energetic, regardless of social class, will find the congressional goodies earmarked for them and exploit those goodies to the fullest. The lazy will sit on their butts and rail against Wall Street fat cats.

It is a bit odd that wealth isn’t taken into consideration, I believe it is for student loans. If you really feel morally wrong to collect subsidies you could always get private insurance. That would be taken the REALLY HIGH moral ground.

When you say income from pensions and dividends, what exactly do you mean? If you are retiring early do you have any income from your pension?

Eligibility is based on AGI and dividends in accounts like 401(k)s wouldn’t count. Since I’m retired early I had to play around with what income would work best. I could have opted for the least income but that would have forced my kids into CHIP. I didn’t feel right about that so I inflated our income to make all of us eligible.

Also, when you pick your plan make sure you don’t just pick the cheapest. We could have gotten a cheaper plan for 2016 but digging a little deeper we found there wouldn’t be a hospital in-network within 80 miles. Having gone through a medical emergency with one of our kids, you realize how important that is.

If you feel slightly bad about getting the subsidies (and I actually do) here’s something to put that in perspective. Our kid’s broken elbow cost our $12,700 out of pocket in 2015. They’ll get to your wealth one way or the other.

Hey, Maarten. You make some great points. I don’t like the subsidies, but I’m going to take them. So what does that say about me? It’s very sobering to see how money can twist your morals. My only defense is that my accommodation of the subsidies is defensive. Obamacare, after all, is making me buy coverage I don’t want and don’t need (e.g., maternity care, pediatric services, mental health services, addiction treatment, etc.). I’d gladly forego the subsidies in return for more freedom. Now is this a legitimate defense? Or is it a bullsh*t rationalization? And I hear you about the healthcare industry’s ravenous maw. $12,700 for a broken elbow? I read recently about a journalist who was in India and happened to get the tip of his nose bitten off by a dog. The cost of the surgery to reattach the tip was less than $200. And the surgeon was trained in America. What ails our healthcare system most is the lack of price transparency and competition. Introduce these things and a lot of unaffordable care will suddenly become affordable.

Hey, Maarten. I forgot to answer your pension question. Yes, because I’ll turn 55 next year, I’ll be entitled to a small pension of $19K for the 20 years I worked for a municipality on Long Island. Does this disqualify me from claiming to be an early retiree? It might. Friends and family certainly don’t think so. They’re shocked that we’re in a position to quit our jobs at such a “young” age. Mrs. Groovy and I also don’t need the pension. We have saved considerably more than 25 times our annual expenses. So why are we taking the pension now and not waiting until age 62 when it will be a much larger stipend? We’re wimps. For all of our adult lives we’ve had regular paychecks. The reality that those automatic deposits will soon stop has us a bit frazzled. We thus see my pension as a safety net, something to help ease our transition from the world of regular paychecks to the world of capital preservation and the safe withdrawal rate.

I bought my own non-subsidized insurance plan separately from the exchange this year, but next year (depending on the scale of my side hustle income), I may qualify for a big subsidy or even for Medicaid. Imagine that: a perfectly healthy late-20-something adult capable of working a full-time professional job enrolling in a taxpayer-funded health insurance program intended for an indigent population. I’m with you — it feels wrong.

Prior to Obamacare, most state Medicaid programs were means-tested (i.e., you were only eligible with a very small net worth), but the ACA legislation was explicit in eliminating that criterion to focus on income alone. Means testing has its problems, too, though, setting up perverse incentives. It effectively punishes the people who save the most, which discourages that behavior. And there are always loopholes, like storing your wealth in your house and car, which are typically excluded from means testing.

That said, though, it would seem to me one of the only (maybe) politically viable ways to slow the massive growth of entitlement spending.

Hey, Matt. Good point about how means testing would set up a perverse incentive not to save. I didn’t consider that. It’s such a mess. Price transparency and incentives that encouraged competition and normal consumer behavior (e.g., seeking the best deal for your hard-earned money) would probably solve 85% of our current problems. But the ACA doubled-down on a business model that is the polar opposite. Who cares about prices? Healthcare’s a right, after all. Let employers and the state worry about the costs. What could go wrong?