This post may contain affiliate links. Please read our disclosure for more information.

Hello, groovy freedomists. Today we have the pleasure of sharing the exquisite financial mind of our good friend, Fritz, who blogs over at The Retirement Manifesto.

What we love about Fritz is twofold. First, he has a very engaging writing style. He communicates to you the way good friends do when they’re hanging out in a bar talking shop. In other words, he’s genuine. He’s not trying to impress you. He’s just sharing heartfelt knowledge.

The second thing we love about Fritz is that he’s a strategy guy. Take any financial topic—from starting an investing career to choosing an appropriate asset allocation—and he has likely posted a definitive how-to guide about it on his blog

And his guest post today on how to manage your finances in retirement is no different. It’s a freakin’ awesome how-to guide. Enjoy.

For decades, you’ve been diligently saving and building your nest egg to insure you’ll have a shot at maintaining an acceptable lifestyle in retirement. Once your working years are over, the focus becomes how to generate retirement income from the wealth you’ve built over your career. Or, in other words;

“How To Build A Retirement Paycheck”

Moving from an “Accumulation Phase” to a “Withdrawal Phase” is one of the most significant financial changes that comes with retirement. Unfortunately, there’s much less written about how to generate an income in retirement than there is about your Accumulation Phase. Today, we’ll address the Withdrawal Phase, outlining a strategy I’ll be using in my retirement.

How To Build A Retirement Paycheck From Your Investments

The Bucket Strategy

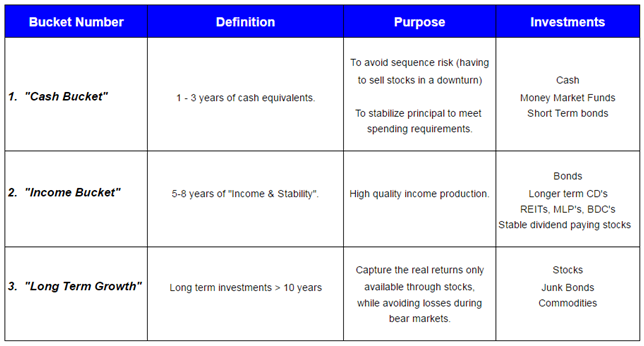

A common approach to setting your investments up for the withdrawal phase is to establish a “Bucket Strategy”, originally conceived by financial planning guru Harold Evensky (for a video of him discussing the strategy, click here) . Even though I’m still several years away from retirement, I’ve already been working on setting this up, and will share the specific approach I’m using. First, a description of each bucket.

Bucket One: “The Cash Bucket”

The cash bucket should be fully liquid, risk free and readily available. Depending on your risk tolerance, you should target to fill Bucket One with anywhere from 1-3 years of spending requirements not covered with other income (e.g., pension, social security, annuities). Your goal here is NOT to generate a high return, but rather to protect your spending requirements over the next few years.

To avoid sequence risk (having to sell stocks during a downturn), get your bucket filled PRIOR to your retirement date. I’m doing that now, and I’m ~2 years away from retirement. As a more conservative investor, I’m targeting 3 years of spending in Bucket One. Why? From 1966 to 2009, it’s taken the S&P 500 three years, on average, to return to it’s pre-crash high. You want sufficient cash in Bucket One to ride out a bear market.

Before retiring, insure you have sufficient assets to cover your annual spending requirement with a safe withdrawal rate of 4% or less (we’ll be targeting 3% in our retirement). For example, if you have $1 Million saved, 3 – 4% would give you a safe withdrawal rate of $30,000 – 40,000/year. A reasonable “Bucket One target level” for someone planning on spending $40k per year would be $80k – $120k.

To insure you stay within your safe withdrawal rate, set up at least one year of your “cash bucket” in a seperate account (I’m using CapitalOne), then establish an automatic monthly or bi-weekly transfer from that account into your checking account. Once it’s in place, you’ve established a “retirement paycheck”.

Bucket Two: “The Income Bucket”

The Income Bucket has a goal of generating income with controlled risk. Since you’ll be using the funds in this bucket to periodically “refill” Bucket One, you want to keep a focus on stability. However, to insure your investments are producing results and keeping up with inflation, you have to take some risk. While Bucket One is “No Risk, No Return”, you can think of Bucket Two as “Some Risk, Some Return”.

Investments in Bucket Two should focus on high quality fixed income assets (bonds, REIT‘s), with a smaller compliment of stable dividend paying stocks (e.g., JNJ) and other higher yield securities (MLP‘s, BDC‘s, etc). “Balanced” mutual funds with a blend of bonds and conservative stocks could also be considered for this bucket, as can mutual funds focused on dividends. In my portfolio, I consider my holdings in Vanguard’s Wellesley (VWINX) and Dividend Growth Fund (VDIGX) as elements of Bucket Two.

If you’re very conservative, consider this advice from Darrow Kirkpatrick and aim for 10 years of spending between cash and bonds. In that scenario, Bucket Two could represent 7-8 years of spending. For our $40k spender, that’d mean a reasonable target level for Bucket Two would be somewhere between $280k – $320k.

Several times per year (I’ll target quarter-ends) look for any asset class which has performed well, and sell portions of those investments to refill the cash in Bucket One. If (more accurately, when) we enter a major bear market, draw down the level of Bucket One for 1-2 years to allow time for your riskier assets to rebound. Alternatively, you can divert your dividend and interest earnings from Buckets Two and Three as a steady stream of cash into Bucket One. I think of the “dividend diversion” as a “Drip Refill” strategy, and plan on using that in my retirement.

Bucket Three: Long Term Growth

With the longest time frame, you shouldn’t have to tap the money in Bucket Three for ~10 years. Therefore, it’s focus is to generate the long term returns possible through stocks. Only stocks have demonstrated an ability to consistently outpace inflation. In fact, according to this article Meb Faber research, stocks have earned 5% over inflation in the past 10 years, compared to 2% for bonds and 1% for T-Bills/cash.

This bucket will have swings in value as the stock market does it’s normal thing. Since you don’t need to worry about accessing the money for 10 years, you can sleep at night through the next bear market, knowing that things will most likely recover before you need to tap into this stash. Don’t panic and sell in a bear, which will turn your paper loss into a real one. Likewise, look for strong market performance timeframes to siphon off some of the gains and diverting the funds to Buckets 1 & 2, locking the gains in for future use.

The Bucket Strategy – A Summary

How To Implement The Bucket Strategy

[bctt tweet=”Follow these steps and you’ll turn your investments into a retirement paycheck.” username=”retiremanifesto”]

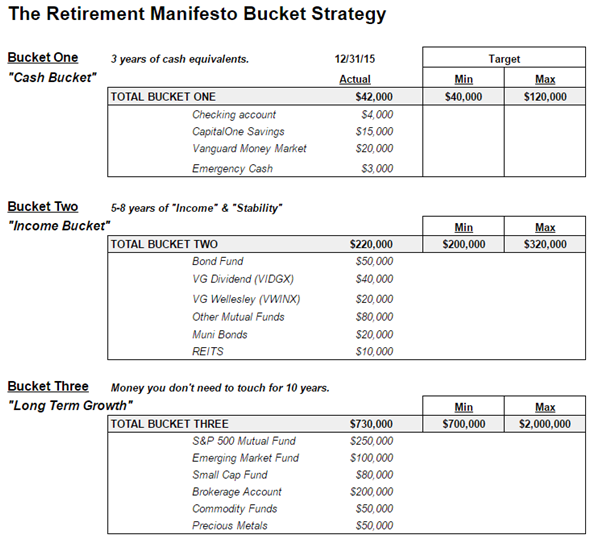

I’ve added a tab in our personal net worth spreadsheet, and have linked all of the line items from our individual accounts into their appropriate buckets. Here’s a screen shot from my spreadsheet, which I’ve modified a bit (e.g., not my actual $ amounts, I’ve eliminated the name of investment holdings, and I’ve adjusted the target amounts to reflect the $40k of annual spending used as an earlier example).

I’m using this exact format for our personal retirement planning, and will plan on updating our actual bucket holdings once per year as I’m updating our Net Worth Statement. At the end of every Quarter, I’ll review holdings for potential reallocation to insure I’m within the target ranges for each bucket.

Note: I’ve also set up a link to the spreadsheet created for this post if you’d like to work with it as a template. To access the spreadsheet, click here.

Conclusion

Managing your money during the Withdrawal Phase is significantly different than during the Accumulation Phase. Take the time to understand the differences before you reach retirement, and work to align your investments to deliver a predictable retirement paycheck for the rest of your life!

If you’re already in retirement, consider setting up a bucket system, especially if you’ve been having difficulties keeping track of your spending. Start with Bucket One, and establish a monthly automatic transfer into your checking account.

I’d welcome any of my readers who are already in retirement to comment on this post, let us know any other suggestions you’d recommend based on your actual experience. If you use something other than the “Bucket Strategy”, I’d welcome your thoughts on why you chose to go a different route, and how it’s working out for you.

Together, we can Help People Achieve A Great Retirement!

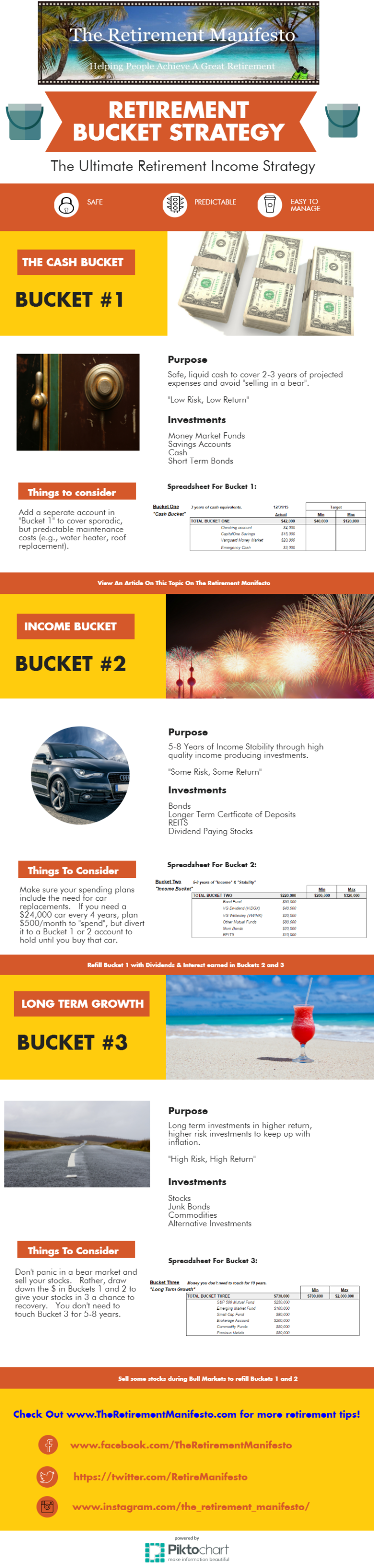

My First Infographic!!

To support this article, I just produced my first infographic, using The Bucket Strategy as my topic. Enjoy!

I’ve never seen retirement withdrawals so clearly explained. Thanks for hosting Fritz for this post.

ZJ, a sincere thank you for the kind words. A real compliment, and you just made my day!

Fritz is awesome! He has the patience to break down complex concepts and share them in an easy-to-understand way. I’m glad you found his post useful, ZJ.

Great info here, Fritz! Thanks for sharing. And the infographic – I’m going to have to give it a try sometime!

We are about 6-8 years out, depending on how real estate investing works out for us. But we need to start seriously working on Bucket #1 (hubby is afraid if we have too much cash on hand it’ll affect FASFA for the kids when they apply for college – anyone have thoughts on this?)

Amanda, check out episode 357 on Radical Finance where Joshua Sheats interviews Brad Baldridge. Brad discusses ways to maximize the application process. He also has a website: tamingthehighcostofcollege.com.

Amanda, thanks for the kind words. I’d support Mrs. G’s suggestion to “listen to the experts” on FASFA impact. I suspect any asset outside of retirement funds would be treated comparably, so whether it’s in “Bucket 1” or “Bucket 3”, if it’s in after-tax it’s likely to have the same impact.

Thank you both! Mrs. Groovy, I really appreciate the resources! I’m heading there today to soak it all in (and will listen to the recommended podcast this afternoon).

Very awesome article! Even though I personally like to prioritize Bucket 3 so that I get a ton of tax-sheltering benefit, there is plenty of merit to use all three. I can’t wait to build back up my dividend portfolio. I really enjoyed getting four figures of dividends trickling in on top of watching my equities grow!

Dividend investing definitely has its advantages. I like tax-sheltering too. We maxed out our employer plans the last few years which helped keep us in the 15% tax bracket.

MMD, as long as you have time before needing the money (e.g., early in your career), there’s no problem with “tilting” toward bucket 3. Bucket 1 is there to avoid having to sell equities after a major downturn, but it will result in a drag on your returns. Security doesn’t come for free.

This is a great post and the infographic continues to be very impressive.

For my “mini retirement”, I anticipate having 6 months to a year wroth in the cash bucket (the length of time really depends on how much I end up spending), and honestly the majority of the rest is in Bucket 2 type funds. That is, is funds that can provide some current income but also ongoing portfolio growth. There’s a tiny sliver of funds that might appear in Fritz’ 3rd bucket, but not too much. This is a tactical decision that I’ve made specifically for the mini retirement. I expect that I would transition back to a more growth focused portfolio when I return to full time work and can take advantage of regularly scheduled investing on the dips with the volatility that comes with more growth type funds.

Stay tuned – I have a post coming out soon regarding why I don’t need to optimize my tax efficiency with the 0% tax bracket applying to most of my investment income during the upcoming year off from work.

Saving and spending cash during your mini retirement and then getting back into growing the portfolio when you return to work sounds like a very good plan, TJ. I look forward to reading your upcoming post and finding out more about the issue of tax efficiency.

If you want to learn Infographics, try Piktochart. I didn’t know a THING before I started working on the infographic in this post. Took some playing around to figure it out, but if I can do it, all of you can do it, too!

Thanks for the tip, Fritz!

I am a huge fan of the bucket strategy for investments. This is such a simple way to ensure that you are setting up the right allocation buckets for retirement and keep you diversified.

BTW…also infographics I definitely want to learn how to do that this weekend!!!

Fritz didn’t know he’d be lighting a fire under us to learn how to do infographics. Thanks a lot Fritz – this better not mess up my MO of doing just one thing a day.

I love the charts and the infographics too! No idea how to do things like that. That’s what is great about this community! Always pushing us to try and learn new things!

I agree w/ Brian that bucket 1 is essential. Buckets 2 & 3 are also awesome in theory, but we simplify quite a bit by holding total market stock and total market bond funds. They cover all these categories but with lower fees and less hassle.

Jim Collins would be proud! Simple is better, especially with the great funds available now, low cost and diversification in one fell swoop!

We’ve got employer plans we need to roll over into traditional IRAs. We, too, want to simplify and boil it all down to just a few mutual funds.

Great overview. I like the bucket theory. I think that bucket one is critical. Having enough cash on handle to ride the early retirement wave. Similar to the importance of the emergency fund.

Brian, I couldn’t agree more. 2 years if you’re aggressive, 5 years if you’re conservative. Given today’s high market and bond valuations, probably safer to tilt toward the longer timeframe in Bucket 1!

Brian, we are in total agreement. We don’t plan on touching our nest egg for at least 3 years.

Nice infographic and summary of splitting up investments for retirement. We’re about 2 years out and recently realized, “Oh crap, we’ve got to figure out if our retirement strategy makes sense and what a good/better withdrawal plan might look like. Are there better ways to protect your nest egg and still expect good growth?” You know, those sorts of questions, lol. 🙂

Timely indeed!

Mr. SSC, happy to hear you’ll be able to put my suggestions to good use! THAT’S exactly why I put the effort into my site, and I’m pleased that The Groovies thought highly enough of this one to share it with their readers!

Isn’t his infographic awesome? I opened the post this morning and for a second I forgot that we were hosting Fritz’s post. And I thought, when the heck did Mr. G learn how to do that?

Always learning, Mrs. G. Always learning!

You guys are freakin’ Groovy! Thanks SO much for your kind words about my work, you brought a HUGE smile to my face this morning!

You are freakin’ GROOVY too, Fritz! Thanks again for making a major contribution to our site!