This post may contain affiliate links. Please read our disclosure for more information.

During the 2008 primary season, MSNBC host Chris Matthews experienced something rapturous as he listened to a speech being delivered by then-candidate Barack Obama. He described the feeling as follows:

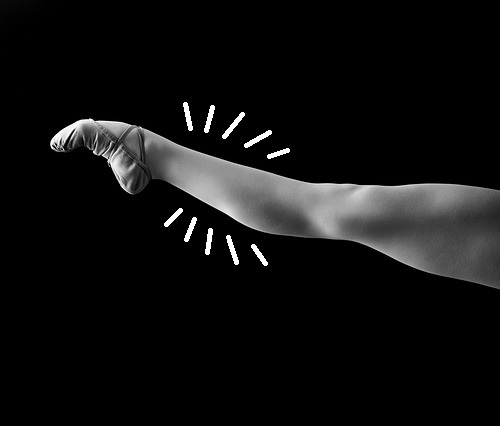

“I have to tell you, you know, it’s part of reporting this case, this election, the feeling most people get when they hear Barack Obama’s speech. My, I felt this thrill going up my leg. I mean, I don’t have that too often.” [Emphasis mine.]

Ah, yes, the Chris Matthews leg tingle, or CMLT for short.

Mr. Matthews caught a lot of flak from his political detractors for describing the jolt of happiness he experienced as a “leg tingle.”

But why? The catalyst behind his leg tingle wasn’t malevolent. It was a speech—from a great orator. Had he gotten the leg tingle from robbing a bank, it would have been an entirely different matter.

CMLTs Are Cool

It seems to me that CMLTs—short-lived bursts of joy derived from wholesome endeavors or things—should be coveted by any thoughtful person. After all, CMLTs are a great way to smooth over all the pain that accompanies the human condition. Heck, CMLTs are even enshrined in our glorious Declaration of Independence.

“We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the PURSUIT OF HAPPINESS.”

With this in mind, then, I decided to review the CMLTs in my life.

When I was younger, my CMLTs were largely connected to testosterone. I would get a CMLT whenever a pretty girl smiled at me, whenever I broke a personal bench-press record, or whenever the Dallas Cowboys won a football game.

My youthful CMLTs were also connected to consumerism. Buy a case of Genny Cream Ale? Wow—CMLT. Put a new electronic gadget on the credit card? Yeah, baby, what a CMLT. Book a trip to Vegas? Super-duper mega CMLT.

But as I aged, and drifted farther away from my fortieth birthday, my best CMLTs began to stem more and more from the core tenets of financial independence. Here are just some of the FI-related CMLTs that have sustained me over the past ten years or so.

- Increasing the percentage of my pay earmarked for my 401(k).

- Filling out the paperwork every year with my HR department so I could take advantage of the 401(k) catch-up provision for employees over 50.

- Checking off the months of our Freedom Countdown chalkboard.

- Calculating our net worth.

- Entering expenses in our expense tracker.

- Driving down my block and mentally noting that my car is by far the worst in the neighborhood.

- Mailing our property tax payment to the county every fall.

- Mailing our estimated tax payments to the feds every quarter.

- Getting a text message from my bank confirming that my monthly pension check has been deposited.

- Re-balancing our portfolio every year to maintain our desired asset allocation.

I could, of course, wax eloquently about my FI-related CMLTs for a lot longer. But that would be rude. So let me leave you with just one more FI-related CMLT. It has to do with Mrs. Groovy and my bedroom.

Yes, Mrs. Groovy really knows how to get my leg tingling in that citadel of nocturnal tranquility. The other day I walked into my bedroom and found 63 cents lying on my dresser. “Holy loose change,” I exclaimed. “Mrs. Groovy really does love me!” I then took that 63 cents and plunked it gleefully into my change jar. My legs nearly buckled as two ferocious CMLTs had their way with my innocent legs.

CMLTs and Financial Independence

There’s no way a young Mr. Groovy would have ever gotten a CMLT from putting loose change in a jar. No, back in the day, CMLTs only seemed to come my way from beer, Mighty Tacos, and securing phone numbers with cheesy pick-up lines (“Gee, your hair smells terrific“).

So what changed? Why did anything related to personal finance and FIRE suddenly make my heart go pitta-patta?

I like to think that my financial renaissance was the result of Mrs. Groovy and the FI community. And they surely played a major role. But my turnaround from a beer-swilling colossus of mediocrity to a raging FIRE enthusiast was so abrupt, I have my doubts.

In other words, my concern is this: My transformation wasn’t a long drawn out battle with many dispiriting setbacks. It was an overnight capitulation. A rout. So, did Mrs. Groovy and the FI community fundamentally change me, or did they merely awaken something that was already inside me?

The answer is critical. What if no amount of education will convince someone without the “FIRE gene” that the CMLT from maxing out a Roth IRA is just as fulfilling as the CMLT from buying a new SUV? What if few or any natural-born spenders can be turned? What if those denied the FIRE gene at birth are forever destined to be the pliant servants of big business? Must the government step in and protect them from their innate consumerism?

Damn, it’s no fun being someone who is pained by the economic tomfoolery of others. Fixing humanity is hard.

Final Thoughts

Okay, groovy freedomist, that’s all I got. What say you? Can anyone be taught to appreciate FI-related CMLTs? Or are they something that only those born with the FIRE gene can appreciate? Let me know what you think when you get a chance. Have a great weekend. Grease for peace.

My favorite FI- CMLT? In October, when I max out my 401(k), 401(k) catch-up and Roth IRA and I have all this extra money on my remaining paychecks for the rest of the year. Swoon! And THEN what I decide to do with that extra money…SAVE IT! Swoon again! 😉

Awesome, Sandra. You really know the meaning of life. BTW, I got a great CMLT reading your comment.

I love the story about the 63 cents of lose change. I, too, get far more joy out of putting money in my change jar and eventually taking it to the bank to add to my emergency fund than I should. My wife doesn’t really understand this but she has figured out that giving me lose change makes me happy. Thanks for the laugh. It’s nice to know I am not the only crazy one out there.

Thanks, Brent. All the hail the crazies out there. We got life by the short hairs. After all, how great is life if you can get happiness from putting coins into a jar?

Maybe twenty years ago I was slammed into the wall playing racquetball with a good friend who was about the size and had the physicality of Thor. It resulted in some weird nerve damage that ended up being one of the coolest things that has happened to me. Maybe a dozen times a year, usually when I’m very tired, like after a 20 mile marathon training run or a brutal tennis match once I stop and rest there will be an enormous tingling sensation that covers the entire shoulder. It is deep inside my muscles and it feels so incredible that I think it would be addictive if I could control it. It is purely physical with no emotional context so it isn’t a CMLT but I’ve never met another person with anything like it. It is the best injury ever!

LOL! That’s awesome, Steveark. Who knew an injury could provide lasting joy.

No CMLT’s from the cowboys this year Mr. Groovy (fellow Dallas fan)…but hey maybe Jerry will get some defense in next years draft!

Haha! So true, Clint. When was the last time Dallas had a good defense?

Oh Mr. Groovy, you just made my day! I always wondered what to call that thrill when I geeked out on FI or personal finance related goals… now I know that the symptoms align with a certified FI-related CMLT!

Have a great Thanksgiving 🙂

Thank you, Mrs. AR. The acronym CMLT really comes in handy. Mrs. Groovy and I had a bunch of them this weekend, and each time we blurted out, “CMLT!”

Just a great blog. So very true. I especially love the 63 cents. If I am out for a walk and I find a dime on the ground, I swear I do a jig right there!

Tingles are great!

Made my night, Stanley. And as I read your tingle story I couldn’t help but think of the song “Out in the Street” by Bruce Springsteen. Here’s my tribute to you with that song in mind.

When I’m out in the street

My eyes catch a hunting glare

When I’m out in the street

A dime will prompt a jig right there

Have a great Thanksgiving, my friend. Cheers.

Seeing as how we’re so goal-oriented nowadays, we accepted that FI is inevitable and I think that we have a greater appreciation for what we have today, big and small.

Having a great cup of coffee? CMLT

Sleeping in? CMLT

Saving money by eating leftovers? CMLT

🙂

Haha! I love it, Claudia. You and Garrett are definitely my heroes. And I love the eating leftovers CMLT. For New Year’s, Mrs. G and I get two combo dinners from our favorite Chinese restaurant. It usually takes care of dinner on New Year’s Eve and lunch and dinner on New Year’s day. We truly don’t need nearly as much as we suppose to have a wonderful life. When will the masses realize this, damn it?

I think part of it is how you are raised. My parents were well off but never showed it. In fact, I remember getting a basketball hoop as a Christmas present one year and thinking we weren’t going to be able to pay the bills. This caused me to grow up saving as much as I could and looking for as many ways to make money as possible.

My wife on the other hand grew up with about the same amount of wealth but her parents didn’t hide it. They spoiled her and now she’s a lover of spending.

Hey, CC. Agreed. I grew up solidly middle-class, and we pretty much had all we wanted. The thing is we didn’t want much. All we needed to make ourselves happy was a football or some gloves and a baseball. I swear to God one of my fondest memories as a kid was making a fort out of a neighbor’s discarded refrigerator box. Back then we really used our imagination muscles. But sadly the art of making something wonderful out of little is a lost art. Meh. Thanks for stopping by, CC. Pointing out how we are sometimes enslaved by our experiences is an important reminder.

Great post as always. I stay away from both the right and left wing media. I wonder how many of your readers know what Genny Cream Ale is? You caused me to have a flashback to the early 80’s. When I was a kid, we used to swipe a few of those green cans out of my dad’s fridge that he kept on the back porch. I guess I was destined for The Financial Independence Community since age 8🙂.

You’re a wise man, Dave. I heard a YouTuber the other day describe our media and politicians as the WWE. And it was the perfect analogy. All the rancor and bluster is for show. Behind the scenes, they’re all part of the same club, and they all help each other protect their respective fiefdoms. And we’re the dumb saps who fall for it. And thank you for shouting out Genny Cream Ale. One of these days I’m going to drag Mrs. Groovy up to Buffalo so I can gorge myself on Genny Cream Ales and Duff’s chicken wings. Thanks for stopping by, my friend. It’s always great hearing from someone who appreciates one of Western New York’s finest brews.

Pffft this is so silly hahaha. That’s how I feel when I see change too. Jared finds pennies and dimes on the street and picks it up for me. The time he found $5 on the sidewalk, I nearly toppled over with CMLT.

Wow! The sidewalk coughing up $5. That’s bound to deliver a glorious CMLT to any FI enthusiast. Thanks for sharing, Lily. I got a second-hand CMLT just reading it.

“Damn, it’s no fun being someone who is pained by the economic tomfoolery of others. Fixing humanity is hard.” Hahahaha……That’s classic! I think everyone has the “gene”. However, it gets buried by the constant commercialism in everything they are exposed to. Must have the newest, biggest, most luxurious, in order to be successful and liked. If you have these THINGS, you will be HAPPY. What a scam! More and more horses are drinking the water that the FI community has lead them to. I get a CMLT every time I can apply something I learned from the FI community that allows me to take bigger steps towards FI. It just takes a little longer to recover from the twitch as I get older. 🙂

So true, FIways and Byways. I had no idea how pervasive advertising and commercialization was until I got rid of cable. Now, for the most part, the only advertising I’m subjected to is the advertising found on blogs and podcasts. And that advertising is usually for things that are beneficial to your pursuit of wealth. The only way to escape the constant pull to seek out the “newest, biggest, and most luxurious” is to de-mediaify yourself. It’s amazing how less inclined you are to keep up with the Joneses when you don’t have cable, don’t subscribe to newspapers or magazines, don’t frequent the movies often, and don’t listen to a lot of radio. Thanks for stopping by, FIways and Byways. It’s always great hearing from another soul who drinks heartily from the FI well. May your future know a copious amount of CMLTs. Cheers.

I think anyone can have FI-related CMLTs, but not everyone will have an easy time transitioning to them. Why the difference? Perhaps it’s related to discipline, or habits, or ability to picture the future. Whatever it is, I’m glad it worked for you. I’ll confess to having some FI-related CMLTs myself, even though my conversion wasn’t quite as smooth.

It’s weird. I didn’t have to constantly remind myself of the genius behind the fundamental tenets of wealth building. I was introduced to the emergency fund concept, found it made sense, and just went about building one. The same thing occurred with pay-yourself-first, dollar-cost-averaging, and index funds. They all made sense, were in my interest to embrace, so I just embraced them. But I know embracing these things doesn’t come easy to everyone. Thanks for stopping by, Gary. I really appreciate the sober reflection you bring to every topic.

I got the tingle about 2.5 years ago when I found out about the Trinity Study and realize I’m already FI. Best.Tingle.Eva.

LOL! Agreed, AF. That’s such a great tingle, in fact, we got to come up with a special name for it. Would MBT work–Mustachean Body Tingle?

How your mind works, Mr.G, Lol! Love it! I’d like to think anyone can enjoy the CMLT’s from FIRE tactics but they need to have an open mind. Perhaps that is a gene. Happy weekend!

Agreed. When I was a child, I used to get a charge out of having a passbook and a savings account at the local bank. I loved seeing my meager savings go up a few dollars every month. But somewhere during adolescence I lost that excitement. Thankfully savings- and FI-related excitement emerged again in my 40s. So there is hope. But why do so many us see it extinguished in the critical years of early adulthood? Sigh. Thanks for stopping by, Amy. You never fail to brighten my day.

This post had me cracking up, CMLT’s are a fantastic concept haha. I think some people can have all the same knowledge and still not be interested in financial topics as we all are in this community, but the knowledge is a great start.

Amen, my brother. Perhaps our schools could tread a little less harder on Oppression Studies and maybe introduce some Wealth Studies or Opportunity Studies? Thanks for stopping by, Matt. I love the cut of your jib.

I got a CMLT last week while swimming. Then again, the water was only 55 degrees! Gotta love tingly legs, however you get them!

“Gotta love tingly legs, however you get them!”

LOL! Truer words have never been spoken, my friend.

“When I was younger, my CMLTs were largely connected to testosterone. “

“Can anyone be taught to appreciate FI-related CMLTs?”

This is genius! I believe almost anyone has the capacity to learn FI concepts, but here’s a half-baked theory:

It’s entitlement. Compared to much of the world, Americans consume and spend like crazy people. We all probably know people earning six figures who are so extended with oversized McMansions and expensive motorized recliners (cars and SUVs ,thanks MrMoneyMustache) that they “can’t”save any money. These are intelligent people, able to earn good incomes, so should be able to grasp FI concepts. But the sense of entitlement doesn’t include sacrifice. They deserve the American Dream–no matter what.

Am I crazy here?

“But the sense of entitlement doesn’t include sacrifice. They deserve the American Dream–no matter what.”

Oh, man, you are so right. And the truly sad part is that most Americans have no idea how lucky they are–and that includes our poorest citizens. The amount of wealth and opportunity in this country is staggering. Here are some interesting statistics I came across this weekend.

1. A net worth of $3,582 puts you in the top 50% of the world’s citizens.

2. A net worth of $76,754 puts you in the top 10%.

3. A net worth of $770,368 puts you in the top 1%.

4. Median wealth in North America is 4x Europe’s, 9x China’s, 50x India’s, and 100x Africa’s.

5. America accounts for 43% of the world’s millionaires but only has 5% of the world’s population.

Message to the entitled: Stop the BS and grow up. You won the lottery by being born in America. Get off your butts and use your functioning brains to make something of yourselves.

Thanks for stopping by, Mr. G. I really love the way your mind works.

My FIRE-related CMLT have been relatively few, but memorable. They are (1) learning about the 4% rule. (2) converting to index funds. (3) when my net worth went positive.

I expect to experience more CMLT as I hit more major financial milestones and finally reach FIRE.

Hey, Ty. That’s awesome. My initial FI-related CMLTs were very similar. For me it was the emergency fund and automating savings. My most pivotal CMLT was stumbling upon Mr. Money Mustache’s classic, “The Shockingly Simple Math Behind Early Retirement.” At the time I read it, in 2013, I thought I was working until I was 67. Mr. MM literally saved me from 12 more years of cubicle hell. Thanks for stopping by, my friend. It’s always great hearing from someone who appreciates a good FI-related CMLT.

You just gave me a CMLT reading this!

(Hubba, hubba)

You’re the best, my friend. Thanks.

Oh, how I wish all of my IRL friends and family members would experirence the joy of an FI-related CMLT. Alas, most think I’m crazy. But I know the truth. 🙂

It’s nice being “crazy” in some aspects of life. What amazes me is how easily FI-related CMLTs come to some people and not to others. Even in the same family there are large variations. My brother and his daughter (my niece) are much moved by FI-related CMLTs. My ex-sister-in-law and her son (my nephew) don’t appear to get CMLTs from savings, cutting expenses, de-cluttering, etc. The human species is indeed fickle. Thanks for stopping by, Laurie. Always a pleasure hearing from you.