This post may contain affiliate links. Please read our disclosure for more information.

Here in Charlotte, a local radio station airs Robert Kiyosaki’s syndicated show on Saturdays. I’ve caught it a couple of times while running errands with Mrs. Groovy, and I enjoyed it. He and his wife were engaging, and his guests were interesting. But I can’t claim to be a fan of Mr. Kiyosaki. In fact, the man bugs me. Let me explain.

Some years ago, I read his famous Rich Dad Poor Dad book. I liked it for the most part. But giving my level of financial sophistication at the time, that’s not saying much.

There were two things in particular about this book that made me uneasy. First, his Poor Dad, who is his father, is portrayed as a financial nincompoop who can barely provide for his family. But his father had a Ph.D. and eventually became the head of Hawaii’s education department. Granted, his dad didn’t have enough scratch to own a G5. But was he “poor”? The current superintendent of Hawaii’s DOE is a six-percenter. What was Hawaii paying its superintendents in the 60s? Minimum wage?

The second thing I didn’t like about Rich Dad Poor Dad was that the Rich Dad was never identified. Call me nuts, but if someone was as influential in my life as Rich Dad was in Kiyosaki’s life, and I wrote a book about this incredibly influential person, I would mention his or her name. To be fair, Kiyosaki claims that his Rich Dad was a very private person and didn’t want to be identified. Fine. I get that. So don’t write a non-fiction book. Write a parable. Use fictional characters to transmit the financial lessons of the two dads. Writing a “non-fiction” book that never identifies the pivotal dad, and thus makes it impossible to determine the veracity of your claims, strikes me as the work of a huckster. Cue up The Music Man, boys and girls. Rich Dad Poor Dad made my BS meter buzz violently.

“Okay,” some of you are no doubt protesting. “Maybe his Rich Dad brand was built on a fabrication. Who cares? What counts is today. And in this regard, Kiyosaki is helping thousands of people improve their financial lives.”

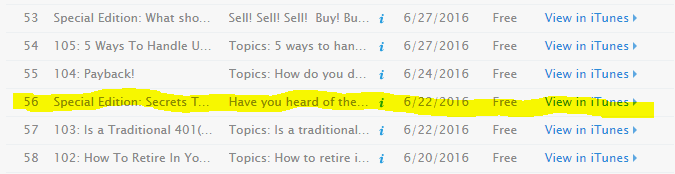

Is he really? A couple of weeks ago, I caught a “Special Edition” of the Financial Rockstar podcast, hosted by Scott Alan Turner. (I couldn’t find a link to this podcast on Turner’s website, oddly enough. You can find it in iTunes, though, by doing a search on Scott Alan Turner. This particular podcast is right after podcast 104. See below).

Turner went to one of Kiyosaki’s free Rich Dad seminars to feast on a bounty of financial delectables. But what he got instead was the financial equivalent of rice cakes. Oh, the delectables were there if you wanted them. But to get them, you had to sign-up for a future three-day seminar and shell out $495. Kiyosaki’s free Rich Dad seminar was nothing more than a glorified sales pitch. And this is what bugs me about Kiyosaki. Why does he have to play games with people? Are bait-and-switch and obnoxious up-selling really the hallmarks of an honorable businessman? And why does his information—assuming it’s worthwhile—cost so much? Dave Ramsey’s Financial Peace University costs $99. Heck, you can learn the meat and potatoes of investing on Jim Collins’s blog for free.

Okay, now on to another person that bugs me, Mr. Robbins.

For years I refused to take Tony Robbins seriously. How could I? His late-night infomercial was usually sandwiched between a Carleton Sheets infomercial and a spray-on-hair infomercial.

But then I heard Tony on a Tim Ferriss podcast. And he sounded remarkably cogent. So I decided to read his latest book, Money, and I was pleasantly surprised. Great book. I invested a modest amount of time reading it and I walked away with a deeper understanding of personal finance. Awesome. That’s the way an author/reader relationship should work. The reader invests a little in the author (whether in time, money, or both), and the author provides the reader with knowledge that is far more valuable than what the reader invested. Tony had won me over.

It was with this fan-boy mindset, then, that I sat down to watch the Tony Robbins documentary on Netflix called, “I Am Not Your Guru.” But very quickly things went south. About a quarter of the way through it, I felt like I was watching psychological pornography. I mean, do I really need to see some poor soul stand before a thousand people and recount the horrors of sexual abuse? How does that help me (assuming I was an attendee)? How does it help her? Is Tony trained to psychologically dissect people the way he does? What are the long-term consequences of his techniques? I’m sure they profit him. But do they profit the people who emotionally spill their guts?

And what’s with all this tier crap? Pay X and you get to see Tony up on the stage. Pay 2X and you get to share Tony with 99 other attendees in a room. Pay 4X and get an hour one-on-one with Tony. Hey, I’m a staunch capitalist, but this business model makes me wretch. It’s one thing to have a tier system when the price of entry starts at $40. But when the price of entry starts at $4,000? That tier crap should be out the window.

Final Thoughts

Okay, groovy freedomists, that’s all I got. Kiyosaki and Robbins are in my dog house. Am I wrong? Am I being too hard on these fellows? Don’t hold back if you think I’m mistaken. I’d love to be convinced otherwise. Peace.

I read a bunch of Kiyosaki’s books about 15 years ago. I give him credit for turning me on to the idea of assets and passive income. Other than that, he seems to be a huckster. He’s been saying the stock market is going to crash for the last 15 years and to buy gold and silver. that has been losing advice. and if you watch his latest videos on youtube, he seems to be marketing his pitch to the conspiracy theorist crowd.

First, your blog is great. Love the post. The first two books I read that got me into the “correct financial mindset” were The Milionaire Next Door and Rich Dad Poor Dad. They paved the way 20 years ago.

I’ve neve paid much attention to Tony Robbins, but his recent book and relationship with Jack Bogle have given me a new found respect for his ways. Obviously a very successful man.

Live within your means, invest in a diversified portfolio from day one through automatic investments and stay the course no matter what. Time will lead to success. Cheers to all.

Thank you, RMPan. I really appreciate your kind words. I definitely have mixed feelings about Kiyosaki. His “Rick Dad, Poor Dad” is a classic, and it got a lot of people to get interested in their finances. I just wish he marketed the book as a parable rather than non-fiction. Why detract from a good message with questions about its veracity? Oh, well. Such is life in the mysterious world of guru-dom.

I know I read this post but looks like I never commented – Oops! Just as well, I have a new nugget to report. I read Rich Dad Poor Dad in high school and at the time it resonated with me. Since then I have heard Robert speak and have been completely thrown off by his arrogance and pompousness. Two personality flaws that are a huge turn off for me. Though I haven’t read any of Tony’s books, I did watch I’m not Your Guru (after hearing him on Ferris podcast) and really enjoyed it. Then I watched it again and it made me wince at times. Knowing how much money these people are paying for help makes me wince more. The fact is, if it helps keep someone from being suicidal then all the money on the world is worth it. If you are one of the other 2000 in the group that doesn’t have a breakthrough, then was it worth it??

Anywho, I told my best friend and her husband to watch Not Your Guru (after I had only seen it once) and they loved it…so much so that the husband immediately signed up for one of Tony’s business seminars next month for $10,000!! Omg. He works in a small family owned business and they are sinking 10k into it to send him there. I feel somewhat responsible but at the same time I can’t be. I said to watch the movie not buy into it! Oh well…to offset the cost I have also told him to start listens to Dave Ramsey podcasts. Maybe Dave will change his mind?

Thanks for the nugget, Miss M. I hope it works out for your best friend’s husband. Ouch! Ten thousand dollars is a lot of money to pay for some sweaty giant to psychologically undress you in front of a bunch of strangers. Can he get a refund? Heck, Financial Peace University is about one-hundredth the cost of Tony’s business seminars. And I’m sure FPU will be just as life-altering. Meh. Keep us posted on how things work out for your friend’s husband. Happy New Year, Miss M.

The Toni Robbins I am not your Guru was one of Tonis. I use to listen to his CDs and read his books back in the 90s. Not anymore.

I hear ya, Pam. You’re not missing anything. Best of luck in 2017. I look forward to reading up on your adventures in the Great White North.

I didn’t want to like Tony Robbin’s book MONEY: Master The Game (it is very salesly), but I got a lot more value from it than the $18 I paid for it. It gave me a few ideas on how to use my HSA account more effectively. Have you seen his I am Not Your Guru documentary on Netflix? I always don’t want to like him, but in his documentary you get a real feel for his earnestness and it made me appreciate him more. He has already made so much money, yet he still goes out and tries to make a difference in peoples lives (and he does). He has been the inspiration behind some of the worlds most valuable companies (Salesforce being one).

Hey, MM. Excellent points. I did see his documentary on Netflix. And I do agree that Tony cares about people. I worry about malpractice, though. Psychologically dissecting people in public is not something that should be taken lightly. I wonder what trained psychologists think of his methods?

Hey Mr. Groovy,

I really enjoyed this rant and thought you brought up some great points.

I don’t know much about Tony Robbins. To be honest, there was always some too good to be true element about him. He seems fake to me so I’ve never looked any further.

As for Kiyosaki, I read Rich Dad Poor Dad back around 2011 and did like the book. I like the concept of buying assets instead of liabilities etc. However, there is a smugness about him I don’t love. And it is a little bit odd that he never mentions who the Rich Dad is. He is also too focused on money and being rich. I mean, finance is important but not everyone needs millions of dollars and fancy cars.

Overall, I did enjoy his book, but I definitely agree with what you’re saying. Great read!

Nice analysis. I too like Kiyosaki’s concept of favoring assets over liabilities. But he always rubbed me the wrong way. I just couldn’t articulate until I read your comment. He is smug. Thank you. And his notion that you’re a loser if you’re not rich or if you collect a paycheck is extremely off putting. Thanks for clarifying my animosity toward Kiyosaki, Graham. I really appreciate it.

Hey, Michael. Thanks for stepping up to Tony’s defense. It’s weird. Tony’s in my doghouse, but I still like him. And that’s basically because I know he’s not all bad. Mrs. Groovy reminded me of his charity efforts as well. She even looked up his charity on charitynavigator.org and his charity was rated very highly–overall rating of 93.48. Personally, I would stick to his books. I can’t see how his seminars would be worth the price. But you went to one and thought it was worth every penny. So I’ll try to be open-minded. Thanks for the link, Michael. I’ll read it and let you know what I think.

P.S. You’re not crazy. In fact, I’m a little surprised that more people haven’t come to the defense of Robbins and Kiyosaki. I surely have my misgivings about the two, but I know they’ve inspired a lot of people to take charge of their financial lives.

Well call me crazy, but I’ll go to bat 1000% for Tony Robbins! I’ve actually benefited directly from his teaching for the last couple decades of my life. I even credit him in my blog bio on how and why I’ve been able to take an early retirement… and that was just from reading his books.

Having said that, I’d never attended a live seminar of his until a year ago. I must say it was rather life changing (if you care to know why you can check out my post – http://www.financiallyalert.com/how-my-date-with-destiny-found-me-part-1/).

That one live event then led to another – DWD, the one you see in the documentary. YES, it was incredibly expensive, but it was also worth every penny I paid for it and probably more.

Why? The short answer is this. I learned to stop living in my head (thinking too much), and start living in my heart (feeling). I know this probably sounds a bit corny and cliche, but it’s true.

Btw, Tony’s companies pull in about $5 billion in revenues annually. So, although he brings in millions of dollars for each live event, it’s actually a fraction of their overall revenues. Each year he continues to up his philanthropic reach through the Anthony Robbins Foundation which feeds millions of people annually.

Anyhow, I don’t expect to change most people’s opinions, but perhaps for those undecided, my comment here will at least entice you to do some further research for yourself.

Cheers!

My only knowledge of Kiyosaki is that I have some friends who did the real estate seminar and it worked out for them. I think they could have gotten the information elsewhere just as easily, but hey, I don’t know what the financial blogosphere was like 15 years ago.

The more interesting thing was they got me to play the Cashflow game a couple of times. It opened my eyes to a lot more passive income opportunities outside of the stock market and the effects of shaking debt.

Yes, passive income and shaking debt are key financial insights. If Kiyosaki would just stick to these concepts, and do so in an honorable fashion, he would be a welcome part the financial community. Why he decided to go the snake-oil-salesperson route is only something he can explain. Thanks for sharing, Emily.

I agree with you on both. Robbins claims to be a low cost proponent, but now works for a higher cost brokerage. Always be skeptical.

“Always be skeptical.” Three words to live by.

I have only read about corporate execs & celebrities doing Tony Robbins excursions which I’m sure are different than the regular public.

Rich Dad, Poor Dad was my first real introduction to personal finance in high school. I thought it was a good book & I like his emphasis on passive income. But I don’t know if there is any “good debt.” I have heard that about his speaking engagements and they are super expensive for not a lot of info. I think I heard he was sued at one time as well and had to change the material or discontinue a certain speaking series.

Agreed. Kiyosaki carries on like there is absolutely no risk associated with debt. I look forward to how he services his debt during the next recession when a sizable chunk of his renters lose their jobs.

You aren’t being too hard on them. Your thoughts are on the mark.

They are both snake oil salesmen, in my book, but they stick around so long because they offer a few great principles that resonate. Kiosaki with real estate and a different perspective on how to earn wealth and Robbins with unlocking the potential within yourself…great principles! The rest is garbage, fluff, and sales BS, which is easy to fall for.

I say to take what you can from them and move on.

I read Cashflow Quandrant from Kiosaki, got halfway through and that was enough for me. I picked up some great ideas and principles.

I tried to read Money, but couldn’t get going. I might try again someday, but I can’t get passed the reviews talking about all that fluff. Whew, that’s a tough ask.

I watched I am Not Your Guru and didn’t like it overall. I don’t know what you are supposed to get from those seminars, and at that price tag, I would expect A LOT. I did enjoy some of it, but mostly felt sorry for the audience members and their tough situations.

Thanks for jumping in, Brian. I couldn’t agree more with your stinging rebuke of Kiyosaki and Robbins. As you pointed out, they offer a few great principles, but an awful lot of “garbage, fluff, and sales BS.” That second paragraph nailed it. With just a few sentences, you summed up the case against Kiyosaki and Robbins far better than I did. Bravo.

No you’re not being too hard Mr. G. A lot of people including finance experts think he is shady.

I didn’t understand that book when I read it and when I finally looked it up online, a lot of people were calling the inconsistencies on it.

I’m a staunch capitalist but I don’t believe in deception in business. Also what if your dream is to work as an astronaut, or for the FBI, or for the CIA, or as a NASA engineer, etc.

It’s kind of hard to work in these careers as an entrepreneur. You know? So to say that people are fools for getting a paycheck? Excuse me.

Oh and by the way his book royalties are paid via paycheck too! duh…!!!

Great points as always, Lila. What if “your dream is to work as an astronaut, or for the FBI, or for the CIA, or as a NASA engineer?” To Kiyosaki, you’d be a LOSER! And don’t forget the guys and gals who dream of being in the military. They’re LOSERS too!

“Am I being too hard on these fellows?”

Nope, particularly with Kiyosaki. While his first book was mildly interesting and communicated some good ideas, his subsequent books – Rich Dad, Poor Dad (insert any subtitle here) – and efforts (e.g. seminars) were simply ways to milk the notoriety he had gained. In some ways he’s like the music artist that has the one hit song and finds a way to hang around for 20 years – and make lots of money – by milking the one song for everything they can in any way possible.

LOL. Love it, James. What a great analogy. Kiyosaki is the KISS of the financial guru world. KISS had one okay hit (I Wanna Rock N Roll All Night) and milked it for more than 20 years. Kiyosaki had one okay insight (your home is not an asset) and milked it for more than 20 years. You nailed it, my friend.

I think its the constant upsells and pushing towards investments that benefit them that irk me the most about these two. I don’t begrudge a motivational speaker charging what the market will bear, but I do not like when they advertise a free setup and then use it as a hard sell. I get it, they make their money off giving advice, just as many people in the blogging world make extra cash from their blogs. The difference being most bloggers don’t promise you free entertaining content and then simply post a bunch of articles on how you should buy their content. Also I like to think that most bloggers only recommend products they actually feel are worth it. The Tony Robbins recent finance bent was half way decent until he recommended funds with higher expense ratios.

Awesome, FTF. What a great summation of the point I was trying to make. The upselling is obnoxious and extremely off-putting–especially in light of the financial blogosphere. Just about every sound bit of advice these gurus offer is given away for free by financial bloggers.

I look forward to Dave Ramsey getting the Andy Rooney treatment from you, too. Or has that rant already been published?

Cheers!

-PoF

No rant on Dave yet. I actually like Dave and credit him with turning around my financial life. His radio show and book, Total Money Makeover, got me on the path to FIRE. But his investment advice bothers me. I don’t like the high-cost mutual funds he recommends. I don’t like his claim that the stock market returns 12% over the long haul. And I don’t like that he gets a fee from the financial advisers he promotes. Too much of a conflict of interest for my taste. But as of now, I think Dave does far more good than bad. His books, classes, and online tools are very reasonably priced–and excellent resources for those trying to get out of debt. Thanks for stopping by, PoF. Love the Andy Rooney reference.

I really thought Rich Dad, Poor Dad was one of the books that helped me make sense of a lot of things. I have no interest in the seminars, etc. though. I think my brother liked some of Tony Robbins early work – I don’t know much about him, so I’ll have to ask next time I talk to him. I like Andrew’s word above though – both sound like hucksters.

Yeah, I would put both in the hucksters category. And it’s a shame. They both have some sound ideas. But the lure of money has corrupted them.

I thought Rich Dad, Poor Dad was only ok. Didn’t care for the main message of using property to build wealth, but the idea of putting money into assets rather than liabilities is a solid one.

I’ll have to check out the Tony Robbin’s book. I have that documentary in my Netflix queue but haven’t gotten around to watching it. Worth my time or no?

Agreed. If Kiyosaki just stuck to the idea of building assets and not liabilities, and avoided all the up-selling nonsense, I’d respect him a lot more. I recommend Tony’s book Money. It’s a good read as long as you ignore the self-promotion and the advice to invest in his financial firm. The Netflix movie is worth your time as well. It’s a great study in the “cult of personality.”

I have never read Kiyosaki book. I did attend a free local seminar of his a few years ago. What a scam. I was basically upsold for 45 minutes to an hour on real estate investing. Looking for me to drop hundreds on books and $495 on a 3-day seminar. I called BS on it and have never taken him seriously since.

Thanks, Brian. Sorry you had to go through that. Not fun. I just don’t understand why Kiyosaki can’t play it straight. And I just don’t understand why radio stations carry his syndicated show.

$4,000 to go see Tony Robbins? Wow. I couldn’t find a way to excuse spending a lot less on attending FinCon – which actually may have helped my blog and side hustling. I would love to poll attendees a month or two afterwards (when they start accruing credit card interest on the cost of their ticket) on whether the experience had made any meaningful difference in their lives.

I have plans to release an ebook and have some ideas for creating a webinar/online course in the future. While I would like to make money from such endeavors, I also don’t want to charge a fortune. Above all, as you discussed above, my goal would be to provide something of value to other people.

Couldn’t agree more, Harmony. Mrs. Groovy and I go back and forth about attending FinCon too. And FinCon is much cheaper than $4K/per attendee. And FinCon will be chock full of people we want to see. In other words, FinCon is a great value and we’re still not ready to pull the trigger on it.

P.S. Keep me posted on your ebook. I’m really looking forward to it. I’m sure it’s going to be a great read and value.

I remember skimming through Rich Dad Poor Dad…it was motivating and inspiring. It didn’t really have much actionable advice but I think it does teach you to change your mindset regarding money. Other than that, yea, I think he’s a huckster. And Robbins, I’ve heard him speak and I guess he has that magnetic personality but part of me think he’s part huckster too. Writing “Money” and getting into the personal finance space seems like a money grab. Nothing necessarily wrong with trying to earn some money (plenty of bloggers have affiliates too)…but I read that Tony argues for low cost investing while promoting a firm that charges 1.2% fees…a firm that he is a partner in.

Thanks, Andrew. I forgot all about Tony promoting a firm that he’s a partner in and charges high fees. Not cool.

I’ve taken a few good things from the writings of both men, but gotten their books out of my public library and not spent a dime. All that upselling is really disturbing (and all the motivational and financial speakers do it).

Excellent strategy, MarciaB. That’s what Mrs. Groovy and I have done. Even gurus with questionable business models have a few good things to say/teach. So why not just avail yourself to the good things for free?

I’ve always had a bit of an issue with those two as well – they both just seem so salesy, which raises my BS meter up as well. I heard that Financial Rockstar episode and remember thinking the same thing. Obviously, people should be able to make money, even if they are trying to help people, but I just can’t help getting the feeling that I’m being sold, rather than helped whenever I read their stuff.

Agreed, FP. By all means, make money. But just be straight with people. Is that asking too much?

I haven’t read any Kiyosaki, mostly because the consensus in the Financial Independence subbreddit was that he was a snake oil salesman. I decided to skip his work (although with the intention of reading it at some point, since it has influenced a lot of people and I want to know what connected with them).

Like you, I had always brushed Robbins off without doing any sort of research. I read Money this year out of a sense of obligation. And like you, I was pleasantly surprised. The book could have been about 50% shorter if he cut out the self-indulgent talk about how important he is and how many important people he knows personally, but the content that was there was actually really good.

I followed that up with Not Your Guru and was torn. On the one hand, it seems like he is legitimately helping a lot of people. On the other hand, I have absolutely zero interest in going to one of those rallies and having someone psychologically dissect me in front of an arena of people. Add in the crazy high costs, and I don’t understand how he continues to sell out massive venues.

My thoughts exactly, Matt. Who’s going to Tony’s retreats? I can’t think of anyone I’d pay $4K to see.

I haven’t spent much time with Mr Robbins work so I don’t have an opinion there

I enjoyed Rich Dad Poor Dad and I think it’s a good beginner book on how to pay yourself. But I did see a recent interview with him on MarketWatch and where he said “if you’re investing for the long term – you’re crazy” soooo – my PF endorsement on his recent opinion is gone.

It bugs me that one line like that could sway people that have read his books and trust him

Agreed. Not everyone is cut out to be a business owner. Not everyone wants the hassles of being a business owner. So why does Kiyosaki mock these people? I tried being a landlord and discovered it wasn’t for me. I couldn’t kick a mother and her three young children out of my house when her husband, the sole breadwinner of the family, got arrested. I just had to forego rent for the three or four months it took for the husband’s judicial issues to be resolved. But I felt a lot more comfortable investing in REITs. And I feel the same way about the stock market. At this point in my life, I’d rather own an index fund than my own business. But in Kiyosaki’s mind, I’m either a loser like his Poor Dad or a fool. Meh.

I heard Robert Kiyosaki on an older episode of Radical Personal Finance, and he sounded like a kook. He didn’t answer a lot of the questions and kept saying that the market was about to crash so people should buy gold and silver.

Who knows? Maybe he’s right. But his speech patterns, arrogance, and refusal to cooperate and actually answer the darn questions makes me wonder if he’s in his own little world.

Hey, Julie. You’re right. I forgot about the RPF episode. Kiyosaki is lucky Joshua is such a gentleman. I crack up every time Kiyosaki says on his radio show, “only fools get a paycheck.” I understand how other sources of income are taxed at a lower rate. But are people “fools” because they get a wage? And how does Kiyosaki get paid for his syndicated radio show? Stock options? Physical gold?

This was my immediate impression as well, which is why I didn’t bother listening to him a second time. “Cleverly” avoiding questions is a sure-fire way to avoid gaining my respect.

So true. If he has nothing to hide, he has no reason to be clever. Now if he were a politician, that’s one thing. We expect our politicians to be clever. But he’s supposed to be a money mastermind with the overarching goal of helping the average person. Being clever in this regard is tantamount to being a fraud.