This post may contain affiliate links. Please read our disclosure for more information.

Last week I tweeted that Mrs. Groovy and I hit a milestone of sorts. We now have over $500K in our retirement accounts.

I found this achievement to be rather remarkable for two reasons.

First, we haven’t had our retirement accounts for very long. We opened our Roths in June of 2006. Mrs. Groovy began investing in her company’s 403(b) plan in June of 2006 as well. I didn’t start working for my current company until July of 2007. I began investing in my company’s 401(k) plan in December of 2007.

Second, we really haven’t sacrificed much in order to accumulate this small fortune. We live in a nice home in a nice neighborhood. We have a nice, if old, car. And we have spent roughly $6,000 a year on vacations.

So how did it happen? How did we accumulate half a million dollars in our retirement accounts in eleven years? And was this feat really so remarkable?

Here’s a breakdown of how our retirement accounts were funded. We’ve maxed out our Roth contributions since their inceptions. We only began maxing out our workplace plans since 2014. But every year prior to that we increased our contributions by at least one percent. Of the $504K in our retirement accounts, $295K has come from our contributions. The rest has come from employer matches and Mr. Market (dividends and capital appreciation). So in other words, we purchased a $504K nest egg for $295K. Not bad, in my book. A deal like that almost makes me feel like a one-percenter.

Retirement Account Balances as of May 31, 2016

| Account | Our Contributions | Employer Contributions | Mr. Market's Contribution | Total |

|---|---|---|---|---|

| Mr. Groovy's Roth | $57,208 | 0 | $32,431 | $89,639 |

| Mrs. Groovy's Roth | $57,208 | 0 | $35,886 | $93,094 |

| Mr. Groovy's 401(k) | $108,107 | $17,950 | $37,332 | $163,389 |

| Mrs. Groovy's 403(b) | $72,765 | $40,921 | $44,110 | $157,796 |

| Totals | $295,288 | $58,871 | $149,759 | $503,918 |

| Averages | $26,844 | $5,352 | $13,614 | NA |

But, again, is turning $295K into $504K over 11 years really something to pound one’s chest over?

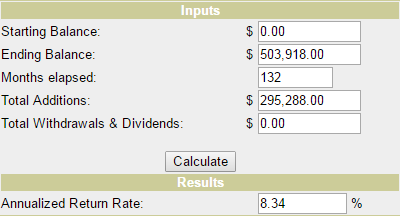

Using a crude ROI tool, I plugged in the above numbers to see how we did relative to the market. Here are the results.

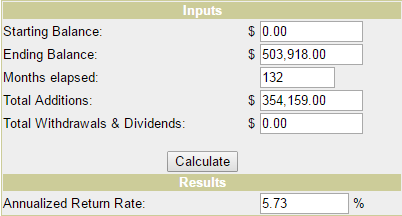

An annualized return of 8.34 percent strikes me as rather good. But what’s the ROI when we factor in employer contributions? To find out, I simply combined our total contributions with our employers’ total contributions and plugged that number into our ROI tool. Here are those results.

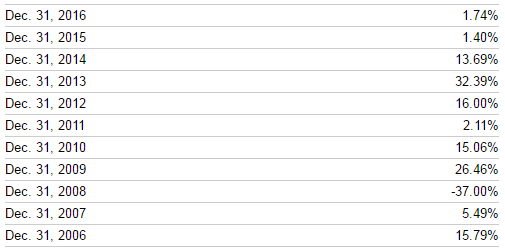

An annualized return of 5.73 percent is not so hot. No Warren Buffet are we. Mrs. Groovy and I did much worse than the market. The S&P 500, for instance, had annualized returns of 8.47 percent during this period. (To get this figure, I googled the yearly returns for the S&P 500, added those yearly returns together for the period in question, and then divided that sum by eleven. Note: the 2016 return is as of May 5, 2016.)

S&P 500 Annual Returns Since 2016

So why did we do worse than the market? Well, we certainly didn’t sabotage our returns by trying to beat the market. Our retirement account contributions have gone almost exclusively to low-cost index funds. But a number of these low-cost index funds have been focused on bonds and international stocks. Bond index funds, especially in a low interest rate environment, aren’t going to perform as well as the S&P 500. And international stocks haven’t had a good run of late. My guess is that if I controlled for bonds and international stocks—that is, if a third of my benchmark included bonds and international stocks, the “market’s” annualized return would have been in the neighborhood of six percent. So our annualized return over the past eleven years really hasn’t been that subpar.

Takeaways

When I tweeted last week that we accumulated over $500K in our retirement accounts, I really was patting ourselves on our backs. I thought we did something pretty amazing. After all, how many people do you know who have taken the balance in their retirement accounts from zero to half a mil in eleven years? But after I analyzed the numbers, and figured out what we invested and what returns those investments generated, I quickly realized that what we did was hardly worthy of a standing ovation. Any well-manicured ape could have turned $300K into $500K over eleven years by simply investing in a 70/30 portfolio consisting of one S&P 500 index and one intermediate bond index.

Okay, we’re average. No investing prowess here. But just because we aren’t masters of the universe doesn’t mean our investing story is devoid of any worthwhile takeaways. Here, then, are the key takeaways from last week’s retirement savings milestone.

Take advantage of employer matches. Because our workplace retirement plans came with employer matches, we were able to boost our annualized return from 5.73 percent to 8.34 percent. That’s nearly a 3 percentage point difference. Or look at it this way. Because of employer matches, we were able to create a less risky portfolio (i.e., more bonds), but still get an S&P 500-like return. How freakin’ cool is that? So by all means, if your employer offers a 401(k) or a 403(b) with a company match, jump on it. Not only is it free money, but it’s a great way to turbocharge your investment returns.

Get out of debt, and stay out of debt. Over the past eleven years, we’ve been able to put, on average, $26K annually into our retirement accounts. We’ve also been able to fund a two-year emergency fund and put a sizable chunk of money into a couple of brokerage accounts. And this isn’t because Mrs. Groovy and I have killer salaries. Our household income over this time span has gone from $90K to $120K. But we’ve been able to save half our household income since 2006 for one simple reason: that’s the year we became completely debt free. And once you rid yourself of mortgages, car loans, student loans, and consumer debt, it’s amazing how much money you can save.

Automate your savings. Habits are destiny. So it makes sense to automate good habits whenever possible. By doing this, you drastically limit the number of times you have to decide between having fun and doing what’s right. In other words, you give your discipline muscles a fighting chance.

Workplace retirement plans are a great way to automate savings. Currently, Mrs. Groovy and I each have over $900 deducted from our bi-weekly paychecks to fund our respective workplace plans. Would we be able to save this much without automation? I doubt it. We are human, after all. And this means we’re just as capable of rationalizing excess as the next guy (hey, that 50-inch flat screen only costs a few hundred dollars more than the 32-inch). But because roughly $3,600 has been automatically removed from our monthly take-home pay, Mrs. Groovy and I are forced to temper our spending habits (the 32-inch flat screen will do just fine, thank you).

Start early. I know, I know. It’s an old saw. But time in the market is your most formidable ally. Don’t waste it. If Mrs. Groovy and I had started our investment careers at 35 rather than 45, we could have easily shaved five years off our early retirement date.

OK groovy freedomists, that’s all I got. What about you? Are you saving enough? Can you do better? How’s your rate of return? Is it better than ours? Please let me know. I’d love to hear how you’re doing.

Nice returns. And I’m still binging, so again sorry if I missed it. I think I’ve seen you mention that you both contribute to your ROTH’s and 401/403, but don’t think you’ve applied the $1000/6000 catch-up allowed. There are restrictions. Did I miss this or,hopefully not, you. Now that that you’re retired not much can be done w/401/403, but don’t miss out on the ROTH’s

Hey, Jeff. Yes, we always maxed out our Roths. When we started our Roths in 2006 we were both 45 years old. So for the first 5 years we couldn’t take advantage of the $1,000 catch up provision. We did, however, take advantage of this provision starting in 2011.

Hi Mr. and Mrs. Groovy,

You need to pat yourself in the back. You have done a phenomenal job saving and investing wisely.

The is always the risk / return trade off is a choice we have to make on any investment.

You have saved well and you investments have given you a decent return.

I have written an entire series of blog posts on asset allocation and you can see my retirement asset allocation performance here – http://stretchadime.com/retirement-account-performance-may-2016/

–Michael

I apologize for such a late response. Thank you very much for your kind words. Mrs. Groovy and I are certainly no Warren Buffets, but we have been able to save 50-60% of our gross household income the last 10 years. So we’re doing something right.

Great hearing from you, Michael. And thank you for the link. I’m on the cusp of retirement, so asset allocation is critical.

Nice! We are 28/29. I have $230k in my retirement accounts and my boyfriend has somewhere around $100k, so we are in great shape.

Holy crap! I bow before my superiors. So young and so financial mature. You guys are awesome. Thank you for giving my saving efforts the thumbs up. Coming from you, Leigh, it means a lot.

I love seeing the numbers! Makes me feel like my fiancé and I can get there too! We just paid off a bunch of debt and are now starting to plan out how to put money into IRAs and increasing our contributions to our 401k. Cool to see the fast-forward of what it can look like in the future! Thanks for the inspiration!

I am truly humbled. You’re a freakin’ financial rockstar, for heaven’s sake. Paying off $90K in debt! Traveling to Ecuador! Going blonde! If anyone’s an inspiration around here, it’s you. Thank you for your very kind words, Julie. I really appreciate it.

Hey Groovys, that some Groovy retirement savings! Awesome job both of you!

I think you should be proud of what you’ve achieved. You chose a great time to start investing, the market has grown a lot since you started. Your total is now so big that it’s really growing well by itself, but you’re STILL contributing to it 🙂 I am jealous and inspired by how well you guys have done.

Tristan

Excellent point! We were only a couple of years into our investing careers when the market crashed. So we didn’t see oodles of money disappear before our eyes. And because of that, we were able to remain calm and stay the course. Now, if a similar crashed happened today, I like to thing I’d have the investment mettle not to panic. But I certainly don’t want to find out. Thanks for your kind words, Tristan. Always a pleasure hearing from you.

Congratz on the 500K in retriment accouts!

You say:”Okay, we’re average”. In the case of investing,average is good as most people do not make market returns.

The question is: are you happy with your asset allocation? maybe not now, as the S&P alone did better. What if the next 11 years it is other way around?

You’re absolutely right, Amber Tree. It took us a while but we actually are happy with our asset allocation right now. And yes, we’re not fretting over some of our poorly performing asset classes. We’re big believers in regression to the mean, and we’re sure those asset classes will rebound.

Nicely done, my friends. A great example of the power of time, compound interest, and consistency.

Thank you, James. You put it so well. “The power of time, compound interest, and consistency”. It’s so simple but so few get it. Always a pleasure my friend.

Sure it’s possible that any “well manicured ape” could do the same thing, but the vast majority don’t. So you deserve a standing ovation in my book. “Habits are destiny” is a great way to look at it. You’ve made some stellar habits and now a wonderful destiny is just a few months away. Enjoy!

You’re too kind, Gary. I don’t know about the standing ovation. If you give me one of those I’m gonna blush. Yes, habits are destiny. And Mrs. Groovy and I are happy we figured that out before it was too late. Damn, if I only knew that in my 20s! I wouldn’t have been a beer swilling idiot into my 30s.

Great insight into how the money adds up over time with minimal effort. Someone could end up very well-off financially and be able to retire decades early just by contributing aggressively to a (reasonably well-invested) 401(k) plan and never learning another thing about personal finance. 5% annual returns may not sound enormous, but $209k of investment growth certainly does!

Matt, you nailed it. I was calculating our net worth two weeks ago and that’s when I had a holy crap moment! Our retirement accounts went over $500K. Even Mrs. Groovy was floored. It’s amazing what time and discipline can do. For many years we were just trudging along and then – boom! All of a sudden there was some real money in there! Or that’s how it seemed, anyway. It’s always good hearing from you, Mr. Matt. Cheers.

This is awesome! Thank you so much for being willing to share the details with us. I love seeing how people amassed their net worth. The amount of contributions vs. market gains is always fascinating to me.

Congrats on hitting $500k! Hope to join you soon 🙂

Hey Kate, I’m sure you’ll be joining us in no time. Mrs. Groovy and I are normally very private but in order to help people with a personal finance blog, we think it’s important to be a lot more transparent. People relate to stories and numbers much better than abstract theories. Thanks for stopping by. I appreciate your kind words.

This is a wonderful milestone! It’s also so encouraging that you started so “late” and were able to get there. Thank goodness for employer matches. May your next half million come even faster.

Thanks, ZJ. Watch for my post on Monday. I need to clarify a few things. Totally agree with you about the benefits of the employer match. Mrs. Groovy has the best match I’ve ever seen. She puts in 5% and the company puts in 8%. That’s a 160% return right off the bat. And would you believe, she’s had to twist the arm of new employees to take the free money? She still thinks most of them have not. Sigh.

Nice article, appreciate the transparency. I’d rather earn a 5% return with less volatility than throw it all into S&P and deal with the downturns. Given that you’re only 6 months from retirement, it sounds like you have the appropriate asset allocation, and should be content with the returns. Congrats on becoming a ….lionarre……(half of a millionairre!). I agree with all of your “Takeaways”, good lessons for all of us! Keep up the good work.

Hey, hey, hey! Fritz you’re killing me. It’s four months, not six months to retirement. In all seriousness my friend, I appreciate your kind words.

Some people don’t start saving for retirement because they think it’s already too late….this is a great antidote for that concern. 10 years and 1/2 $Million? Pretty awesome! And definitely inspirational for folks in their 40s, 50s, and even 60s that it’s not too late to save.

(and I’m with Brian. Great new look for the website!)

Hey Emily, thanks for your kind words. Mrs. Groovy and I hope we can be an inspiration to late starters. We had a lot of good fortune but we’ve done a lot of things right. And we hope others in their 40s and 50s can learn from our successes. I’m glad you like the new design. We like it too. It’s a lot cleaner.

Hey nice new design on the site! You guys are 1/2 millionaires! Nicely done! I love the first chart. You took $300K of your own money and turned it into $500K for doing what? just being smart with you money and having a plan. Sounds like a pretty good deal to me. We could be saving more, but have a few short term goals we are tackling first.

Hey Brian, thanks for the thumbs up on the new design. Not to pat ourselves on the back, but the $500K is what we have in retirement accounts. We actually have quite a bit more in other investments. Otherwise we wouldn’t be quitting our jobs in October. Making $500K last another 30-40 years in the U.S. would be pretty rough. I’m not exactly ready to move to Ecuador or Thailand just yet (although Mrs. Groovy is). Good luck on those goals. I look forward to hearing your financial updates.