This post may contain affiliate links. Please read our disclosure for more information.

A few months back I came across a company called the Lending Club. And from what I read, it struck me as having a very intriguing business model. Here’s how the Lending Club works.

- Potential borrowers with relatively small loan requirements join the Lending Club (average loan size is $14,553).

- The Lending Club determines the riskiness of these potential borrowers and makes loans to those it deems to be an acceptable risk.

- Investors who join the Lending Club fund the loans that the Lending Club makes.

- Investors make money on the interest charged to borrowers.

- The Lending Club makes money by charging investors a 1 percent fee on every monthly payment a borrower makes (a $100 monthly payment, for instance, would generate $99 for investors and $1 for the Lending Club).

- If the Lending Club screws up and completely misjudges the credit-worthiness of its borrowers, investors and the Lending Club lose money.

In a nutshell, the Lending Club is the Uber of small-loan banking; it’s connecting people who need something (in this case, small loans) with people who want to provide that something (for a profit, of course).

I brought the Lending Club to the attention of Mrs. Groovy and we both agreed it might be worth a try. Perhaps we would invest $5,000-$10,000 in grade-A loans. Grade-A loans returned about 5 percent. That’s much better than what our bond funds were (and are) returning.

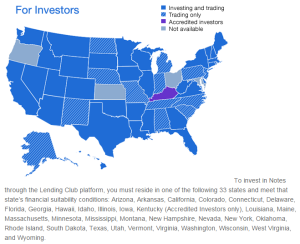

So, somewhat excitedly, I went to the Lending Club’s website and began the process of setting up an investor account. But there was a problem. I live in North Carolina. And the Tar Heel state doesn’t allow its citizens to be investors with the Lending Club. It’s illegal (see to the left the chart copied from the Lending Club’s website).

So, somewhat excitedly, I went to the Lending Club’s website and began the process of setting up an investor account. But there was a problem. I live in North Carolina. And the Tar Heel state doesn’t allow its citizens to be investors with the Lending Club. It’s illegal (see to the left the chart copied from the Lending Club’s website).

I was pissed. I can go online and legally buy an AR-15 assault rifle. No questions asked. If I were a pregnant 16-old-girl, a minor, I could legally, with neither the consent nor knowledge of my parents, contract the services of an abortionist. Again, no questions asked. But throw $5,000 at the Lending Club business model? Hell no. North Carolina can’t allow consenting adults to engage in money-lending. That would be as unseemly as “dogs and cats living together”, for heaven’s sake!

Why? Why can’t I risk $5,000 with the Lending Club?

Is it more risky than purchasing an assault rifle or getting an abortion?

One could argue that investing isn’t a constitutional right but possessing assault rifles and access to abortions are. Granted, the Constitution does give us the right to bear arms. But it says nothing about a right to abortions. In order to see that right in the Constitution, you have to put on your penumbra glasses. Only then can you see that abortions are protected by the equally invisible right-to-privacy clause. But if abortion is a privacy issue, why isn’t investing with the Lending Club a privacy issue? After all, what business is it of yours and anyone else if I want to lend money to someone at a modest interest rate and have the Lending Club be the matchmaker?

The point of this post isn’t to debate the merits of gun rights or reproductive rights. So I don’t want you to get sidetracked by those two emotional issues. I’m just trying to wrap my brain around this conundrum. Why are two commercial transactions, seemingly fraught with risk for the consumers involved and society at large, permissible, and one commercial transaction, seemingly with little or no risk to the consumer involved and society at large, not permissible? I guess if something isn’t deemed a constitutional right, the government, be it on the federal or state level, can decide who can avail themselves to it and who can’t. Some animals are more equal than others.

We’re in some dangerous territory here. Risk-taking is essential to freedom. Think about what the risk-taker is saying with his or her actions. He or she is saying that conventional wisdom is wrong; that he or she knows a better way and wants to prove it. Isn’t this how individuals and societies grow—by individuals experimenting, foregoing what’s comfortable, and exposing themselves to the possibility of ridicule and failure? And how free are we if we need permission from the government to challenge the status quo?

My inability to join the Lending Club as an investor is a trivial affront to liberty. But this trivial affront is far from isolated. Government is obsessed with “protecting” us from risk.

Want to buy a car directly from GM, Ford, or Chrysler? Not going to happen. You need the protection of a middleman (i.e., a car dealership). Want to use Uber? Maybe. As long as the city you’re in thinks it’s safe for you to be chauffeured by a contractor who hasn’t passed a state-approved background check. Want to be a DIY lawyer and prepare for the bar exam without college? No. For your own good you must attend seven years of college and have at least 100K in student loan debt before you can take the bar exam. Want a factory job? Forget about it. Building factories here will enlarge America’s carbon-footprint. And you don’t want that. You’ll be much safer from global warming if factories are built in China or Mexico instead. Want to opt out of Social Security at the start of your working career and use the savings from your reduced FICA taxes to supercharge your own retirement savings? Don’t make me laugh.

If one sentence can sum up the decline of America it is this: Death by a thousand little protections.

So get used to it, America. No risk-taking means no advancement for our country and no worries for entrenched powers. Everything that sucks (think healthcare, banking, education, the economy, border security, etc.), will continue to suck. Forever.

Any chance our esteemed members of the Supreme Court can find a right to take some freakin’ risks in those constitutional penumbras they’re always ruminating on?

Oh my God that’s dumb. I have another favorite quote now!!! “Death by a thousand little protections.”

I’ve heard good and bad things about lending clubs. I’m not completely sure what to do with any of the info. How and who makes the judgment on the grade of the borrower. If they advertise on late night channels then I avoid it and I think lending club does. No huge loss Mr G!

Nice post. I have been thinking of trying this. It is basically another Passive income Stream to add to the pile. It sucks you can’t participate.

I think as a country we go overboard with just about everything. Both political parties are moving closer to the fringes. There is no middle ground on anything. People were crying about Trump being elected. Really !! Get a grip people. If you want to risk your own money, you should be able to.

Sorry for the rant 🙂 Thanks for sharing.

-Brian

Don’t be sorry about the rant. Rants are welcome here. And I wholeheartedly agree with your political analysis. The middle is gone. And if you disagree with the other guy, you’re not just wrong, you’re a “racist” or a “commie.” Yes, people should get a grip. And as you so succinctly put it, “if you want to risk your own money, you should be able to.” Thanks for stopping by, Brian. I really appreciate it.

Arrrrrggggghh! I get so fired up when I see these government “protections.” In my view, our rights as citizens are squeezed to force us to take the prescribed path, the path that makes us productive to the economy…go to college and take out huge student loan debt, be forced to work off that debt by getting a job…buy a house = more debt…work longer…have kids = more debt…work longer…realize that you have pitiful retirement savings…work longer.

In this case, I’m guessing that NC and other states are trying to protect the status quo. Lending Club, Prosper, Uber…they are all economic disrupters. They force change and gov’t doesn’t like change. They like citizens all feeding at the gov’t approved economic trough.

I’m not a fan of status quo, which means I’m not a fan of gov’t in general. I’ve got a Lending Club account here in Virginia. Just started it this year. It takes a while for the returns to normalize, but I’m looking at greater than 10% right now.

Agreed. It’s so frustrating. My state has no problem selling me all the alcohol and lottery tickets I want. Little risk there. But peer-to-peer lending? No way, man. That’s way to risky.

But you nailed it. My state isn’t try to protect me from risky investment opportunities, it’s doing its level best to protect status quo businesses from competition (i.e., economic disruption).

Thanks for stopping by, Brian. I’m glad your state has a little more respect for your liberty, and I’m glad your Lending Club investment is doing well. Cheers.

It’s a shame because I’m getting 7.6% on the money I’ve invested through Prosper

Agreed. Why is my state stopping consenting adults from establishing a lending arrangement? It’s so silly. And, damn, that 7.6% would be as nice compliment to my portfolio. I’m jealous, Brad. Thanks for stopping by.

Why can you make trades on wall street but, making a loan with LC is too risky. Who decides what levels of risk are appropriate for you and your family.

That is outrageous. NC and other states must be trying to figure out how they can make some money.

Hey, Michael. It is a little nuts. Like you said, you can go to town on Wall street, but making a loan with LC is too fraught with danger. Really? I remember the scene in All the Presidents Men when Deep Throat advises Woodward and Bernstein to “follow the money.” So who’s lobbying to keep LC out of North Carolina? Or maybe North Carolina is just looking for a little payola before it allows LC to come in. Your sense that there’s a money angle can’t be too far off. Thanks for stopping by.

I too was pretty frustrated that I couldn’t make an investment when we lived in Tennessee. Strange rules.

Then, a month after we made a move to California, I get an email – “Investors – Lending Club Now Available in Tennessee”. Interesting.

Apparently, they’re working toward allowing it in additional states, but who knows when that’ll happen. Hopefully they’ll come to NC soon!

Hey, Brian. Strange indeed! Have you by any chance begun investing in the Lending Club now that you’re in California? I would love to hear about your experiences if you have done so.

Not yet, but we definitely plan on it in the near future — possibly early 2016. We’ve mainly been pumping most of our excess money into Betterment with the market being wobbly lately. I’ll definitely work up a post when we give LC a shot!

Hey, Brian. How about a post on Betterment? I’m very interested in the robo-investing movement. Would love to hear how that business model is working out for you.