This post may contain affiliate links. Please read our disclosure for more information.

I was bored last night, so I decided to determine what my effective tax rate for 2017 is going to be. Since I know what my income and property taxes will be for 2017, this calculation was rather straight forward. Here it is.

2017 Effective Tax Rate Without Obamacare Subsidy

| Income (Pension + Dividends + Interest) | Federal Tax | State Tax | Property Taxes | Sales Taxes | Total Taxes | Effective Tax Rate |

|---|---|---|---|---|---|---|

| $30,000 | $930 | $564 | $2,102 | $1,200 | $4,796 | 16% |

The only thing that posed a little problem was estimating the amount of sales tax I would pay in 2017. To get this number, I took what we spent in 2016 ($36K) and removed those spending items that weren’t subject to a sales tax (property taxes, gifts, HOA dues, dental services, etc). This left me with $24K. I then took this amount and multiplied it by 5 percent. The result was $1,200. Is this a fair estimate of what our sales tax bite will be in 2017? I think so. Our spending should be a little less this year, and while some of the things we’ll purchase will face a sales tax greater than 5 percent (gas, for instance), a lot won’t (food, clothing, cell phone plan, etc.). Five percent thus strikes me as a good compromise.

Okay, assuming my sales tax estimation is legit, I will pay $4,796 for government in 2017. On a $30K income, that will give me an effective tax rate of 16 percent ($4,796 ÷ $30,000). Not bad. My effective tax rate for 2017 might not be as low as Warren Buffett’s, but in the scheme of things, it’s very reasonable. I get to spend the bulk of my income on what I want to spend it on, and I contribute something to the commonweal. I’m not a total moocher.

Or am I?

What would my effective tax rate be if I included my Obamacare subsidy for 2017? After all, my Obamacare subsidy is the equivalent of a tax refund. Money that I would have dished out to abide by the health insurance mandate is being dished out by the federal government instead. Here, then, is my effective tax rate with my Obamacare subsidy added to the mix.

2017 Effective Tax Rate With Obamacare Subsidy

| Income (Pension + Dividends + Interest) | Federal Tax | State Tax | Property Taxes | Sales Taxes | Obamacare Subsidy | Total Taxes | Effective Tax Rate |

|---|---|---|---|---|---|---|---|

| $30,000 | $930 | $564 | $2,102 | $1,200 | -$23,376 | -$18,580 | -62% |

Whoa! Minus 62 percent (-$18,580 ÷ $30,000)! Are you sh*tting me? That effective tax rate makes a mockery of Warren’s. Consider me an honorary One Percenter.

The Rant

First, with the introduction of Obamacare, it pays really well to be income poor and asset rich. Because my household income is less than 200 percent of the federal poverty level, I’m entitled to a $23K gift from the taxpayers. It doesn’t matter that I have over 30 times my annual living expenses sitting in the bank and various investment accounts. The federal government doesn’t care about that. All it cares about is my paltry income.

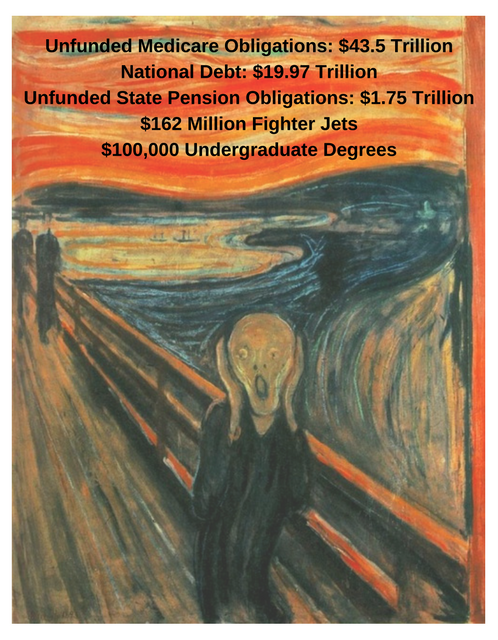

Second, the federal government shouldn’t be giving a $23K gift to a rich person. But of course the insanity of the Obamacare subsidy guidelines isn’t the only thing that’s out of control. This boondoggle is just the tip of the iceberg. Here are some other things the government shouldn’t be doing.

- Paying $400 billion for 2,457 fighter jets. The Chinese could probably build 20,000 comparable planes for that amount of money.

- Investing $150,000 in every child’s K-12 education and ending up with a high school graduate that is typically bereft of any real job skills and barely literate.

- Charging people over $100K for a college degree that doesn’t necessarily enhance one’s job skills or critical thinking skills but allows one to go on more job interviews. Really? $100K for a piece of paper that signals to employers that its holder isn’t a total moron? Can’t the government devise a cheaper credential?

- Promising retired public servants lucrative pension and healthcare benefits and then refusing to fully fund those obligations. Illinois’s pension system, for instance, is only 40 percent funded.

- Being over $19 trillion in debt and allowing massive numbers of unskilled immigrants (legal and illegal) to enter the country annually. According to one study, over 50 percent of immigrants receive some form of welfare. Meh. We have enough native-born dependents. Do we need to import more?

Final Thoughts

I don’t see how this ends well. Those wedded to the status quo are too powerful. They see the huge monstrous cliff right before us, but they don’t care. They were promised. They’re gonna get what they’re entitled to no matter what. So we’re gonna drive over that huge monstrous cliff. The only way to mitigate the horror of the impending crash is threefold: be completely debt free, be largely self-sufficient, and be physically fit.

If you can’t achieve these three things by the time we launch ourselves into the fiscal abyss (10 years from now? 20 years?), you’re screwed. Be afraid. Be very afraid.

Mr. Groovy have you by any chance read Ann Coulter’s Adios America. The immigration problem is a bigger one than I ever imagined. And yes to everything else

Hey, Jeff. Sorry for the late reply. It’s been real crazy in Groovyville lately. Anyway, I haven’t read Ann’s book. I’m depressed enough as is. But I know I shouldn’t shy away from reality, so I will put it on my reading list. All I ask people who don’t want to enforce our immigration laws is what other laws can we ignore? I would love to stop paying taxes. After all, I just want a better life for myself. And I’m sure businesses would love to ignore our labor and environmental laws. What would people think if cities across America became sanctuary cities for those companies that wanted to flout our labor and environmental laws? Meh. What a mess. Thanks for stopping by, my friend.

As you can imagine, I’m leaving a big fat “Ditto” for this one. All of the points bug me, but especially the education one. What a freaking waste they are making of their allocated dollars. Have seen it first hand in local governments. And, as a homeschooling family, we are teaching our kids for a total of under 4k a year including extracurricular activities. If we really splurge, we’ll go up to $8k a year, or $2k per kid. And, all four are on track for huge career, financial and moral success. The school systems can definitely do better. As can every single other budget category in federal, state and local government. 🙂

THANK YOU! Another person gets it. I grew up in Plainview, New York, and I looked up what the Plainview school district is currently costing per student, and I almost had a heart attack. It’s over $25K. Twenty-five freakin’ thousand dollars per student!!! You’re spending less than $2,000 per child to teach your kids. Imagine what you could do if you had $25K to spend on each of your children? Arrrggghhh!

P.S. I think that what society is doing to teens that can’t afford university degrees is very cruel. They graduate with a h.s. degree but they don’t have any skills and must take on massive student loans for university.

This is just not enough in today’s world. I don’t understand why we’re not providing vocational studies in high school in addition to academic studies to teens that will NOT be going to a university.

While they’re in h.s. they can learn a vocation in addition to their academic studies, then when they graduate they won’t be stuck with a minimum wage job.

Our society is leaving teens defenseless with ZERO skills by the time they’re 18. That is absolutely ridiculous.

How do you get to 18 with zero skills? I don’t understand this. You should be able to do *something* by the time you graduate whether you’re a rich kid, middle-class kid, or a working class kid.

IF my h.s. had offered a vocational program in addition to academics, I would have picked web design, graphic design, or coding.

I don’t understand how in the U.S. the richest country on Earth, people get to 18 with zero skills on how to earn a living. That’s just ridiculous!

“Our society is leaving teens defenseless with ZERO skills by the time they’re 18. That is absolutely ridiculous.”

I COULDN’T AGREE MORE!

But sadly, it’s even worse than that. I managed to get an undergraduate degree and a master’s degree and still had ZERO skills. And I’m not the only whose college education was marred with such abject futility. Meh.

And to get even more depressed, I looked up the per-pupil cost of my school district back on Long Island. In 2013, Plainview spent over $25K per pupil. Holy crap. This means the taxpayers of Plainview will be investing more than $300K in each member of the Class of 2029, and many of these graduates will have NO SKILLS. There’s got to be a better way.

We could be headed for another depression, maybe not as long as the 1930’s one. The U.S. has had several depressions besides the 30’s one (a lot of people forget this).

I don’t know what the future holds, but this week I decided I’m going to start a one year household stockpile on toiletries, cleaning supplies, and other household items (non-perishables, baking supplies like flour, etc., meat, frozen veggies and fruits).

I’m going to buy a little bit at a time, a lot of stores have sales cycles so it’s not hard to build one up. They also put limits and I see the 4 max item limit on a lot of sales flyers to keep things fair for customers.

A stockpile can act as a second emergency fund so you don’t go through your emergency fund as fast.

Hey, Lila. You are wise beyond your years. Mrs. G and I feel the exact same way. That’s why were buying a couple acres of land this year. A little farming and a little stockpiling should be a formidable second emergency fund when the country implodes.

Excellent post, Mr Groovy. Our tax rules can definitely be pretty baffling, but hey, I don’t fault anyone for using the law to their advantage.

Thanks, TJ. I’m not proud of my Obamacare subsidy. But I bring it up because I’m trying to convince people that the law has to be tweaked. But the odds of Obamacare subsidies and other such subsidies being reduced or eliminated are small. We Americans love getting something for nothing. Meh.

The Obamacare subsidy isn’t a subsidy for you as much as it is the healthcare industry. Just saying most countries are far more effective as far as outcomes go without spending nearly the same amount of money on the industry. Price transparency would help a lot, as would reasonable network rules (why can a hospital be in network but all your doctors at the same hospital be out of network?)

I get what you’re saying about subsidies, but where would you pull the plug? Obamacare is an easy target. Itemized deductions are a lot harder, but basically the only one that is really fair is unreimbursed business expenses. Tax-Subsidized mortgages are really just middle-class welfare that costs the government a lot more than SNAP.

Haha! You nailed it, Emily. Health insurers, while hardly angels themselves, charge ridiculous premiums because the price of healthcare is ridiculously high. Check out this Morgan Spurlock clip about medical tourism. Price transparency, competition, and capped government subsidies for the poor and uninsurable are the only way to fix the fraud, waste, and inefficiencies of our healthcare system. But Mrs. G and I aren’t counting on that ever happening. So we’re learning all we can about medical tourism. I refuse to be held hostage by the medical-industrial complex.

P.S. You’re also right about welfare for the middle-class and the rich. That kind of welfare dwarfs the welfare for the poor.

I find it pretty odd that parents assets weigh into the student loan FAFSA application but they don’t weigh in when the individual is receiving the benefits directly (ie. HealthCare for themselves)

The gov shouldn’t assume parents will/want to help students by saying they can afford to do so.

You raise some great points in this post Mr Groovy

Great observation, my friend. Man’s eternal quest to get something for nothing leads to some really bizarre situations. I guess healthcare is a “right” so the medical-industrial complex can’t feast on your assets. College isn’t a right so the college-industrial complex can go to town on your assets. Isn’t it wonderful that our college administrators and professors care so much about the downtrodden and the scourge of income inequality?

I’m afraid. I’m very afraid. Wish I had some of that health care subsidy, the cost of private health care is scary. Very scary.

Gee, govt and health care, both inefficient. What to do?

At least gun manufacturers are efficient. Covered on that front!

It’s a joke. A $25K premium for two very healthy people in their mid-50s? But I only have to pay 5 percent of that premium, so I guess it’s no big deal. Sigh. Like you pointed out, Fritz, “at least gun manufacturers are efficient.” Best observation of the weekend, my friend.

Thanks for writing about this. We just completed our taxes for 2016 and were in a similar tax bracket as you will be in 2017. I had always heard “it pays to be poor” and having several children. Now, I can understand first hand, assuming you are asset rich.

Honestly, if it wasn’t for our mortgage payment & the desire to max out our retirement accounts, there really isn’t as much of an incentive to return my old salary range since we live a simple lifestyle.

Plus, we are too young to stay in this income bracket long-term.

Hey, Josh. Agreed. It’s amazing how affordable life is when you focus just on your needs and not your wants. Do I really need a fabulous wardrobe? Do I really need a Lexus? Do I really need a McMansion? Nope. I’d rather have my pathetic capsule wardrobe, my 2004 Camry, my modest home, AND my freedom from work (i.e. financial independence). As Paula Pant says, “You can have anything you want. You can’t have everything you want.” Thanks for stopping by, my friend. It’s always great hearing from another person striving to be income poor but asset rich. May our tribe multiply.

I agree as well. What the government officials choose to spend funds on and what they choose not to spend funds on is often baffling for me.

The apparent corruption saddens me at times, but where there are people there is corruption so maybe you guys have the right idea – move to Montana and avoid people! (J/k). (About avoiding people, not about moving to Montana, that sounds like an amazing adventure)

“[W]here there are people there is corruption.”

Very prescient, my friend. One of the best books I ever read on government was called Plunkett of Tammany Hall. It shows political corruption is not a modern day invention. It also shows that the only way to limit political corruption is to limit the size of government. Thanks for stopping by, TPOH. I really appreciate what you had to say–especially about the great state of Montana.

As an American working and living overseas I am not taxed on the first $102,000 of my income although I use no services of the Federal Government. The US and Eritrea are the only 2 countries taxing on citizenship rather than residency.

It all makes no sense! Smaller government and term limits are a good start.

Agreed. A normal person who is a personal responsibility warrior and has embraced a prime financial culture needs very little government. Our problem, aside from a very twisted tax code, is that too many Americans have embraced a subprime financial culture. And government and tyranny batten on dependency. Meh. I love the cut of your jib, Ian. Thanks for stopping by, my friend.

Abolish Big Govt and the Federal Reserve!

Nice post!

Haha! Bring back the gold standard too.

Mr. Groovy, I agree with many of the points you make here:

-No reason you and I can get subsidies for healthcare with our assets. I believe that the plan will change however.

-The cost of higher education is a scam, and the government is complicit along with the universities and colleges in this.

-Unfunded and underfunded pensions are also outrageous. Many of the state employees covered by these funds negotiated smaller wages and benefits during their working careers in exchange for more lucrative retirement benefits.

However, while I agree that immigration presents problems and challenges, we spent trillions on two unfunded wars and billions on subsidies for corn farmers and oil companies. We can’t ignore those things and expect to fix our problems by stemming immigration benefits.

This is an interesting post and I appreciate your perspective.

To clarify my first sentence (rough way to start!), I meant to say that I agree with you that people with substantial assets shouldn’t be eligible for subsidies based on income.

No worries, my friend. Thanks for the clarification.

Note to elected officials: When your country is trillions of dollars in debt, don’t start unnecessary wars. And don’t give welfare to big agriculture and big oil. Welfare should only be for the poor, not the middle class and the rich.

Excellent point, Mr. G. I didn’t want to go crazy listing all the ways the government wastes our money. There are so many! But I should have pointed out the trillions we have spent maintaining an empire. Perhaps it’s time to pull back from NATO, Southeast Asia, and the Middle East.

So if your pension doesn’t get funded does that mean you get to enjoy the Obamacare subsidy… a little of “Peter robbing Paul”?

My husband is from an affluent family in Mexico. He once watched the government cut his grandfather’s NW in half. I believe this was during the 80’s. There is no reason NOT to believe the same thing could happen here… however I don’t know how arming yourself will make any difference. Who are you going to shoot? There are so much guns and ammunition amongst us… someone will just shoot back…

I love your moxie, SJ. I don’t know if I’ll ever really enjoy my pension and Obamacare subsidy. If I had my druthers, I would have taken a defined contribution over a defined benefit. I know a defined contribution puts the risk on the public servant, but I’d rather have it on the public servant than on the taxpayers. Seems more ethical to me. And you make a great point about arming yourself. The guys and gals who will be targets (i.e., the politicians, judges, and bureaucrats who orchestrate the money grab) will have people to shoot back. I’d much prefer the kind of massive civil disobedience that brought down the communist regime in Poland and the Marcos regime in the Philippines. But if that fails, gunfire will be necessary. Sigh. Thanks for stopping by, SJ. I really appreciate your thoughts. And I’m really sorry your husband had to experience firsthand the tyranny of government.

If you move to Montana, you won’t have sales tax. 😉 Thankfully we have a crazy amount of million+ dollar vacation homes paying a crazy amount of property tax.

LOL! I’m not letting Mrs. G see your comment. She would move to Montana in a heartbeat, and I don’t need her riled up.

Oh my god, Mr. MMM would LOVE moving to Montana! I wouldn’t mind it, either. Maybe after I jettison my W2, we’ll check it out 😛

Ah, the lure of the West. Montana is a fantastic place. Mr. MMM is not wrong.

I think it’s nuts that assets don’t count when it comes to some federal programs. It makes you wonder why they don’t change that – but then again, some of the people in power might be in the same boat. They obviously aren’t going to shoot themselves in the foot. And, I suppose, being asset rich and income poor is only a small sliver of the population. I hope to be in that sliver within the next few years if I decide to dump my W2. Our biggest concern, since I carry the bennies, is walking away from our excellent health coverage with the uncertainty of the future of the current program.

It looks like everyone is on a tax kick around the FIRE community these days. I need to get on the bandwagon. We have an appt. scheduled with our CPA. I hate to see our effective rate this year. I guess I shouldn’t complain. It’s a good problem to have.

Haha! You’re absolutely right, MMM. The only reason they don’t look at assets when determining premium subsidies is because very few people are income poor and asset rich. Once the FIRE community changes that, and millions of people fall into this category, the subsidy schedule will be changed. And it never hurts to know your effective tax rate. After housing, government is the next biggest cost for most Americans. Thanks for stopping by, my friend.

Honestly I worry what will come along with that cliff will be some sort of attempted repatriation of retirement accounts to save it all. Something like what happened in Cyprus. I’m not sure there is a way to protect against that.

“The tree of liberty must be refreshed from time to time with the blood of patriots and tyrants.” Arm yourself, my friend. If the government goes Cyprus on us, we’ll have to go Whiskey Rebellion on its ass. Big time!

Huh. I didn’t know the ACA only looked at income and not assets. That really seems backwards.

But I do agree that government spending is largely ill-controlled. It’s a multifaceted issue, of course, so it’s complicated to enact real change. I don’t agree about the immigration issue, but that’s just my blue side showing. 🙂

But man, could you imagine paying taxes, have the government not spend it on BS, and then it would pay off a bigger chunk of the national debt?

What a concept. 🙂

No worries, Mrs. PP. I fully expected some blowback on my immigration comment. It’s becoming an AI and robotic world, and since there’s no shortage of people who want to come here, doesn’t it make sense to favor those immigrants who can thrive in a de-industrialized country? And, yes, it would be great if the government didn’t waste so much money. “Imagine there’s no government boondoggles. It’s easy if you try.”

Actually, Mrs. Picky Pincher, I’m always shocked by how many laws look solely to income! It’s the central thrust behind my posts relating to spousal support: support is based on income/earning potential rather than some combination of wealth/income/standard of living/contributions to marriage, which can lead to ridiculous outcomes. But these laws are all based, implicitly, on a central idea that happens to be true for most Americans: We spend everything we earn, so income is a great barometer of “fairness” when it comes to moving wealth around.

Of course, for most people on this blog, income is a horrible barometer of anything. So most of those laws are easily beaten or will easily beat you, depending on your perspective.