This post may contain affiliate links. Please read our disclosure for more information.

Jeremy over at Go Curry Cracker has just published two terrific posts on Obamacare optimization (see here and here). They’re not for the faint of heart. The numbers, charts, and fiscal permutations will make your head spin. But they’re definitely worth a read, especially if you plan to retire early and will be relying on Obamacare.

So in honor of Jeremy’s outstanding contribution to the Obamacare discussion, and because Mrs. Groovy and I are planning to retire next year, I decided to run through a handful of Obamacare scenarios and see which one works best for us.

Mrs. Groovy and I prefer a plan with a health savings account (HSA). HSAs are hands down the best saving vehicle ever conceived by man. For an excellent tutorial on the awesomeness of HSAs, I urge you to read this post from the equally awesome Mad Fientist. But here’s all you need to know about HSAs right now. The money you put in an HSA goes in tax free, just like an IRA. Money in an HSA may be invested in stocks and bonds and grows tax free—again, just like an IRA. But here’s where an HSA and an IRA part company: the money withdrawn from an HSA, as long as it’s for a qualified medical expense, is not subject to taxation. HSAs are thus triple tax-advantaged. How freakin groovy is that! And since Mrs. Groovy and I are in excellent health, most of the money we sock away in an HSA will be there years from now to help cover the medical expenses that Medicare doesn’t pay for (e.g., vision and dental care).

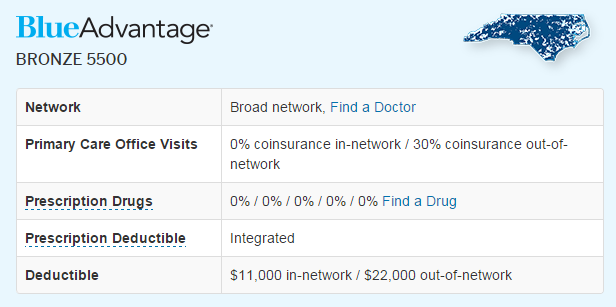

Blue Cross is the largest health care insurer in North Carolina (the state where Mrs. Groovy and I reside). I went to its website and it appears that only its bronze plans are eligible for HSAs. For our Obamacare test, then, I selected the Bronze 5500 plan. Here are the plan’s main features.

Next year I’ll turn 55 and will be eligible for a reduced government pension of $19,100 per year. Add to that the roughly $12,000 in dividends Mrs. Groovy and I get annually from our taxable brokerage accounts and our Obamacare income for our first year of retirement will be $31,100.

Now here’s what makes Obamacare optimization such an intriguing exercise, especially for someone retiring early. As your income rises, your Obamacare subsidies fall. Any Roth conversions you perform or any capital gains you realize will necessarily subject your Obamacare subsidy to a hit—assuming either tax move is done to augment existing income. The question is whether that hit will be outweighed by the benefits of a) having more immediate income (thank you capital gain) or b) having more future income not subject to income taxes (thank you Roth conversion).

Okay, let’s begin. Which Obamacare scenario will cost us the least in taxes and health insurance premiums?

Scenario 1 – Pension and dividends

Pension Dividends Roth Conversion Capital Gains HSA MAGI for Obamacare MAGI as Percentage of Federal Poverty Level $19,100 $12,000 $0 $0 $7,650 $23,450 147%

- Federal Taxes: $1,050

- NC State Taxes: $64

- ACA Annual Premium: $385 ($12,849.36 subsidy)

- Total of Taxes and Premium: $1,499

The nice thing about Obamacare subsidies is that they are based on your modified adjusted gross income (MAGI). HSA contributions get subtracted from your MAGI calculation. Since Mrs. Groovy and I will be contributing the maximum to our HSA, our Obamacare subsidies will be based on an income of $23,450 rather than $31,100. Under scenario 1, then, our combined income taxes and Obamacare premiums would come to $1,499.

Scenario 2 – Pension, dividends, and Roth conversion

Pension Dividends Roth Conversion Capital Gains HSA MAGI for Obamacare MAGI as Percentage of Federal Poverty Level $19,100 $12,000 $10,000 $0 $7,650 $33,450 209%

- Federal Taxes: $2,153

- NC State Taxes: $638

- ACA Annual Premium: $1,725 ($11,509.68 subsidy)

- Total of Taxes and Premium: $4,516

- Effective Tax Rate on Roth Conversion: 30.2%

Under scenario 2, Mrs. Groovy and I augment our pension and dividend income by transferring $10,000 from a traditional IRA into a Roth IRA. Sheltering this money (and the returns it generates) from future taxes will cost us $3,017. That amounts to an effective tax rate on the Roth conversion of slightly more than thirty percent. Is it worth it? Depends. If our future marginal tax rate is significantly above thirty percent, it would be.

Scenario 3 – Pension, dividends, and capital gains

Pension Dividends Roth Conversion Capital Gains HSA MAGI for Obamacare MAGI as Percentage of Federal Poverty Level $19,100 $12,000 $0 $10,000 $7,650 $33,450 209%

- Federal Taxes: $1,050

- NC State Taxes: $638

- ACA Annual Premium: $1,725 ($11,509.68 subsidy)

- Total of Taxes and Premium: $3,413

- Effective Tax Rate on Capital Gains: 19.1%

Under scenario 3, Mrs. Groovy and I augment our pension and dividend income by realizing a $10,000 long-term capital gain. Because we’re in the fifteen percent federal tax bracket, that capital gain would be tax free at the federal level. It would not be tax free at the state level. It would also boost our MAGI, thus lowering our Obamacare subsidy. The net result is that we would pay an additional $1,914 more in taxes and Obamacare premiums by realizing a $10,000 long-term capital gain. The effective tax rate on that gain would be nineteen percent. Is that too steep a tax to pay for an additional $8,000 in spending money?

Scenario 4 – Dividends, savings, and Roth conversion

Pension Dividends Roth Conversion Capital Gains HSA MAGI for Obamacare MAGI as Percentage of Federal Poverty Level $0 $12,000 $19,100 $0 $7,650 $23,450 147%

- Federal Taxes: $1,050

- NC State Taxes: $64

- ACA Annual Premium: $385 ($12,849.36 subsidy)

- Total of Taxes and Premium: $1,499

- Effective Tax Rate on Roth Conversion: 0.0%

Under scenario 4, Mrs. Groovy and I forego the reduced pension, preferring instead to wait until I’m 62, the age in which I’m first eligible for a full pension. We’ll only have dividends and savings to cover our expenses.

But this raises a problem. Our dividend income is well below the federal poverty level for a family of two. We wouldn’t be eligible for Obamacare subsidies. Nor, because of our financial assets, would we be eligible for Medicaid. The whole burden of paying for our health care premiums would fall on us. The horror!

One easy workaround to this lamentable situation is to do a Roth conversion. If we did a Roth conversion equal to my reduced pension amount ($19,100), we would regain our Obamacare subsidies, shelter an additional 19k every year from future taxes, and pay no more for income taxes and Obamacare premiums than we did in scenario 1. The effective tax rate on our Roth conversion would be zero. Very nice. The only drawback is that we might be going through our seed corn faster than we might find tolerable.

Final Thoughts

My brain hurts. Trying to optimize Obamacare is easily as challenging as a graduate-level business course.

As far as which scenario is best for Mrs. Groovy and me, I’m leaning toward scenario 1. It’s simple and straight-forward and gets the job done. Mrs Groovy agrees for the most part but is intrigued with scenario 4. She likes the idea of a larger pension and zero or greatly reduced RMDs when we’re septuagenarians.

So we’ll see, groovy freedomists. The plot thickens.

In the meantime, let me know what you think. Jeremy and I can’t do all the work. We’re going to need some help getting Obamacare figured out.

Great tips I have noted all in my diary I’ll use your all tips as you mentioned I really like your article I was searching on health tips as I’m working on health topics as Healthy Information you can see my work but yours is too good I personally appreciate you for this. Keep working like this.

I am trying to figure out your math. I also live in NC. In 2015 the tax rate was 5.75% and the standard deduction was 15k. So on the $23450 you would be taxed on $8450. At 5.75% that would be $486. How did you get $64? As far as the fed with $23450 in 2015 you would get $12600 standard deduction and $8000 for the 2 exemptions that brings taxable to $2850 meaning at 10% you tax bill would be $285. Also did you consider since you are in a low tax bracket that any of those dividends that are qualified would also not be taxed at the fed level?

Hey, Rob. Good catch. I’m looking at the numbers and I don’t know how I got a state tax of $64. I blew this one bigtime. I’ll have to make the corrections and update this post. I owe you, my friend.

Appreciate you guys going through these calculations! I’m planning to RE – probably in the next 6-12 months – and am in the early stages of starting to walk through the Obamacare maze. So – I definitely find what you’re providing to be very useful!

I’m a family of five – with two kids in college and one headed there in about 18 months. I want to make sure we’re all covered, while maximizing the benefits of Obamacare/early retirement.

Appreciate it all – this stuff is really top of mind for me right now!

Hey, Lance. Congratulations on your pending RE. Mrs. Groovy and I will be retiring this October. So our Obamacare optimization plan will soon be going live. We think we have every angle covered. But you never know. Mrs. Groovy wants to meet with an independent insurance agent just to make sure. We’ll keep you posted on what we discover. And good luck on your end. Having three kids certainly elevates the stakes. But as long as this topic is on the FI community’s radar, and as long as bloggers share their experiences, I’m sure we’ll muddle through the “Obamacare maze” successfully. Thanks for stopping by, Lance. I look forward to hearing about your Obamacare adventures.