This post may contain affiliate links. Please read our disclosure for more information.

I detest politics. I’m at the point now where I find it impossible to even look at a politician, regardless of party. So why does this blog occasionally veer into an area of life I find so objectionable? Because failure to do so would be a dereliction of duty. Let me explain.

Achieving financial independence isn’t only about mastering math. If it were, achieving financial independence would be easy. Just spend less than you earn, invest the difference, and keep doing that until you have accumulated twenty-five times your annual expenses.

But very few Americans have mastered the math. And it’s not because they’re stupid or wantonly indifferent to building wealth. It’s mostly because they’re ignorant. They’ve been told their whole lives that debt is normal, that bigger is better, and that more stuff makes you happier and sexier. And after years of being pounded by this spendthrift ideology, they have forged habits, attitudes, and biases that make it impossible to master the math.

Achieving financial independence then is as much about fixing wealth-crippling habits, attitudes, and biases (i.e., behavioral economics) as it is about mastering math. And any blogger dedicated to financial independence would be guilty of malpractice if he or she ignored this. After all, who is going to challenge our hyper-consumerist culture? Who is going to say, for instance, that a Roth IRA stuffed with maxed-out contributions will do more for one’s long-term happiness than a closet stuffed with clothes and shoes? The credit card companies? Macy’s? Madison Avenue?

Okay, now onto the dreaded P word, politics.

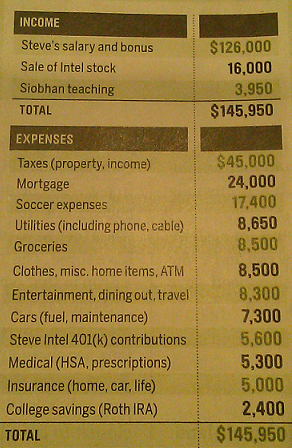

The below image comes from an article in the October 2015 issue of Money in which author Paul Keegan provides an in-depth analysis of a California family’s finances. Notice what the family’s biggest expense is? It’s government. Forty-five thousand dollars is slightly more than thirty percent of its household income. And that 45K represents just the easily quantifiable cost of government (property and income taxes). It doesn’t include the taxes the family surrenders when it pays utility bills or buys food, clothing, and gas. If we accounted for these taxes, the cost of government would easily reach one-third of its household income.

Now suppose for a moment that the cost of government for our California family miraculously drops without compromising the sum and quality of the goods and services the government provides. Rather than eating up thirty-three percent of its household income, taxes eat up twenty-five percent. Our California family would now have nearly $12,000 extra every year to throw at its 401(k) retirement account ($48,163 – $36,487 = $11,676). Its quest for financial independence would become decidedly easier.

Our California family is hardly alone. For most Americans, the cost of government is their largest household expense. But no personal finance blogger I know writes about ways to reduce the cost of government. Sure, they write about ways to reduce the current year’s tax bite, such as tax-loss harvesting and larger 401(k) contributions. But these tax-deferring strategies, while helpful, aren’t available to everyone, and don’t address the problem. They don’t make it any less costly to incarcerate a felon, educate a child, or pave a road.

Dropping the Ball

There are three components to financial independence. There’s the behavioral part (train your mind to spend less than you earn and save the difference), the income part (earn more), and the frugal part (cut expenses so you have more to save). Financial bloggers do a great job of covering the behavioral and income components of financial independence. And for the most part, they do a great job of covering the frugal part. But consider this: Mr. Money Mustache, perhaps the most interesting financial blogger out there, has made a very strong case that cars are a major detriment to the long-term financial well-being of most Americans (see here, here, and here). But how great an expense are cars for the typical American family compared to government? For our California family, car expenses were five percent of its household income. Government expenses, on the other hand, were thirty-three percent. And, yet, no where in his prolific blog, does Mr. Money Mustache tackle the cost of government. And by no means am I saying this to slight Mr. Money Mustache; this just isn’t in the consciousness of the financial blogging world.

Something’s wrong here. Financial bloggers take great joy in helping people reduce their household expenses. I’ve seen posts extolling the virtues of tiny houses; posts urging readers to cut the cord; and innumerable posts showing people how to reduce their food, clothing, entertainment, travel, borrowing, portfolio, and smartphone costs. But I’ve never seen a post showing people how they can reduce their government expenses. Why is the cost of government off limits? Are financial bloggers worried about offending their audiences? Is the challenge of reducing the cost of government too hard?

The position taken here at Freedom Is Groovy is that government is a major household expense that has a decades-long record of only growing larger, and it would be incredibly irresponsible of Mrs. Groovy and I if we 1) didn’t raise an alarm, and 2) didn’t offer ways to reduce its costs.

Final Thoughts

First, I don’t equate eliminating government with reducing its costs (although that would certainly do it). So I’m not going to suggest that we get rid of the military, discontinue Social Security, and shutdown the Department of Education. No, here reducing costs will mean providing a public good at a reduced price without sacrificing its quality. The cost of humanely incarcerating a felon, for instance, drops from $50k a year to $40k. That’s what I mean by reducing the cost of government.

Second, politics here will not mean hurling firebombs at either Democrats or Republicans. If you want that, you’ll need to visit another site. My goal here is to make government less costly. It’s not to put more Ds or Rs in Congress.

Third, reducing the cost of government will not be the dominant theme of this blog. It will still be mostly about Mrs. Groovy and I’s quest for financial independence and the groovy things we’re doing to get there. But reducing the cost of government has to be part of the discussion. Government is too big and costly to ignore. I suspect that one out of every four or five posts will be about politics. That strikes me as a reasonable balance.

Okay, with that said, I want to give you a sampling of the politics this blog will explore. Here are some rough ideas to reduce the cost of K-12 education:

- Have small class sizes for math and English (10-12 kids) and large class sizes for everything else (30-40 kids).

- Get rid of tests for everything but math and English. Churches don’t require their parishioners to take notes and cram for tests. But their parishioners, by showing up and participating, learn the lessons of the Bible. This teaching model can work just as well for social studies, science, history, civics, and computers. As long as the kids show up and participate, they’ll learn.

- Bring the adjunct model of higher education to lower education. Wouldn’t it be great to have a retired ER doctor teach a single biology class for the entire school year? And do so for a nominal fee ($1,500 – $2,000)? If adjuncts taught twenty-five percent of a given high school’s classes, that school’s instructional budget would fall twenty percent. If adjuncts taught fifty percent of classes, the instructional budget will fall forty percent.

- Get volunteers from the community to help clean classrooms, mop floors, cut grass, and perform other custodial services.

- Get out of the pension business. The

defined-contributiondefined-benefit model is too costly. Enroll new teachers in a 403(b) plan and provide an employer match of up to four percent of their contributions.

What do you think, groovy freakin freedomists? Will the above ideas reduce the cost of lower education, the largest component in your property tax bill? Will they reduce the cost but sacrifice the quality of our schools? Will they kill the teaching profession? Are they nuts? Don’t worry about hurting my feelings. I’d love to hear from you.

What do I think? First off, I think your school-related political ideas will be fiercely resisted by teacher’s unions for one reason – they’ve got it freakin made right now, and you’re challenging the status quo!

Second, I think I’m grateful this blog is sharing this message. I try to do the same, so you have an ally!

Thank you, TV. I always knew you were in my corner. And you are so right about teachers and their union. They believe they have an unalterable right to all the money collected by the state to educate children. The idea that they should compete for students with private teachers and schools (hello, vouchers) is as repulsive to them as Trump is to La Raza.

I agree with Julie as well as yourself in the above post. Kids need tests to practice meeting deadlines and real-world demands, but they also need hands-on experiences. I was fortunate in school when I was young. I “played” at science a lot. I did strap a camera to a rocket once, and launched it. My teachers gave me free reign to study things I wanted in class as long as I learned the basics, and because of this I saw the benefit in working harder. I even went to the national spelling bee as a kid, because of the support from my parents and teachers. Unfortunately, a lot of this boils down into parent involvement as well (my mom was awesome and did a lot more to support me than many parents). Too many parents treat school as a daycare program and then plop them in front of the TV afterwards. (full disclosure: I do not have kids myself)

Agreed. Tests do have a role–feedback, practice at meeting deadlines, etc. My anti-test rant was more about my frustration with K-12 education. Think about it. Thirteen years of education. All that money and time. And a shockingly large amount of our kids emerge from that experience with lousy skills and attitudes. Meh.

It sounds like you had a wonderful education. Your schools and parents worked together to meet the needs of a curious child. Now if we can only make your experience the norm rather than the exception.

I wish I had answers. The status quo isn’t working. Our schools and parents got to do better. Schools shouldn’t kill curiosity, and like you said, “parents [shouldn’t] treat school as a daycare program.”

Thanks for stopping by, Lindsay. I really appreciate your perspective. It made me think.

Political science major here who works in tech so I come from a biased background but eliminating tests for everything except for math and science is a bad idea. Americans are already not as globally/culturally aware as others in the world. Tests help with retention. I also learned a lot from my chemistry and physics tests even if I did not pursue those careers. Computer science is key too. I don’t think discussion based learning is enough. Tests teach kids to master things and meet deadlines which are skills you need for most jobs.

Hey, Julie. Excellent points. And truth be told, I don’t have a counter argument. I just feel that maintaining the status quo in lower education is worse than my limited-test suggestion. Consider this analogy. Football practice sucks, but it’s bearable because at the end of the week, you actually get to play a game. There’s the learning side of football and the playing side of football. Lower education is all about the learning side and never about the playing side. In other words, do our kids ever get to play science? Imagine if instead of tests, our kids wrote an algorithm to grab stock quotes from Yahoo Finance. Or how about if our kids built a small rocket, attached a GoPro to it, and then launched it 1000 feet into the air. Or how about if our kids took a donated car and converted it to electric. You get the idea. I rather see more “playing” in high school than testing. Thanks for stopping by, Julie. And thanks for challenging my ideas. It helps me see the flaws in my thinking.

This is a hard subject. I am incredibly grateful for the services that the government provides, including public education, national parks, police, and roads, but I do wish it were done more efficiently.

There’s an argument for privatizing all of these services, but private companies also fail and don’t always have a good track record with the environment. (Not that the government does either, but that’s a whole other post.)

Thanks for bringing up this topic, and I look forward to your future posts.

Thanks, Julie. This is a hard subject. I too am incredibly grateful for roads, police, national parks, and the safety net. So I’m not an anarchist. Government is essential to our quality of life. But I also have a devout fear of government. I worked in government for over twenty years. I saw how the sausage is made. It ain’t pretty. I didn’t see evil, but I also didn’t see a lot of selflessness. Government employees were just as self-centered as people in the private sector. Government, in effect, is a very dangerous tool, and it is best used as infrequently as possible. Besides, free people can figure out a lot of stuff when they have to.

Politics and government are deeply related to your personal finance. I think it makes sense to discuss it in our blogs.

I’m more inclined to reduce our military costs. I was raised on bases, and know many people who serve. Most of these men and women I personally know believe that much of our spending supports businesses and not our military’s current needs.

Thank you, ZJ. It’s definitely a touchy subject. After all, compared to fixing the government, fixing your finances is a breeze. I’m with you on the military. I don’t know if having an empire serves us well. I’d rather have our military on our southern border than in Europe or South Korea. It would certainly be cheaper to scale back our military reach, and it might reduce our international headaches as well.

Hey there!

I really love that you go into the politics of financial freedom, it definitely gives me a lot to think about. (On that note, have you ever listened to the Survival Podcast by Jack Spirko? He’s a pretty interesting dude who’s talks a lot about ‘rebelling’ against the gov’t by paying as low taxes as legally possible.)

Anyway, in a perfect world I wish everyone could simply vote with their feet by moving to areas with low/no taxes. In the meantime, I think continuing these conversations about smaller government is already making a positive effect. I’d really hate for us to just give up because we feel the matter is out of our hands. After all, the government is supposed to work for us.

I can’t believe you know about Jack Spirko. I recently stumbled upon his podcast. Definitely an interesting fellow. I’m very torn about introducing politics to a personal finance blog. People get very emotional about politics. They are therefore quick to challenge the intelligence and morals of their ideological foes. And that’s the last kind of behavior I want to encourage here. But government is a very dangerous tool, and if its use is not properly checked, our ability to achieve financial independence will be severely compromised. It’s such a conundrum. People hate politics (for good reason), but politics can’t be ignored (for good reason). So I’ll tilt against windmills every now and then on this blog. I just hope my readers understand that my occasional political post is not geared to put either more Ds or Rs in power. (I don’t give a crap about the fortunes of the Dems or the Repubs.) My occasional political post is geared to make the quest for financial independence easier for all Americans. Thanks for stopping by Katasha. And thanks for understanding my intentions. I really appreciate it.

OMGGG YES, I’m a huge fan of Jack Spirko! I just love it when he has these heart-to-hearts with young people about the importance of self-reliance, gaining life skills, and starting your own livelihood. Also, believe it or not, he’s one of the reasons why I started my debt-free journey in 2013!!

As for politics, I totally understand why emotional politics would make you want to keep the government talk in check, but darn I wish it wasn’t so! It’s just unfortunate that people store such a large part of their identity in their political party. It makes it so much harder to have these necessary conversations and progress as a human species.

Anyway, I’m all for it!

I think it is a good topic to cover in a personal finance blog because of the point that you make of how big an impact government makes on the household budget. The single simplest lever would be to vote for politicians willing to pass a balanced budget proposal. 49 of the 50 states have a balanced budget amendment or statute – why is this so hard on a national level?

Hey, Mr. FS. Politics is tricky. I think it is necessary fodder for a personal finance blog, but you have to be extremely careful. People get very emotional about it. I believe that trickle-down government is just as ineffectual as trickle-down economics. I also believe that people who think otherwise aren’t evil. So that’s the way I try to approach it. I suggest a better way to use the coercive powers of the state. If a reader thinks my suggestion is loony tunes, that’s okay. He’s still my friend and the first round of beers is on me. And you are so right about a balanced budget proposal. If $19 trillion in debt doesn’t say the current model is broken, I don’t know what does. I’ve had a post about our federal budget process in the hopper for some time now. It may be time to unleash it. Thanks for stopping by, Mr. FS. And thanks for your support.

While we’re glad you’re asking these hard-hitting questions and getting us thinking beyond our “that’s just the way that it is” mentality, I think most PF bloggers aren’t talking more about this topic (and far be it for me to speak for anyone but myself) is because government spending isn’t really our choice. Paying taxes is kind of a legal matter that’s out of our hands. We can control buying/not buying clothes, cars, and houses; that’s our choice.

Raging against the machine is a long, arduous process; however, I do think by inspiring, encouraging everyone to live frugally and consume less, we’d begin to see a major shift in politics and government spending. These are tough questions and great points that I’m glad you’re raising. Mr. Saver and I had a lengthy discussion about this post, so it’s a success! Great job getting this dialogue started!

Hi, Mrs. Saver. Thank you for sharing your thoughts. You’re absolutely right. Fixing yourself is a hell of lot easier than fixing the government. Mrs. Groovy and I had a number of heated discussions about whether this topic should be any part of a personal finance blog. Mrs. Groovy felt the topic was inappropriate. And, sadly, I have a sneaking suspicion that she’s right. It just kills me that the only viable defense against expensive government is geoarbitrage (Mrs. Groovy and I, by the way, left the heavy taxes of New York for the moderate taxes of North Carolina). So I’ll use this blog to occasionally tilt against windmills. My only promise to you and other visitors is that the “politics” of this blog will be respectful. I don’t care about the fortunes of the Ds or the Rs. And I certainly won’t accuse those who disagree with me of villainy (my ideas are weird). I just want to lower the cost of government without sacrificing the current level of service. And I would love to get, as you mentioned, a dialogue started with the PF blogosphere. The PF blogosphere has a tremendous amount of brain power and influence, and it would be a shame not to direct some of that cognitive might toward the problem of wasteful government.