This post may contain affiliate links. Please read our disclosure for more information.

The cost of college is a major impediment to financial independence. Every dollar that is used to fund a 529 plan, or pay a student loan, or support a state’s university system, is one less dollar that can be contributed to a Roth IRA or a 401(k).

For the past several decades, the game plan to make college affordable has been simple. Put more money in the hands of students. More scholarships. More work-study programs. More Pell grants. And, most importantly, more student loans.

But this approach, as many Americans are all too aware, has failed miserably. It has only encouraged colleges to spend more and drive up costs. The typical college graduate now leaves the hallowed halls of academia with nearly $30,000 in student loan debt.

Senator Bernie Sanders thinks he has the answer. He wants to make college more affordable by de-emphasizing student loans. He wants the taxpayers to shoulder a greater percentage of higher education’s costs. The legislation he has introduced will make college tuition free by imposing a tax on Wall Street transactions. Hillary Clinton has also floated a proposal to de-emphasize the student-loan component of college financing.

Making college financing less reliant on student loans is no doubt politically attractive. It gives college students, a highly visible and sympathetic group, a terrific perk. But how exactly does it bend the cost curve of higher education? Does doing away with student loans give colleges an incentive to reduce costs? Is the typical college likely to show more concern for the financial well-being of the taxpayers than it has shown for the financial well-being of its students?

The problem with this new approach to college affordability (de-emphasizing student loans and putting more of the burden on the taxpayers) is that it’s really no different than the old approach. It’s still only attacking the symptom. The disease is allowed to fester.

Attack the Disease

The disease of higher education is its current business model. College, simply put, will never be affordable, whether it’s paid for by students or taxpayers, as long as…

- it hires full-time professors and gives them part-time teaching responsibilities.

- it provides its students with resort-like accommodations and amenities.

- it operates minor-league franchises for the NFL, NBA, MLB, and NHL.

- it sponsors Greek life, a multitude of clubs, and a variety of causes.

- it devotes an increasing percentage of its resources to social services rather than instruction.

- it wants to impart commercial skills, and do research, and make sure its students think the right thoughts.

To make college truly affordable, you have to challenge the six practices outlined above. Anything short of that is lipstick on a pig. The plan I’m proposing takes aim at practices one and six. Let’s start with practice six.

The college-industrial complex (CIC) is wedded to the notion that college is something more than a glorified trade school. Nothing wrong with that. But that’s the CIC’s definition of education. What if you’re perfectly fine with a glorified trade school? What if all you want out of college are the skills necessary to be an effective accountant, programmer, or nurse? What if you loathe the progressive ideology that is so prevalent on campus today and see much of the CIC’s course requirements, not as a noble quest to impart well-roundedness, but as a pernicious effort to shape hearts and minds? What if you embrace the CIC’s progressive ideology and welcome its understanding of well-roundedness but can’t afford to be well-rounded? A college credit no longer costs $15, after all.

If you believe college should be nothing more than a glorified trade school, or if all you can afford is a glorified trade school, you deserve that option. My plan provides that by requiring the following:

Every college has to offer a certificate degree for every one of its majors. A certificate degree shall not exceed 20 classes and shall only contain the classes that pertain to the requirements of its corresponding major.

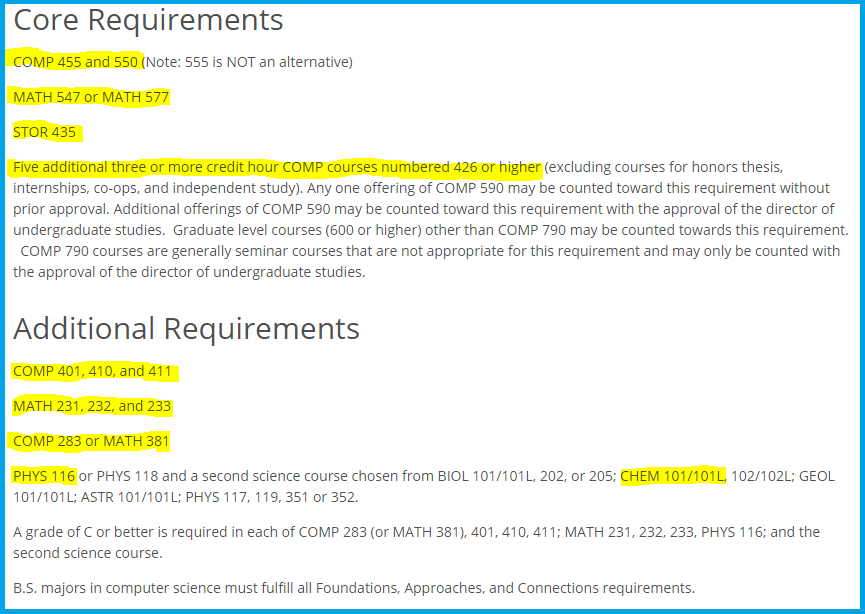

Here’s how a certificate degree would work. I looked up the degree requirements for a BS in computer science at University of North Carolina Chapel Hill (UNC) and made a copy of them below. I count eighteen computer-related classes (see the yellow highlights). Under my proposal, UNC would have to offer a certificate of science (CS) in computer science that required only these eighteen computer-related classes. Students would thus have a choice. They can go for the full monty and take the 40 classes necessary to get a bachelor’s degree (18 computer-related classes plus 22 non-computer-related classes). Or they can go the frugal route and take the 18 classes necessary to get a certificate degree (18 computer-related classes plus 0 non-computer-related classes).

Degree Requirements for a BS in Computer Science

Going by the most recent UNC schedule of tuition and fees, here’s the difference in cost between a CS in computer science and a BS in computer science.

Certificate Degree

| Total Credits (18 x 3) | 54 |

| Classes Per Semester | 5 |

| Total Semesters | 3.6 |

| Total Cost of Tuition and Fees | $15,868.97 |

Bachelor’s Degree

| Total Credits (40 x 3) | 120 |

| Classes Per Semester | 5 |

| Total Semesters | 8 |

| Total Cost of Tuition and Fees | $33,343.68 |

When I look at these numbers I weep. Why are we making it so hard on today’s young people? My certificate degree idea would easily halve the cost of a college credential. And it wouldn’t cost the taxpayers a dime.

Now let’s consider practice one. How ethical is it for a college to justify its outrageous cost by pointing to its awesome faculty but then hire adjuncts (part-time professors) and grad students to teach many of its classes? In other words, is it cool for a large share of a college’s classes to be taught, not by the A team, but by the B and C teams?

It doesn’t strike me as ethical at all. It’s the kind of bait-and-switch crap I expect from big-box retailers or Wall Street. To make the CIC more ethical and transparent, then, my plan requires the following:

Every college must discount the cost of classes taught by adjuncts and grad students by at least a third.

There are, of course, legitimate reasons why adjuncts and grad students teach college classes. For many introductory classes, adjuncts and grad students are more than capable instructors. Also, would it make sense to have the world’s leading astrophysicist teaching remedial math classes? Shouldn’t rockstar professors be working with the strongest students on campus rather than the weakest? So there’s definitely a role for adjuncts and grad students. But adjuncts and grad students are paid a fraction of what full-time professors are paid, Students, therefore, shouldn’t have to pay the full-price for a class taught by an adjunct or a grad student. A discount is only fair.

Final Thoughts

My plan to lower the cost of college is a no brainer. It would easily reduce the cost of a degree by half, and it would very likely increase the graduation rate. Surviving a two-year gauntlet is much easier than surviving a four-year gauntlet. The only loser in my plan is the college-industrial complex. It knows very well that much of its product only exists because students are forced to support it. If a bachelor’s degree were “unbundled,” and students were allowed to only take the classes that pertain to their areas of interest, many professors and administrators would lose their jobs.

So, groovy freakin freedomists, do you think my plan makes sense? Would it work if enacted? I’d love to hear your thoughts.

P.S. For sh*ts and giggles I’m sending my plan to lower the cost of college to my elected representatives. I’ll keep you posted on their responses.

I agree that anymore college has become an over priced money making scam. Some colleges make a fortune off their sports teams with advertising, research, etc plus have huge endowment funds. They also solicit money from their alumni. But they always need “more” and will raise tuition prices by a large percentage every year. What a joke. Time to find an alternative way to be successful. Time for people to stop acting like sheep and start thinking for themselves and seeing the college scam for what it is.

Mr & Mrs. Groovy,

I’m with you…college has become a scam. The tuition numbers thrown around as normal rates are scandalous. What’s even crazier is how casually people obligate themselves to debts of $50k-$200k at the ages of 18 to 22. It’s insane!

While a certificate program is a step in the right direction, there are many interesting and inexpensive online options such as udacity.com and teamtreehouse.com . Higher education had better get with it, or it will be left behind. There are so many free online learning opportunities, and there are certainly more to come.

I’ve come up with my own college degree alternative that we hope to use with our son:

http://www.millionaireeducator.com/2016/03/a-7500-college-degree-in-12-months.html

The plan above would provide the student with a 4-year degree that would allow for graduate school or a certificate program. The plan would also streamline the six years from high school and the first two years of college. Those years are highly redundant and inefficient; my plan would aggressively bank college credit along the way. Shouldn’t good college prep high school students be earning college credit for the hard work. I say yes!

Just my two cents,

Ed