This post may contain affiliate links. Please read our disclosure for more information.

To travel hack, or not to travel hack, that is the question:

Whether ’tis nobler in the wallet to suffer

The slings and arrow of outrageous redemption policies

Or to take arms against a sea of complications

And by finding the right card gain free airfare to Chiang Mai

Mrs. Groovy and I have always been intrigued by travel hacking. Get a couple of credit cards geared for travel, use the cards to buy what we would ordinarily buy anyway, and bam!—we’re suddenly flying first-class to Sydney for free.

Yes, in theory, travel hacking sounds marvelous. But whenever Mrs. Groovy and I caught a travel guru on some podcast explaining “churning” and other travel-hacking techniques, we would invariably look at each other at some point in the show and say, “no freakin’ way.” The whole travel-hacking enterprise just struck us as way too complicated and way too time-consuming.

But now we’re having a change of heart.

This is partly due to our fellow bloggers. Over the past two months, we’ve come across a spate of travel-hacking posts that have done a great job of demystifying the how-tos of travel hacking (see here, here, and here). In other words, because bloggers rule and podcasters suck,* the whole travel-hacking enterprise now seems a lot more doable.

Our change of heart, however, is mainly due to this: We’re building a house. And in the next six months or so, we’re going to spend roughly a quarter of a million dollars. If spent strategically, that quarter of a million dollars could turn into a bounty of travel-reward points. [Mrs. Groovy here. Keep in mind that a small custom home builder may not accept payment by credit card. We’ll have to find out.] What kind of financial bloggers would we be if we walked away from such an easy win? Would we be shunned by our blogging peers? Would sweet, lovable Tonya revoke our FIRE card?

So will we finally give travel hacking a try? Maybe. Here are our main concerns.

1. We have no debt and our credit score is excellent. But our household income is only $30K. Does that qualify us for a Capital One Venture card or a Chase Sapphire card? [Mrs. Groovy here. Does retirement on a fixed income qualify us for any card? Never mind a travel rewards card.]

2. Even though the annual fee for the most popular travel-reward cards is usually waved the first year, the thought of paying $95 annually in year two and beyond for each travel-reward card we get makes us shudder. [Mrs. Groovy here. I think the idea behind churning is to cancel the card before you’re hit with fees. Then you open up another one. But wouldn’t that mean you need to use the points before you cancel?]

3. And speaking about travel-reward cards, our current financial footprint is extremely uncomplicated. Do we want more passwords, credit lines, and payments to manage?

4. Accumulating points—especially the bonus points—sure looks easy. But what about redeeming points? Credit card companies aren’t on a mission to lower our travel expenses. They’re on a mission to make us one of their many profit centers. So how many hoops will Mrs. Groovy and I have to jump through to make our dream vacation a reality? The cynic in me says that redeeming points will be a royal pain in the arse. [Mrs. Groovy here. I agree, especially when I think the pain is mostly gonna be in my arse.]

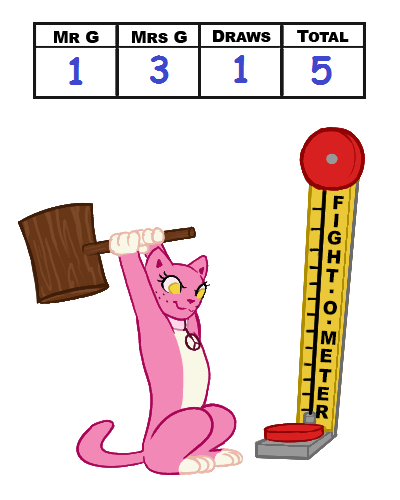

Fight-O-Meter

No fights this past week. The Fight-O-Meter remains the same. Mrs. Groovy holds a 3 to 1 lead.

Final Thoughts

Okay, groovy freedomist, that’s all I got. What say you? Should we break out of our comfort zone and dive head first into the maelstrom of travel hacking? And if we wimped out and took a pass, would you cry havoc and demand that we surrender our FIRE cards? Let me know what you think when you get a chance. Peace.

* Only kidding about podcasters sucking. Podcasters don’t really suck. In fact, without podcasters, our daily constitutional would suck bigly. No, my saying that podcasters “suck” was just my ham-fisted way of saying that Mrs. Groovy and I can better make sense of the intricacies of travel hacking via the written word than via the spoken word. That’s all.

Hi there!

I just came across your post today and thought I’d chip in with my two cents.

Travel hacking is not hard. I tried to write a comprehensive post about it explaining some of the ins and outs about it. I linked it to my name if you want to check it out.

I’m always dishing out free travel hack advice to friends and fellow bloggers. Feel free to ask and I’d be happy to help 🙂

Thanks, Mr. McFrugal. I really welcome your two cents. Checking out your travel-hacking post today. Cheers.

Groovy friends, we are in the same boat! It seems like such a “of course we will take advantage of that!” but then managing all the cards, renewal fees, minimum spends, how do you use the various points to get the trips you actually want… we are being kind of cowardly right now. :/ If you figure it out, please share your secrets!

Hey, BE. Sorry for the late reply. Somehow I missed your comment. But, yes, we’re cowardly too. I think if we just keep it simple and get two cards, a Chase Sapphire for me and a Chase Ink for Mrs. Groovy (as The Luxe Strategist suggests), we might be able to pull it off. We’ll see. Overcoming that coward inertia is hard.

I took the excellent TravelMiles 101 course (free at https://www.travelmiles101.com/101) and learned a lot.

The Mad Fientist also has some great info in travel hacking.

Ultimately we decided to go with a cash back card, mostly for simplicity. They typically offer 1.5% back, and we enjoy the freedom to use it as we see fit. The travel ha king points typically accrue at a higher percentage, but this was a good trade off for us.

Keep the posts coming, Mr. Groovy!

At the very least, we’ll get ourselves a good cash-back card. We’re good managers of debt, never carry a balance, and it’s foolish not to make the most of that good fortune. Thanks for stopping by, Mr. G. And thanks for link and mentioning the Mad Fientist. I forgot that he’s an accomplished travel hacker.

I’m like the old you, it sounds nice but it also sounds like more work than me just consulting a few extra hours and getting the ticket that way. But if I was building a house…..??? That would be intriguing. I think you should go for it and then explain it for your readers (OK, mainly for me).

Thanks, Steveark. Blogging about our travel-hacking experiences should help a lot of people. I’m just hoping our experiences–should we decided to give travel hacking a try–don’t turn out to be a cautionary tale.

Just last week I got my first ‘travel hacking’ credit card. I’ve been meaning to do it for awhile and finally went for it because we were just about to book our summer road trip so I’d have enough payments on it to hit the sign up bonus. Now bring on ALL the free travel (wishful thinking?)

I’ve always had some concerns about churning cards so I’m not going to go crazy with opening/cancelling cards. We also have way fewer options in Canada so that cuts down the temptation.

PS Keep up the good work on the Fight-O-Meter Mrs G 😉

Woo-hoo! Now I have another reason to visit Smile & Conquer. Can’t wait to see how your first track-hack adventure turns out.

P.S. Do you believe that the expansion Vegas Nights have one the best records in the league and Stanley Cup royalty like the Islanders and Oilers won’t even make the playoffs. Talk about bizarro world.

The comments are as good as the post – super helpful w/ tons of great info!

Agreed. The personal finance community is the best community on earth.

I’m with you. I never caught the travel hack bug but since we spend sooo much money every month…maybe we should. Definitely on the to do list!

Thanks, Doc G. I suppose any financial blogger worth his or her salt should at least give travel hacking a try. With two cards the downside should be minimal. We’ll keep you posted, my friend. Cheers.

I’ve been kicking the can down the road on travel hacking for a while now. I do have a great rewards card that I use for everything, so in a way I’m doing it somewhat. But I haven’t done the card-churning yet. Like you I’m worried about complicating my already complicated life.

Congrats on a fight-less week 🙂

Fightless week was great. And we just completed round two with our designer. Again, no fights. The Groovies are once again carrying on as a unified team. But will it last? Thanks for stopping by, AF.

For people like us who barely travel much we still do some credit card reward hacking on the side. It’s useful because you never know what might happen especially when you have family in different states! Jared likes doing it because he enjoys…(it weird) he likes reading the small print of things and making fun of them. He’s also great at details and bookkeeping so he’s usually on top of it. It does take some time though 🙂

We love small-print money nerds here. So Jared’s a cool dude. Do I have the stomach for small print and bookkeeping on two cards? I think I do. I do my own taxes every year, and wading through IRS nonsense has certainly giving me enough practice. Right now I’m leaning towards giving travel hacking a try. We’ll see what the boss says, however. Thanks for stopping by, Lily. Always a pleasure hearing from you.

Thanks so much for the link! I’ve actually been thinking of writing a ‘travel hacking myths’ post, and judging from the comments here, it’s totally needed!

I would love to see you guys sign up for new credit cards, especially as meeting the minimum spends is the main barrier, and that won’t be a problem with the house building costs.

My answers to each question:

1. We have no debt and our credit score is excellent. But our household income is only $30K. Does that qualify us for a Capital One Venture card or a Chase Sapphire card?

Answer: Your approval is determined by your credit score, so you should be fine. The income you put in the app isn’t verified, but will probably affect the credit card limit you receive. If the limit is low, you can always call the CC company later and ask them to raise it.

2. Even though the annual fee for the most popular travel-reward cards is usually waved the first year, the thought of paying $95 annually in year two and beyond for each travel-reward card we get makes us shudder.

Answer: Think about it this way: wouldn’t you pay $95 to get a $950 flight? Would you think that’s worth it? If you go with Chase (which is what I would recommend) if you don’t want to pay the fee, you can open up a no-fee card in the same program (like the Chase Freedom and then move the points from the fee card down to the no-fee one). However, you shouldn’t have a problem using the points before the annual fee comes up.

3. And speaking about travel-reward cards, our current financial footprint is extremely uncomplicated. Do we want more passwords, credit lines, and payments to manage?

Answer: So, open up one card each. You can’t manage ONE extra card! If you have too many cards, you keep the ones you’re not using in a drawer at home.

4. Accumulating points—especially the bonus points—sure looks easy.

Answer: You do need to be good at planning. Thankfully, Chase points are extremely flexible and there are multiple ways to redeem:

-Cash

-Booking travel through their portal for 25% discount

-Transferring to airlines for flight (this is the best value)

I think you should get the Chase Sapphire Preferred (50k points) or Chase Ink Business card (80k points). That’s just one card each to start. What you do is one of you opens up one card, then refers the other for the same card. Then you get an extra 10k points.

You do NOT have to churn cards. That’s a myth. Just start with one card each to try it. If you can’t redeem for flights with miles you can always pay out of pocket and then redeem the points for a statement credit.

I have a referral link to the CSP if you want!

The Luxe Strategist recently posted…How a Non-Rich Person Started Investing, and Why You Should Start, Too

Thank YOU for this extremely helpful comment. I’m going to save it in my Travel folder.

When I checked out the travelmiles101 site a current post made me think of you. You mentioned something on Twitter about Iceland? You should check this out.

“You do NOT have to churn cards. That’s a myth. Just start with one card each to try it.”

You’re a bridge over troubled waters, LS. If there’s any blogger giving me the courage to overcome the evil pull of inertia, it’s you.

You should absolutely try travel hacking and report back so that all of us who are in a similar position can benefit from your experience! I’ve always done cash rewards and been pretty happy with it, but I’m at the point where travel hacking intrigues me. I don’t have any particularly large purchases coming up, but I do think we could make a go of it anyway.

Gary @ Super Saving Tips recently posted…Stock Market Volatility Is Always an Unwelcome Event

We’ll report back for sure if we give it a try, Gary. I had no idea so many of us are in the same boat, especially since the personal finance community is filled with travel hacking stories.

We’ll keep you posted, my friend. As I pointed out to another commenter, just buying our kitchen appliances will secure the bonus points of any number of travel-reward cards. Throw in some furniture and a riding lawnmower and we’ll be able to secure the bonus points of another travel-reward card. Seems to easy to pass up.

We are new to travel hacking. Our first two cards were Chase Sapphire Preferred cards. I opened one and then my wife opened one after we hit $4K in spend on the first card. Just from those two cards, we are going to be able to fly to Dublin, Ireland from Philadelphia for about $300 out of pocket. That is about $1500 in savings. Our plan is to churn 4-5 cards per year. We only take one major vacation every summer. Opening and closing a few cards every year for a free vacation seems worth it to me.

Woo-hoo! That’s a major coup getting those Dublin flights. Nice going!

That’s awesome, Dave. Enjoy the multiple pints of Guinness.

Sounds like a layup if you can stay organized and disciplined. We saved some considerable cash during a family trip to Disney last year. Hotel and airline for our family of five all booked with reward points. We’ve now closed most of those cards to avoid any mishaps.

Brian recently posted…Teaching Your Kids Financial Discipline

Considering the park fees and the restaurant prices, using rewards for a Disney trip is a huge win. Mr. G’s sister was at Disney last week and described for us last night a $25 breakfast she had. It consisted of a small sliver of quiche and a few little pieces of fruit.

Nice, Brian. This is what makes the notion of travel hacking so tantalizing. Layups!

I haven’t dipped my toe into that arena yet, due to the same thinking you guys pointed out. However, I will click over to the other blog links (thanks for those!) and check them out. Since this year’s FinCon is coming out of my allowance funds, I want to minimize that as much as possible.

Funny how when it becomes “my money” getting spent, I’m like, “Whoa, whoa, I gotta figure this sh!t out quick!” lol

Mr. SSC recently posted…Stick to the Plan or Chase Adventure?

Is your allowance fund sort of like what Dave Ramsey calls blow money? Will Mrs. SSC travel to FinCon too?

So, no… on the allowance. We realized early on we have totally different views on money. In a sense it’s “blow money”but I’ve never listened or read any Dave Ramsey so I have no clue if it’s the same. Essentially, it was Mrs. SSC’s way of damming up the outflow of cash from me early on. Have I mentioned I used to really suck at money? We both knew of couples that had “allowances” and it seemed to work well for them. So we implemented $500/mo each as allowances, this was pre kids and it covered “anything that won’t benefit the other person.”

Since then it has grown to include any restaurant meal, and clothes, and has dropped $100/month… so yeah, now that my “hobby money” has to cover fincon… yipe!!!

I like spending my allowance, so I’ve got to find a hotel card soon to cover the stay and use it for “allowance” purchases to make whatever limit it needs. Sorry for the long reply. 😁

Mr. SSC recently posted…Stick to the Plan or Chase Adventure?

Don’t be silly about the long reply! We love long replies!

It’s always fascinating to hear how other people handle their finances. It can get tricky with couples, no doubt. We are so plain and simple vanilla. Our money is in one pile and one pile only. However, Mr. Groovy keeps mental tabs on money he’s spent on his bucket list trips with his NY buddies. He reminds me once in a while that I should spend the same amount on myself. But that’s just silly to me. I have nothing I want to spend on just to match what he’s paid for his trips. However, I told him when we move I’ll take us girls in the family to a day spa for an afternoon of pampering.

I forgot, no there will be no Mrs. SSC at fincon. Unless we get her parents to watch the kiddos and she wants to go lose her voice talking so much (a bit of an introvert) it does not sound like her idea of a good time. But! If you guys road trip through our area, you have an open invitation whether it’s houston, canyon lake, or TBD.

Mr. SSC recently posted…Stick to the Plan or Chase Adventure?

I already started a FinCon packing list. And the first thing I put on it was Ricola throat lozenges.

Thank you so much for the invitation. We want to get a camper after our home is done — it would be great to get together.

You and this whole community provided the reason for our decision to go to FinCon. I was on the fence. I’m not an introvert but I really don’t like large group settings. I don’t like hype. I don’t like cliques. But I do like hanging out with friends and having fun so we are expecting to do some of that with you!

It’s amazing how a future travel expense concentrates the mind. We’re within driving distance of FinCon 18, so at least we get to avoid the air fare. Didn’t think about using credit card points to reduce or eliminate the hotel bill, though. You got me thinking, Mr. SSC.

I don’t travel hack because travel is just exhausting with children in diapers…maybe in a few years.

With that being said, we have the IHG Rewards Card that gives us a “free” annual night each year for a $49 annual fee–it saves us between $50 and $150 depending on where we stay. It comes in handy as we travel to see family and book a hotel room I also have 200,000+ points from my corporate days and owning the card means our account doesn’t go inactive and I lose the points.

Currently, we use a 2% cash back card because the cash statement credits are more practical for us and indirectly buy us a small vacation each year.

Also, I’m sure you’re already familiar with the Chase 5/24 rule.

Josh recently posted…Is The National Debt A Reflection Of Our Society?

I like how you’ve tailor-made your system, Josh. Not too shabby on 200K points, a free room, and 2% cash back!

I’ve heard of Chase’s 5/24 rule. I don’t see us having a problem with that at all.

Thanks, Josh. You gave us a lot great advice to consider.

Many of the cards allow you to transfer points out to other programs, for example Some can transfer to say American Airlines or United points for future use (Amex and Chase come to mind but check transfer rates). So even if you cancel there’s usually a way to get the points out first. If your really worried about it get a cash back card. Then just take the points as a credit on your bill. Bank of America premier currently has a 500 dollar out. Schwab Amex premium allows you to transfer points to a brokerage. Discover it is another good one for those less travel inclined.

FullTimeFinance recently posted…The First Million is the Hardest

Thanks for the suggestions, FTF. I’m glad Mr. G did this post because there’s a huge learning curve for us in this whole credit card hacking/churning world. I had no idea any points were transferable.

I didn’t know points were transferable as well. That’s good to know. And very encouraging. Thanks for sharing your knowledge, FTF. I appreciate it.

A reasonable compromise might be to get a fee-free 1st year rewards card for an airline that flies out of your local airport (an airline like Delta whose miles never expire) AND a good cash-back rewards card. For instance, I just earned 60,000 Delta miles (Gold Delta Amex) after only $1,000 spend in 1st 3 months. Easy to track online. Then, get a cash back rewards card in the other spouse’s name. Maybe your builder will let you pay for supplies with your cc or buy them yourselves. You could save money on his markup, and buy what he needs online, as he needs it, and have it ready for him to pickup at store (at Lowes or HD, anyway). Add that to your builder’s contract, or add that he will use your cc if he gets a builders discount, etc.

After earning the bonus miles on the 1st airline card, maybe you downgrade to free card, and then apply for same fee-free 1st year card for the other spouse so they also earn the bonus miles. Meanwhile, you could do the same with the cash-back card if they offer a sign up bonus for each card. It sounds like you could meet the required spend for each airline rewards card in the 1st month with no admin sweat at all. Try it, at least! You may need a vacay after all the stress of the build, haha!

Also, Mrs. Groovy, remember that the cc apps allow you to list total household income, whether or not you spend it, so include all dividends, cap gains, Roth conversions, etc., etc. Ours is all on our tax return if ever asked, but no one has ever asked. Just try one 1st yr fee-free airline card each, would be my advice. You can also do the cash back card for everything else.

Personally, I think the extreme churning and MS spend is the admin nightmare, time consuming stuff. I also avoid it all. But one bonus airline card each is pretty simple stuff to me! The cash back rewards seems like a no-brainer considering the build expenses.

Best to you both on the build. Really enjoying following along with you both!

You mention some good compromises, Lisa. Thanks for laying this all out for us.

I think some of the builders use suppliers that are not Lowe’s or Home Depot . They may even use a huge one that’s smack in the middle of our town — but it’s possible we could work something out.

Our low income is including dividends and capital gains, LOL. But The Luxe Strategist pointed out above that credit card companies don’t verify income so that may not be a hurdle.

They don’t check income, and another interesting thing I found after freezing my credit a few years before I retired…your credit report is “frozen” with your info/employer at the time you freeze it. Found that out when I unfroze my credit for a few days at the bureau the cc used, but the online app could not confirm my identity when I listed Retired. I pulled my own credit report for free, saw my old employer still listed, did another app listing old employer and salary, and bingo, my identity was confirmed, app approved, and good to go. Called credit bureau later, and a real human confirmed that your report is literally “frozen” with info on it at the time you freeze it, and cannot be updated or changed after that until/unless you report new info yourself. So, just sayin, cc doesn’t confirm income, but they do confirm app info against your frozen credit report info. If either of you were working when you froze your credit, like me, they will expect you to list the employer still on your frozen credit report to confirm your identity. I think Doctor of Credit lists the bureaus each bank uses so you can just unfreeze that bureau’s credit report for a few days before you submit your app. Hey, they make the rules, not us!

Wow, Lisa. That’s very interesting. Thanks for sharing.

The annual fee scares me a bit. We simply use a cash rewards card that earns 1-3% back based on the type of purchase. It doesn’t cost anything to have, and we use it for every purchase we can. We normally cash out the rewards at the end of the year and use it for X-mas expenses!

Getting as much as 3% is pretty darn good. I know it depends on the type of purchase.

Yep, some of the fees scare us too. And they also piss me off. I don’t like paying for the privilege of using debt. Even if they are giving me something in return — they’re counting on getting more out of me than I am out of them.

Yep. Paying an annual fee for a credit card is now as sacrilegious as paying for news via a newspaper. The annual fee is what’s giving me the most psychological drama.

Go for it. Redeeming the points isn’t any more difficult than booking a flight or booking a hotel. Chase has a great site for redeeming points.

I did Chase Sapphire last year and it was great. I canceled when the annual fee showed up on the statement and they gave me a refund.

Thanks for the encouragement.

It seems that Chase is the Grand Poobah of all cards. I’m very surprised they refunded the fee without you twisting their arm.

I think they will refund the annual fee if you catch it before 30 days. Enjoy! 🙂

Good to know, Joe. Thanks.

That’s good to know that Chase treated you well. If we do decide to venture into travel hacking, we’ll more than likely apply for the Sapphire card. Thanks for chiming in, my friend.

I put my foot into the credit card hacking concept before planning to travel and it was too many cards to keep track of, so I ended up closing them all out within 6-12 months of opening and sticking with our old standby, Chase Unlimited Rewards.

We may open a Sapphire, but the yearly fee is annoying after year one (you can transfer points to another Chase fee-free card before closing BTW to not lose the rewards).

One reason I’m glad we did close out those cards: we got hit with a local fraud who stole our regular credit card and shopped around. Luckily, they were caught within 5 minutes of their purchase since I setup alerts for any charge over $1 on our card. I called the company, my husband called the store, and said person was nabbed at the next store.

For that reason alone, I was reminded why I was glad I didn’t have a bunch of cards to keep track of and companies to call. Just having one works for us for now. Maybe when we become super world travelers, but for now 1.5% points vs 2x is worth it for peace of mind.

And after the Equifax breech, I froze my credit report so I can’t open anymore in the churning process even if I wanted to in a weak moment.

Kate recently posted…Jason from Winning Personal Finance – LLP013

I didn’t even think of the additional fraud exposure. That’s a good point. Way to go in helping to nab the crook!

Not that I want to twist your arm to get back into the credit cards, but we both have credit freezes too. Here in NC it’s easy to “thaw” and then refreeze again on line, with no fees.

Oh, wow, Kate. Thank you. The increased risk of fraud didn’t even cross my mind. We have a credit freeze as well. And our two cards have respective limits of $1,000 and $5,000. So right now, identity theft can do little damage to us on the credit card front. And I love the strategy of setting up $1 alerts. That’s brilliant.

We have a single credit card – the Citi Double Cash Back card – and we put as much on it as we can. Of course we pay it off every month (never carried over a balance) and we get about $2,000 per year in cash back that we apply to our vacation/travel budget.

Brad – MaximizeYourMoney.com recently posted…Why You Need To Understand How Mortgages Work

That’s a simple and clean method. Glad to hear it works for you. We’ll keep that card in mind, thanks. I think I could live with $2,000 cash back.

Love it, Brad. Simple and good. As Mrs. Groovy pointed out, I think we can live with $2,000 cash back. Thanks for the tip, my friend.

I thought I would try it last September and signed up for two new cards (Canada doesn’t have as many great deals) with cash back offers. Sounded great, except I forgot I had to spend a minimum on one of them and kept using the wrong one. Anyway, a few months later and I just find it a real pain overall. I will probably cancel at least one of them at the end of the free year. It’s too much admin work for me right now, I can’t be bothered. I will stay with my current card:)

Caroline recently posted…Income, Expenses & Goals Update – January 2018

I could totally see us using the wrong card, too.

I think we’d meet our minimum spend pretty quickly. Otherwise I wouldn’t want the thought of it encouraging us to buy more just to meet the minimum.

I hear ya about the administration work, Caroline. And that’s probably my biggest fear. But I am retired. If I can’t handle the administration work now, I’m pretty pathetic.

Travel hacking is something I want to get into but seems like an administrative hassle, to be honest. For that reason, ESPECIALLY if you’re not planning on doing it much more than one time, I’d probably let it slide and instead of travel hacking, just look for good general rewards cards if you can. Seems like a better fit, IMO.

Dave @ Married with Money recently posted…What To Do With The Market Going Down

That might be the way to go. But I’d like to compare current offers to see what’s out there. A few websites keep good tabs on all of that — one of them is travelmiles101.com

Thanks, Dave. One way or another we got to do better with our credit cards. We use them often enough, and always pay the balance in full every month. So at the very least, why not seek out the best cash-back deals?

I feel your pain. I kept getting denied for awhile not because my credit was bad and I didn’t have a good paying job (on the contrary!), but I think it’s because I downgraded an existing card to avoid the fee, which might have been a mistake because why then would they issue me a new one? I’m still not 100% sure but just as I was about to buy my new expensive computer, I got a new cc. I do hate that it’s somewhat complicated/messy and you have to practically have spreadsheets if you do it right, but considering how much you are going to be spending, I can see where it would be totally worth it for you to get at least a couple to use for travel. And if not travel then cash back, although you don’t get as much money doing it that way. PS, I will never revoke your card! 🙂

Thanks for sharing your experiences, Tonya. It’s nice to see that I’m not the only one who has reservations about travel hacking. I already have enough spreadsheets in my life. Do I really want another one? But then again, just buying the appliances for our new house will secure the 50,000 bonus points of a Chase Sapphire card. That’s looks like really low-hanging fruit. Ah, decisions, decisions.

Mr. G, I have never travel hacked and do not plan to do so. Just to much administration to keep track of. We have one credit card that we charge everything to that rewards us with about 2% cash back. That’s good enough for me. I understand your hesitation. On the other hand many folks swear by it. Tom

Tom @ Dividends Diversify recently posted…My Only Regret In Life: Speed To A Million

That’s the thing. Mrs. Groovy and I definitely have to up our credit card game. We’re leaving a lot of rewards on the table. So at the very least we’ll get cards that offer better cash-back opportunities. On the other hand, there are many bloggers who we admire and respect that swear by travel hacking. And it’s very hard to discount their enthusiasm. Aaaarrrrgggghhhh!

I grapple with the same issue. Seems like a lot of work but worth the savings I guess. I have a Chase Sapphire but missed the 100k points and the cost is expensive….so we may drop it next year. We will see.

When you say you missed the 100K points do you mean they expired? Or you got in on a different promo? We’ll really have to decide how far we want to tread in these waters.

The promo went away. Still got 50,000 points though.

That’s 50,000 more than I got!

I hear ya, DDD. Chase Sapphire appears to be the top card for travel hackers. But the $495 or $95 annual fee is very off-putting.

You left out “Friends, Romans, Countrymen, Lend Me Your Ears. I come to bury travel hacking, not to praise him.”

I can TOTALLY relate to your anxiety over the seemingly complex world of churning for miles. I’ve avoided it for the same reason (tho, I’m biased since I’ve got ~1 Million miles on Delta from all my years of global travel).

I’m all about avoiding pains in the arse. Gotta say, tho, you do have an opportunity given the housing spend. May be worth a try. Just wear bike pants, they’re padded and will cushion your arse.

So funny, Fritz. Coincidentally, two nights ago we watched the Little Rascals episode called “Beginner’s Luck,” where Spanky was in a talent show reciting the Friends, Romans, Countrymen speech, while the kids in the audience assaulted him with pea shooters.

Sure, rub it in with those 1M miles.

I love Spanky! Trust me, I earned every one of those 1M miles! Only 1 more international trip (Switzerland in May) and I’ll be DONE!

Haha! There’s the rub, my friend. In one corner we have complication. In the other corner we have a bounty of travel points. And in the early rounds, especially since we’re building a house, the bounty of travel points have a decided edge. I’m leaning toward giving travel hacking a try. But I’m very leery. Thanks for stopping by, Fritz. And when are you going to do a post on your 1 million miles? I’d love to hear what you and Jackie do with those miles. Cheers.

I think you should go for it. If nothing else, it’ll make great fodder for your blog! (Oh no, The Groovies are becoming travel hacker bloggers!).

The funny thing about having so many miles….Jackie and I are both pretty much done with the international travel. I’m burned out from so many trips for biz, and we’ve knocked off most of the countries we’ve wanted to visit in the 30+ years I’ve been working. At least they never expire….

LOL! That’s exactly what I said to Mrs. G. Building a house and exploring travel hacking will certainly give us plenty of future fodder for blogging. And I hear ya about the sheen of travel coming off fairly quickly. I remember when I first started traveling for work. I thought it was so neat. Then, after just a couple of trips, it got very old. I soon began to dread every trip to Dallas. Quick question: Can you use your Delta miles for domestic travel?

Yep, we can, and we have. When we flew out to see our daughter in Seattle for Christmas, it was compliments of Delta. I suspect we’ll burn most of them flying out to see her!

I shouldn’t even comment here because I’m currently in the exact same spot that you were about travel hacking. It sounds like a pain and way too much effort, so I can’t even bring myself to read posts about travel hacking. But maybe I’m totally wrong too…idk. I just wonder, can the points or miles really be better than the 1-5% cash back I earn with my Discover card or my Amazon (Synchrony) card? I mean the money I earn adds up! Can a really do much better in travel savings? And then the restrictions? Again, I have no idea and I’m too lazy to figure it out, so I’ll just shut up now.

We’re so lazy about figuring it out that we don’t even have a cash back rewards card. We get some rewards on one account which we redeem for gas gift cards. I would guess that amounts to a few hundred dollars a year but we don’t even know the spend levels that are required.

We’re right there with you, Kat. The older I get, the more I appreciate simplicity. And that’s my main resistance to travel hacking. Is the complication worth it?

It almost sounds like as much of a pain as managing a bunch of rental properties….haha, but I digress…

Kat recently posted…Investing in Student Rentals: the Pros, the Cons and the Chaos

Great analogy, Kat. Now you’re really scaring me.

I am going to follow along on this one! I’ve never gotten into the credit card churn, but if it is easier than I’ve heard (had the same resistance as you) I am all ears!

Wouldn’t mind at all getting free air-line miles to visit my sister across the country with my family of five, if that’s possible!

I thought your response would be the odd one out, PP. I really expected most folks would call us out for being credit card idiots. It seems a bunch of us are in the same resistance boat. We’ll have to report back if we move ahead with any suggestions.

Thanks, PP. We’ll keep you posted.