This post may contain affiliate links. Please read our disclosure for more information.

Today we have a guest post from Mr. Xyz who blogs with his wife at Our Financial Path. They are both in their 20s and hail from Canada. They plan to retire at 35, after ten years of blogging about their journey.

In their Open Book series, Mr. and Mrs. Xyz write about their various investment strategies. You can also read about how they travel the world using rewards points, and their suggestions for earning more money without spending additional time at work or a side hustle.

Today’s post is about consuming less and saving more by choosing to live a conscious and stress-free life.

Enjoy!

We live a conscious life.

We consciously choose our purchases, our investments, and our lifestyle.

When we face a choice, we try to think of alternatives and try to pick the optimal option that will maximize our happiness while minimizing costs. Using the utilitarianism ethical theory, for example, “Happiness” here is defined as the maximization of pleasure and the minimization of pain. Pain here being; departing from our hard-earned dollars.

Jeremy Bentham, the founder of utilitarianism, described utility as the sum of all pleasure that results from an action, minus the suffering of anyone involved in the action. – Jeremy Bentham

There are greater consequences behind consumerism; everything we buy or choose not to buy is affecting someone else. The conspicuous consumption North Americans have become used to is affecting the lives of many around the globe. Production of so many goods is exhausting our planet’s recourses and exhausting workers across the globe. Factory workers in China, for example, often work over 16h a day, six days a week to produce all this stuff.

Choosing happiness

We chose the path of voluntary simplicity for our own and the greater good. Some live extremely frugally by refraining from luxury and indulgence but we are not ascetics. We still enjoy some material possessions and luxuries but we consciously choose where we splurge. Our decisions tend to balance value rather than completely depriving us of some things.

We restrain ourselves from unnecessary purchases and impulse buys and when we do want something, we see if anything we already own could accomplish the same utility or we try to find it used for less than half the retail price.

Companies like Amazon try to make effortless to spend your precious dollars. They offer Daily Deals, Lightning Deals, 1-Click Ordering and algorithms will always show you a product that you might want but the only function we like to use is the Wish List. Saving everything you want there, before completing your orders, will allow you to see if you actually need it. Wait a few days and come back to it. Half of the time, we forget stuff was actually saved there.

Source: ABC (Youtube)

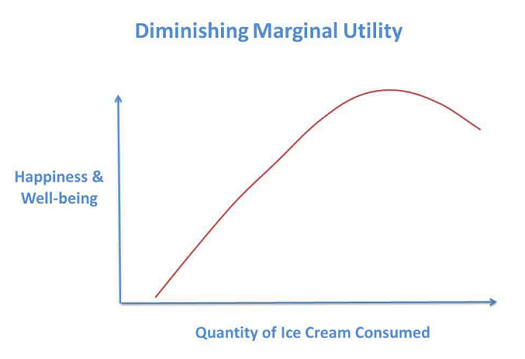

Not only is consumption costly but it does not always make us happier. The diminishing marginal utility implies that your happiness and wellness level will increase when you first start buying things but after a certain level, any extra consumption will not make you happier.

We like having a 60’ TV, nice modern furniture, and staying in luxury hotels when we travel but we have a balance and live a life of luxuries without going into debt. Most of our furniture was bought second-hand, we never paid retail price for clothes, and we travel like kings for a fraction of the price using rewards points.

Choosing a stress-free life

Because we do not have any debts other than our mortgage, we enjoy a significant level of freedom. Our cars were paid cash, our furniture was never bought on payment plans, and we never carried any credit card debt. Living within our means increases our happiness and well-being considerably.

We are consistently bombarded with messages trying to convince us to consume more and it is all easily available through credit but living within our means allows us freedom. The freedom to live a stress-free, happy, life.

Own your stuff, do not let them own you.

Becoming minimalists made us happier and decluttering our home has been a great exercise to make us rethink about the things we actually like. This past year, we sold or gave away a lot of dust-collectors and clothes.

- We sold a TV and with a stand for $100. Who needs more than one television anyway. It was untouched for months.

- Gave away about 3 bags of clothing to our local charity. If we did not wear a certain article of clothing in the past three months, there probably is someone else who needs it more than us.

- Sold an extra pair of skis for $80.

- Sold an old iPod we never used anymore for $100.

- Sold four PlayStation games for $15 each.

- Sold a ceiling lamp for $20.

At the end of the day, we now have a cleaner, decluttered home, we gave a new life to our old stuff, passing along the joy it used to provide us, and we made $360 along the way!.

Choosing our way out

By consuming less, we can also save a lot more. We are currently saving over half our incomes and at that rate, we are right on track to retire 10 short years after committing to this journey. Once we reach financial independence, (a bit more than 8 years left!) we will have the freedom to work, or not, on whatever we want. The projects, the hustles, the hobbies… Anything is possible once money is out of the equation.

Meanwhile, we enjoy every moment we can throughout our journey towards financial freedom. We opted for a good work–life balance, each working less than 40 hours a week with semi-flexible schedules and travelling the world a few weeks a year. We can enjoy our weekends together, both finish work around the same time, and follow each other’s schedule.

- On the work side, we do want to perform and grow our careers but we do limit the hours we are devoting to it just to keep our sanity.

- On the life side, we try to fill our lives with priceless experiences rather than pricey materialistic stuff.

We hope you are enjoying your journey as much as your destination.

Originally posted on Our Financial Path, written by Mr. and Mrs. Xyz on .

Groovy, thanks for sharing this story from Mr. Xyz. It hits the bone of part of the consumptive problem within modern society, even as that same consumption seems to drive growth. We could all live a lot more simple lives and more resources would be available to a wider subset of the population.

I appreciated the point about marginal utility and diminishing returns on spending. The same can be said about marginal utility and its impact on income. Each extra dollar earned doesn’t generally create as much value as the last.

Chris@TTL recently posted…Marginal Utility of Income and How to Build Wealth in Your 20s

Great post – experiences over stuff all the way. I wrote about hedonistic adaptation too – its an interesting one. It’s something you allude to – Own your stuff, do not let them own you! the more you do abstain from being a consumer, the more enjoyable it tends to become 🙂

Sorry we missed your comment, James. Hedonistic adaptation is an interesting concept. I’ll look for your post on it.

We didn’t realize how deeply we were being brainwashed by advertising, especially during the holiday season, until we got rid of cable TV. I highly recommend that to everyone.

We have so much clutter in our apartment but we are currently house hunting and we once buy one we will get rid of the unused clutter. It just takes space away and collecting dust. We are imaging that when we move in with the stuff we only need their will be so much space. Can’t wait!!

Like you said experiences are more life fulfilling than materialistic items!! Thanks for the guest post Mr Xyz!

Totally true, we couldn’t agree more

That’s exactly it, experiences are more life fulfilling than materialistic items so focus on what’s worth focusing on.

Good job on the move!

I recommend the tidying book by Marie Kondo. Examine each possession and ask, “does this bring me joy?” if the answer is no, send it on its way. Sell. Donate. Discard. If the answer is yes, then put it where you’ll see and appreciate it. Repeat for every possession. You may find you need less space.

“The Life-Changing Magic of Tidying Up.” or for those with shorter attention span, “The Life-Changing Manga of Tidying-Up.” http://amzn.to/2wOkQXA

Great guest post. I can relate to how you feel. For me, spending money pushes my goal of early retirement further away. I only buy what we need and truly want. When we do buy, we also look for the best quality at the lowest price. I am fine with spending more for a product that will last.

Buying for life is a pretty cool concept that vanished from our culture decades ago. Before Ikea, furniture would last long enough to pass down to your children 🙂

Exactly, Dave. The less money you spend mindfully, the less money you have to spend on freedom. Better to be “spartan” and FI than fabulous and broke. Thanks for stopping by, my friend.

This is fabulous! Having a partner on the same page is key. It is very hard to roll a boulder up a hill if your partner is strapped to it instead of helping push. Getting rid of crap you don’t need is also huge! I moved to my boyfriends about a year ago and never emptied my apartment. It just sat there with all my things in it while I made do with the few clothes that I brought to his place. When it came time to get it rented last month I realized how much crap I had that I don’t need…pretty much everything that was there! I sold a ton (all my furniture), gave away things to friends, and donated the rest. Very few of the things did I bring back here. As time goes by you realize that the more things you buy don’t fill the gap of what you are really looking for. Quality time with family and friends, nature, time to be creative. Those are the things that truly matter…coincidentally, those things happen to be FREE! 🙂

This is exactly what we are aiming for; cutting down the crap, increasing what we are really looking for… More friend time, more nature, more creative time.

“Having a partner on the same page is key. It is very hard to roll a boulder up a hill if your partner is strapped to it instead of helping push. ”

No truer words have ever been written. If it weren’t for Mrs G, instead of being FI, I’d be broke, swimming in debt, and running the Long Island militia. She truly saved my life.

Thanks for another sage comment, Miss M. You got a fabulous mind.

Thanks for sharing your story!

The Mad Fientist has a great podcast with Michael Kitces that touches on this topic.

The main problem is that as people’s income rises so does their “cost of living.”

People think of living simply or frugal means cutting back on everything and living on spaghetti.

In actuality, it means not expanding on how you currently live. It also means mastering the big stuff.

If you can spend $100k less on a smaller house, and not fill it with stuff, you’re going to be much further ahead on the path to financial freedom than just cutting back on Starbucks coffee trips.

Absolutely, it’s not the Avocado Toast that will slowly ruin you, it’s the car leases and the houses.

“People think of living simply or frugal means cutting back on everything and living on spaghetti.

In actuality, it means not expanding on how you currently live. It also means mastering the big stuff.”

I love it. A lot of wisdom there, Nick. I’ve always said the key to being financially independent is being half normal. The typical new car purchase, for instance, is over $30K. If you can limit your next car purchase to $15K or less, and save the difference, you’ll give yourself a wonderful opportunity of achieving FI before you’re 50. And the amazing thing about being half normal in an American sense is that such a lifestyle is far from deprivation. Buying a four-year-old Camry instead of a new BMW is in no meaningful sense a sacrifice. Thanks for stopping by, my friend. I like the cut of your jib.

I’ve read that it’s pretty much proven by now that experiences bring lots more long-term happiness than possessions. Buying stuff can resemble drug addiction, in terms of giving a short-term rush that wears off pretty quickly.

I agree with an approach based on balance, having great experiences, and putting a premium on savings.

Savings can bring a high too! I get a little something everytime I buy more VTSAX 🙂

Haha! So true. One of my greatest joys while working was seeing that 401(k) contribution come out my paycheck every two weeks. And I still get a high adding change to my change jar. Oh, the thrill of conspicuous saving!

Nailed it, Miguel. Whenever I get together with friends and family we always manage to bring up past experiences. I don’t recall us ever discussing past purchases. What cars we had ten years ago is absolutely meaningless. But that family trip to Disney World or the time the gang went to Lambeau Field for a Packer game only grows in significance. Experiences are surely the secret sauce of life. Thanks for stopping by, my friend.

I love that you each work less than 40 hours a week and have pretty flexible schedules. I think that would have been really hard for me to do if I found the FIRE community earlier! (We were almost FI when we found it and we were always pretty frugal.) After just returning from camping for two weeks, it is amazing how little “stuff” you actually need. You are mastering that young which is terrific. It’s amazing what stuff sits around your house not being used year after year. Nice post!

Thanks, we are very fortunate to have flexibility with our jobs, it’s what keeps us going!

“It’s amazing what stuff sits around your house not being used year after year.”

Ah, the curse of wealth married to the curse of impulse. The sooner you master frugality, the sooner these scourges are removed from your life. Thanks for another keen observation, Vicki. I love the way your mind works.

This is a good reminder I should do some cleaning. I don’t have too much crap, but I definitely could de-clutter!

Thanks for sharing FIG

We even setup a reminder in our calendar to give away something once in a while. It’s a great way to declutter.

That’s a great idea, Mr XYZ. Nothing like a digital reminder to keep a key frugal muscle from going soft.

Good stuff! I also am in the camp that thinks you don’t have to never buy anything, but just need to be choosy and mindful about what you are buying. This is why I love the book Your Money or Your Life. It just makes me think twice about where my hard-earned money is going. And the more I have saved, the less I am beholden to work for someone else.

Great book, we highly recommend it.

It’s so true, debt keeps us prisoners of our income. Once you save, you no longer need to do everything the bossman ask you to do.

Hey Tonya. Oddly enough, I’ve yet to read that classic. I finally got around to reading The Richest Man in Babylon this year. Perhaps it’s time to finally pick up Your Money or Your Life. Thanks for the reminder.

We went through a cleaning of the house too. I love selling everything on craigslist and think it is often underrated. My closet now is streamlined and my garage is nearly empty.

The area that we accumulate the most in is with our toddler, but even his stuff gets donated. We just gave away 4 bins of his kids clothes and toys. It felt great and removed the constant pressure to have kid number 2. Now, I figure if we get kid #2 in 2-4 years we can accumulate what we need for the time being.

As for frugality, it is the key to wining the savings game. When we were trying to pay down over a $100K in consumer debts and my wife student loans, we started being much more spending conscious and took the additional cash and placed it into our debt. Those 3 years of less spending changed how we fundamentally use money which has been huge for our net worth.

Thank you for sharing your story, cleaning the house with a minimalist’s eye is key! Congrats!

Mr and Mrs XYZ definitely nailed it. Free your house of clutter and you free your wallet and your mind.

Strictly from a numerical perspective. The best thing someone can do starting out on the FIRE path is master FRUGALITY. let someone else (me) figure out the relative merits of “snowball” vs “avalanche” debt retirement strategies. Max the gap between income and outgo. Toss a coin to choose snowball vs avalanche, then pay off debts ASAP.

Master the dark arts of personal finance after you’ve got enough money to buy Vanguard Admiral shares (e.g. VTSAX).

Exactly, the formula to financial independence is not really complicated; Spend less than you earn, invest the most you can.

Either you increase your income, or reduce your spending. There is no other way.

We definitely worship at the altar of frugality. We’d much rather travel the country and own our time than have a lot of expensive stuff that will only bring us temporary joy. Mr and Mrs XYZ found the secret to true happiness. Would that more Americans followed their example.