This post may contain affiliate links. Please read our disclosure for more information.

Anyone familiar with this blog knows that I’m fond of saying, “your habits are your destiny.” And ever since I read the book, The Checklist Manifesto, by Atul Gawande, I’m fond of checklists. So for this post, I’d like to combine these two beloved things—an adage and a tool—and gear them toward personal finance. In other words, I want a list of ten things you should do daily in order to give yourself a fighting chance of achieving financial independence.

Now before I unveil my checklist, I need to insert an important qualification. The things on my checklist are different from the things you see on a typical financial checklist. Latoya over at lifeandabudget.com, for instance, has an excellent financial checklist geared toward millennials that includes such things as “keep tabs on your credit report,” “get life insurance,” and “start a side hustle.” Now, as important as these things are, you’re not going to check your credit report, get life insurance, and start a side hustle every day. Latoya’s financial checklist, like ever other financial checklist out there, is more about mechanics, about building a financial operating system to grow and protect your wealth. My financial checklist, on the other hand, is strictly about habits—the daily actions that will either bolster or confound your financial operating system. It’s a subtle difference, for sure, but an important one.

Okay, enough of my yammering. Here’s my stab at a daily FI checklist.

The Daily FI Checklist

1. Spend at least 15 minutes cleaning something.

Industry begets industry. So get up earlier than you normally would and clean something. It doesn’t matter what it is. A bookcase. A closet. A room. Fifteen minutes of cleaning sets the tone for the day. It’s your first victory, your first defiant slap across the face of idleness. It’s your bold proclamation to the world that for at least one day you won’t succumb to the sinister luxury of sloth.

It’s also a great way to maintain the tidiness of your home and keep your weekend free for more enjoyable activities.

2. Spend at least 15 minutes exercising.

Poor health equals a poor quality of life—regardless of how much money you have in the bank. The veracity of this belief really hit home when Julie, a physician who blogs over at choosebetterlife.com, left a very sobering comment on one of my recent posts on retirement. Here it is.

“If you’re overweight, your body wears out more quickly. In addition to heart disease and diabetes, you’ll have pain in your knees, hips, and back. This will make it more difficult to exercise, to enjoy yourself, and also to work.

We have family members who can only walk from the house to the car, so that rules out hiking (of course) and even museums, window-shopping, grocery shopping, festivals, attending grandkids’ soccer games, etc.

I also know people who have had to turn down jobs because they couldn’t climb or descend the single flight of stairs required to get to their office.

Without decent health, so much of the other stuff becomes out of reach too.”

Don’t let the important stuff in your life become out of reach because you failed to care for your body. Move at least 15 minutes every day. And if you’re not sure what to do, just walk. Walking is great exercise. When you’re ready to do more, there’s no shortage of YouTube fitness enthusiasts who will help you craft a suitable fitness program. Here are links to three such fitness enthusiasts to get you started.

8 Best Bodyweight Exercises Ever

Best “In Home” Bodyweight Strength Circuit

3. Make your breakfast and your lunch.

Don’t buy anything to eat once you leave for work. Eat breakfast at home and brown-bag your lunch. Conservatively, paying for breakfast and lunch outside the home every workday buying breakfast and lunch every day at work will cost you about $2,400 annually ($10 x 240). If you can’t go completely cold-turkey on the dining out front, limit dining out to paydays only. If you get paid every two weeks, this strategy will save you $2,160 a year ($2,400 – $240).

4. Read at least one personal finance blog post or one page from a personal finance book.

Personal finance isn’t rocket science. But there’s a lot to learn. And the best way to master personal finance is to study it every day.

So every day, do one of two things. Read one personal finance blog, or read a few pages from a personal finance book. That’s it. Give yourself 15 minutes. If you can do more, great.

Not sure where to start? Here are my suggestions.

For personal finance blogs, go to rockstarfinance.com. Rockstar Finance is, in its own words, “a collection of awesome money articles.” And every day it features three or four posts from three or four terrific bloggers. Here, for instance, is a screen shot of the featured posts from 1/3/2017.

For a personal finance book, I have four suggestions. Doesn’t matter which one you start with. They’re all great.

Total Money Makeover, by Dave Ramsey

Automatic Millionaire, by David Bach

One-Page Financial Plan, by Carl Richards

The Simple Path to Wealth, by JL Collins

5. Save the amount necessary to reach your saving goals in five to ten years.

Suppose for the moment that you’re 25 and you’re renting a one-bedroom apartment. Your monthly living expenses are $2,000. Let’s further suppose that you want to buy a one-bedroom condo in the near future. And, finally, let’s suppose that you want to establish a six-month emergency fund ($12,000) and accumulate a down payment for that one-bedroom condo you’ve been eyeing. You figure a 20% down payment will run you about $30K.

Okay, now that you got your saving goal ($12,000 + $30,000 = $42,000), you need to figure out your daily saving amount. To do this, you simply use the following formula.

Saving Goal ÷ (Number of Years x 365) = Daily Saving Amount

Start off by plugging five years into the formula. This shows you will need to save $23.01 a day or $700 a month ($42,000 ÷ 1,825). If that’s too steep, plug in ten years. At ten years, you will need to save $11.51 a day or $350 a month.

Finally, once you know your daily saving requirement, times it by 30, and then automate the monthly transfer of that result from your checking account into your saving or brokerage account. Do this and voilà, you’re saving what you need to save every day to meet your saving goals.

6. Invest the amount necessary to have a million dollars by the time you’re 65.

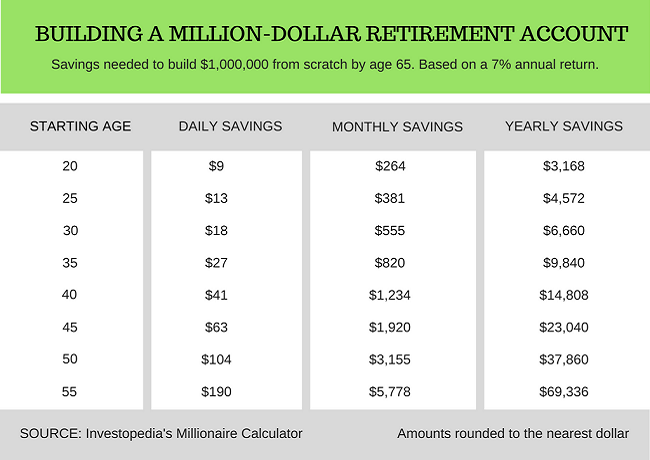

Again, let’s suppose you’re 25. If you want a million-dollar portfolio by the time you’re 65, you will need to save $13 a day or $381 a month (see table below). If you want a million-dollar portfolio by the time you’re 55, you will need to save $27 a day or $820 a month.

Once you know your daily investment target, you do the same thing you did to finalize your saving goals in Step 5 above. Only this time, you make sure the result is diverted into an IRA or a 401(k).

If you’re not sure what to invest in, keep it simple. Put your money in a target date fund that comes closest to matching the year you hope to have a million-dollar portfolio. If you’re currently 25 and hope to have a million-dollar portfolio by 55, choose a target date fund that has a retirement year of 2045 or 2050.

7. Keep track of your spending.

In order to check #5 and #6 off your FI checklist every day, you need a sizable gap between what you earn and what you spend. Creating that gap, in turn, requires one of three things: 1) you need to increase your income, 2) you need to decrease your spending, or 3) you need to do a combination of both. If you’re like most people, the surest way to achieve the gap is to choose option 2. You need to attack the spending side of the equation.

And how do you attack the spending side?

You track your spending. You can use a free online tool such as Mint or Personal Capital. Or you can use a boring spreadsheet. I prefer the boring spreadsheet, and if you want to see what I use, you can go here. But how you track your spending is immaterial. The point is that tracking your spending is crucial to your financial health and with today’s technology there’s really no excuse for not tracking it.

Okay, once you see where your money is going, you attack your spending with a series of tactical retreats. Say for instance you’re currently spending $400 per month on groceries. If you can get that down to $350 a month, you now have an additional $50 a month to throw at your retirement account. That doesn’t sound like much. But $50 invested every month at a 7% would turn into $26,319 in 20 years. Imagine what you could have in your 401(k) if you performed a tactical retreat on big ticket items such as housing and transportation? Living in a 1,500 sf house rather than a 2,000 sf house would easily save you $500 a month in reduced mortgage, property tax, and utility expenses. Buying a three-year-old car every 10 years rather than a brand-spanking new one every 10 years would easily lower your overall transportation expenses by $100 a month. Put those savings in your 401(k) and your 401(k) will have an additional $315,829 in it after 20 years.

Remember this key insight: Over several years, one small retreat in lifestyle amounts to one giant advance toward financial independence (thank you Neil Armstrong). And if you want to secure a bunch of small retreats, you need to track your spending.

8. Spend at least 15 minutes learning something that will make you a better worker/earner.

The machines are coming. The algorithms are coming. Every day your job becomes a little less secure. Every day your skills become a little less relevant. So don’t stand still. Spend 15 minutes a day improving your skills.

When I was employed, for instance, I worked a lot with relational databases. So every night I would open one of my SQL Server books and work on my SQL language skills. I would also work on a new kind of database that was gaining traction called No SQL. Was it fun? Hell no. Who wants to go home and be humbled every night by esoteric SQL queries? But I was ready if my company ever decided to outsource my job or migrate to No SQL databases.

Fortunately for me, I achieved FIRE before I suffered obsolescence. Don’t let your skills atrophy. As the great Satchel Paige once said,

“Don’t look back. Something might be gaining on you.”

9. Do something silly.

Don’t take yourself too seriously. You’re not a celebrity. You’re not a tech titan. You’re not a Master of The Universe. You’re a well-manicured ape whose death will go completely unnoticed by all but a small sliver of humanity. So have a little fun. Spread some joy. Sing a diddy, make a funny face, or, if you’re in a real silly mood, do the Hucklebuck.

10. Do something nice.

Presidents aren’t the only ones who have a legacy. How do you want to be remembered? Do you want to be remembered as a miserable cur? Or do you want to be remembered as a good egg? Well, if it’s the latter, do at least one kind thing every day. And it doesn’t have to be anything earth shattering. Penny over at shepicksuppennies.com just completed a 31-Day Kindness Challenge. Here’s her verbatim list of some of the kindness she dished out during the challenge:

- Donated two winter coats I could have sold.

- Donated gently used scarves and gloves.

- Shopped for the food pantry each time I grocery shopped.

- Bought materials and made a no-sew blanket with my students.

- Made our usual monthly donations.

- Let someone go in front of me at the grocery store.

- Turned in a pair of lost gloves in the Target parking lot.

- Called an out-of-town relative every week.

- Shoveled in front of our neighbor’s house.

- Paid our cleaning lady double for the holidays.

- Decorated the cemetery for my nana.

- Helped my neighbors track down a lost package.

- Bought some treats for Mr. P at the grocery store.

- Hooked up my parents’ wireless printer and taught my dad how to print from his phone. By the grace of a technology god somewhere.

- Tossed spare change in every bell ringer bucket I passed.

Notice how most of these acts of kindness require little or no money? So don’t let your financial struggles, whether real or imagined, tarnish your legacy. The world is cold enough as is. Use what power you do have to make it a little less so.

Final Thoughts

Okay, groovy freedomists, that’s all I got. Is this a worthwhile checklist? If you followed it faithfully for, say, ten years, would you find yourself closer to the dream of financial independence? Or is my FI Checklist total flapdoodle? Let me know what you think when you get a chance. Peace.

Great 👍post.

I especially liked the learning, cleaning, and doing something kind everyday.

Eleanor Roosevelt said as a way to grow you should do something that scares you everyday.

I also to exercise daily even if it’s 5 minutes and I make my bed daily as my 1st big win of the day!

Miriam

Greenbacks Magnet recently posted…How I became a 401(k) Quarter of a millionaire

Above given points are very useful in terms of saving money especially what I miss usually is keeping the track of my spending which is a really important point.

Steve Watson recently posted…Why Should You Invest In Search Engine Marketing Services?

So cool! Have been struggling with how to encourage my clients to do what you list here. Thanks for thinking it through so well.

1. Enjoy life

2. Take studies seriously

3. Get a job

4. Go out with friends

5. Play some games

6. Don’t depend much on others

7. Be yourself

8. Graduate from college

9. Save up some money

10. and no least important, S.H.A.R.E

Note: is only what i think, don’t need to do it that way is writing or change the positions and do what i said.

Save, save, save!

That is all I did before I learned the hard way that it’s not just about saving money in a savings account but actually making it work through investing. I have since then diversified my portfolio, used both safe and risky containers to put money – even trying my hand at crypto – and saving for an emergency fund.

Looks like it is working because the wife has joined the wagon too. We will soon be the FI couple!

I think #8 is very underrated. It’s a lot easier than most people think to increase their income significantly by working towards a large promotion or outperforming their peers in work that matters.

Thanks for the checklist, I’ll use it!

Good list. I think there can be more variation added based on age group, but these can be done by anyone. I would also like to add that one should read before going to bed, something they love. This helps further enhance their understanding of these topics. I love reading The Economist every night, it has helped in improving my writing and given lot of perspective on finance and business. And don’t have to schedule extra time to finish reading it.

Such a good list, and I definitely wasn’t expecting this. I’m absolutely certain that learning new things daily –

whether they’re related to your main income sources or not – gets you closer to your goals

Great list. All play a huge impact on your quality of life and finances. The only thing I see is that the chart about savings should if anything be inverted. I have seen a few charts like it. They say save a little when you are young and increase the savings as you get older and make more money. That is all well and good, but if you do the opposite and save more when you are young, then you will have to do less work in the future because of the compounding. Guess either way, if you are saving and investing you will get to FI eventually.

Agreed DD. As long as you’re saving, you’re good. But if you can be a little disciplined while you’re young, your new-found buddy, compound interest, will be handy to have around when the heavy lifting is required. Thanks for stopping by, my friend. I really enjoyed your contribution to our conversation.

Solid advice to build wealth, stay healthy, help others, and to enjoy the journey toward FI. Love it.

Hey, Dave. Sorry for the late response. I haven’t stopped by this post in a while. But thank you for your kind words. We definitely make things to complicated. As you said, “stay healthy, [save money], help others, and enjoy the journey.” The Forest Gump road to FI.

Great list. It’s obvious, but if you want a million, you gotta save enough to have a million. Not enough lists just say that.

To be honest, my favourite is the exercise one. Even if you never reach your financial goals, at least you give yourself the best chance of staying healthy. And there’s not much point reaching your financial goals if you don’t have the health to enjoy it!

“[T]here’s not much point reaching your financial goals if you don’t have the health to enjoy it!”

So true. I know about a half dozen guys from my previous job who died within a year or two after retirement. And none of their deaths were a surprise. They all drank, smoked, and ate themselves into an early grave. Sigh.

Thanks for stopping by, Sarah. Your comment contained a lot of wisdom.

This is a great checklist. I like the daily saving goal to a million chart, this is a super visual way to wake up some later-bloomers!

Thank you, Xyz. We are visual creatures, so it never hurts to provide a chart. And another thing I like about the million-dollar chart is that it shows the feasibility of saving a million dollars. Most anyone can do it–providing they start early enough, of course.

this is amazing

You’re too kind, Matt. Thank you for stopping by.

this is fantastic

Thank you, Jacob. I really appreciate your kind words.

Fabulous list! Perfect in its simplicity.

I’m blushing, Michelle. Thank you for your kind words.

Ooh, I love checklists! It feels great when you cross them off. I like how completing the items on this checklist will not only improve your financial situation but it will carry over to all aspects of your life! Good habits are crucial to living a great life!

“Good habits are crucial to living a great life!”

Truer words have never been spoken. And I totally agree with you about crossing off items. It’s silly I suppose. But I love watching the little victories accumulate.

Thanks for stopping by, T. I really appreciate it.

I think it’s so interesting that the first two and last two habits aren’t directly related to finances, yet I couldn’t imagine the list without them. I started working from home and I can notice a drastic decline in my productivity if my bed isn’t made. There’s something about cleanliness that promotes my productivity. As a kid I never understood why you should make your bed, you’re just going to mess it up later.

As for the health, silliness, and kindness, I get it. What’s the point of being successful if you can’t enjoy it, or share it? Life is much more fun if you don’t take yourself too seriously.

Thanks for taking the time to list these out!

“What’s the point of being successful if you can’t enjoy it, or share it? Life is much more fun if you don’t take yourself too seriously.”

Awesome, Kraken. It’s so great to hear that another person gets it. And I hear you about making the bed. For the longest time, I too thought it was utterly pointless endeavor. But ever since I started doing it (about two years ago), I’ve never been more productive. I can’t explain the psychology behind it, but it freakin’ works.

Thanks for stopping by, Kraken. I really appreciate what you had to say.

I personally like the clean something 15 minutes a day as it’s something that adds huge value that you don’t realize all the time. I find myself doing this and the financial benefits are huge. Not only am I freeing up my spare time on the weekends to enjoy my life, I save alot on maintenance costs because I see problems and am able to do minor repairs before it REALLY breaks and gets REALLY expensive to fix. I’ve owned my own home for 2 years and I didn’t think I was a handy guy before I bought. So far, I’ve been able to fix everything myself with utube and just monitoring daily maintenance issues before they turn into big problems. All that money I’ve saved by not hiring handy people has gone right into my investment accounts!

Haha! So freakin’ true. About two months ago I was straightening out the vanity below my bathroom sink and I noticed a drip coming from the faucet connection above. I think it took fifteen minutes to unbolt the connection, apply some plumbers tape, and then tighten the connection back up. Problem solved. If I only cleaned my bathroom once in a blue moon, however, that leak could have caused some nasty water damage. Like you said, finding small problems before they become big or monster problems is one of the side benefits of routine cleaning and maintenance. And don’t talk to me about YouTube instructional videos. Love them! Earlier this year I had some engineered flooring planks that separated from the concrete subfloor. Spent fifteen minutes on YouTube and found a great DIY repair kit. When the kit arrived, it took me all of five minutes to fix the problem. The kit cost me less than $40. How much would it have cost me to get a flooring expert to do the job? Way more than $40. Thanks for stopping by, Bill. You made my day.

I love this list! Too many people try to make drastic changes or improvements to their life, only to fail. Breaking it down like this, into small daily tasks is so much more realistic.

That being said, I’ve always tried to follow my own version of #1, which I call The Ten Minute Tidy. I’m terrible at sticking it to, though. So instead of spending 10 minutes washing the dishes today, it takes me an hour (or more) to do on the weekend. And I’d much rather be doing anything else than the dishes on a Saturday! But I’m not giving up. I’m going to keep trying the 10 Minute Tidy until it’s descend nature – then I’ll look to add more from your list of suggestions. Hopefully they’ll stick!

What a great idea. The Ten Minute Tidy! It’s amazing what you can do with ten minutes, especially if you do it on a regular basis. Tuesday is my bathroom day. And because I clean my bathroom every Tuesday there’s hardly any soap scum or hair to clean up. The end result is that I easily have my bathroom spotless in less than twenty minutes. Good luck with making the Ten Minute Tidy a daily ritual. I’m pulling for you, Amanda.

Great list! Although I would argue for a least 30 minutes of exercise on most days! But hey, if you not doing anything at all just get in the habit. I also think cleaning is huge. I think people get weighed down by their stuff and mess and can’t do anything productive.

Agree totally about the 30 minutes of exercise. Mrs. G and I walk every day for 40-45 minutes. And I do bodyweight exercises every day. On M-W-F I get fairly ambitious and do about 30 minutes of bodyweight exercises. I chose 15 minutes because I didn’t want to scare anyone off. I’d rather someone do just a little exercise than be totally paralyzed by a seemingly unrealistic goal. And excellent point about the cleaning. I find that disorder and untidiness can kill my motivation. Why is that? We need to get the behavioral economists to study that one. Thanks for stopping by, Tonya. Always a pleasure hearing from you.

I have never seen the millionaire’s checklist before. It’s like the charity commercials where you can sponsor a child or save an animal for a few pennies per day.

I also like how you mentions our habits are our destiny. My wife says something similar to this, and its true. I like how your recommendations also include non-financial activities to reach Financial Independence. It truly is a “big picture approach.”

Nice analogy. A little investment, whether it’s money, exercise, or habit-building, really builds up over time. Thanks for stopping by, MB. And I love the way your wife thinks. Habits can either propel us or destroy us. It’s our choice.

Great list. I can say I do all of these on a fairly regular basis except #1. I do wash dishes and put them away, but as far as cleaning a part of the house every day, I’m terrible at that. I just might have to implement this one and see how long I can keep it up!

Thanks for sharing!

Cleaning is the hardest item for most people. And it certainly was for me. Mrs. G’s idea of putting together a schedule and being more systematic about cleaning really helped. It has kept us accountable and left our weekends free to do the things we really want to do. Thanks for stopping by, GFY. And keep me posted on how you do with the cleaning. I’m pulling for you.

Thanks for the list! I read The Checklist Manifesto but, alas, I am not a list maker. But that’s ok because you made one for me!

I particularly like the first two, clean something and exercise. Fortunately I am married to an exceptional saver so we are doing that and some of the others already. this will be helpful for my millennial nieces and nephews.

Hey, Mr. Grumby. I’m definitely not a cleaner or an exerciser. But I am a morning person. So I force myself to do the cleaning and the exercising before my day really kicks in. If I wait for after dinner, I’m sunk. Maybe it’s because I’m mentally done with the day at that time. I just can’t seem to muster the energy to clean or exercise. But everyone is different. If you’re a night person, cleaning and exercising at night would work better. Thanks for stopping by, Mr. Grumby. Glad you chose wisely on the marriage front. And glad you’re sharing your financial wisdom with your nieces and nephews. They might not get it right away, but eventually the light bulb will go off.

I love this checklist! I especially need to remind myself to make meals at home. I do this, but it is a struggle every single day. My biggest daily financial obstacle is the urge to eat out. Ugh. I like to also get little wins in like cleaning stuff here and there as I go along. The idea of putting it on a checklist is an interesting idea. I just might have to add this to my list! 🙂

Mrs. Mad Money Monster

I hear ya, Mrs. MMM. When I worked for government, hardly any of my co-workers brought their lunches to work. Eating out was ingrained into our culture. When I moved to the private sector, I was fortunate enough to work in an environment where everybody brown-bagged it. The only exception was pay day. So every two weeks we would go hog wild and hit Wendy’s or Subway. Oh, the simple joys of life. Thanks for stopping by, Mrs. MMM. And good luck with your biggest daily financial obstacle in 2017.

Great list! I try to do most of those but I do trip up on the buying lunch once or twice a week. I think with any of these, if you make it as part of a routine, it will become part of your life and easily achievable. Thanks for sharing!

-Brian

Haha! You’re not alone, Brian. We do the same over here is well. One of my vices is Taco Bell–I’m so ashamed–and I’ll hit that every couple of weeks or so. But as long as the dining out for lunch is in moderation, I think we’re okay. Thanks for stopping by, Brian. And thanks for sharing your not-too-serious financial flaw.

Love the checklist, I’m going to print it out and stick it to my bathroom mirror and office wall until it becomes habitual!

Thanks for the great tips!

Excellent! The power of checklists lives! We did the same over here in Groovy land. We printed out the checklist and hanged it on our refrigerator. Items 5 and 6 no longer apply, but the rest still do, and we want to be constantly reminded of them. Thanks for stopping by, Wes. I like the cut of your jib.

I had to look up what ‘cut of your jib’ meant. Haha! However, thanks to google I now understand.

Thanks Mr. Groovy!

Hey, Wes. It’s funny how phrases go out of style. When I was growing up, ‘cut of your jib’ was common. Obviously, now, not so much. Here’s another one for you. When I was growing up, calling someone ‘mental’ was a way of saying someone was acting stupidly. But I hardly ever hear that phrase anymore. In fact, the last time we heard it, about two years ago when a father was admonishing his son, we broke out laughing.

What an interesting checklist. I am currently just turning 25 but i am able to put in more than $380 a month into my stock portfolio per month. I am trying to become a millionaire well before I am 65 but time will tell. It’s going to be a long journey but I am trying.

Thank you, Caleb. I love it! $380 a month? At 25? You’re well on your way, my friend. I wish I were as financially sophisticated at 25. Thanks for stopping by. It’s always great hearing from an Aussie whose got his financial act together.

Your checklist is awesome, so is your infographic. But, you should put your website name on your infographic. Get that credit! Seriously. It will get pinned. (I pinned it because it’s awesome!) There may be people who see it but don’t click, but might be intrigued enough to click on something else they see later if they know it’s from you.

I’m working on adding in the exercise. The cleaning is a great idea too. Life would be so much easier if we did that!

Thank you for your kind words, Emily. And thank you for the infographic tip. Didn’t think of putting the website on it. Mrs. G was working on adding it last night. I think she got it done. We’ll update our post today with the new and improved infographic. Good luck with the snow today. No accumulation down here in Charlotte. Roads look icy, though.

I dig all of these (except the first one–not much of a cleaner). I especially like the point about figuring how much you need to save for a major goal. I figure passive income in relation to the number of hours of freedom it would buy me on an annual basis.

Whoa! I like that idea–figuring out how much your passive income will buy you in hours of freedom. Very cool concept. I’m going to have to play around with that. Once I’m done, I’ll compare that to how you do it. Thank for stopping by, Chris. You really gave me something to think about. Cheers.

Fantastic checklist, Mr. Groovy. Love them all! I particularly like that they are very do-able. You break them down into manageable chunks. I can do anything for 15 minutes!

I use the 5, 10 or 15 minute trick to work on the things I procrastinate on the most. I tell myself, just do it for 15 minutes, then you can stop. I usually do more but, even if I don’t, it’s still progress.

Of course, I love #10 with all my heart.

Penny deserves a lot of the credit for #10. Loved her post about her kindness challenge and had to get that sentiment into the checklist. On one level, it isn’t about personal finance and financial independence. But on another deeper level it is. In the long run, good people will attract the kindness of others. “What goes around comes around.” And when you’re striving for financial independence, it never hurts to have your family, friends, and neighbors smiling upon you. Thanks for stopping by, Amanda. I love hearing from people who have adopted the 15-minute trick as well.

Oh, I love this so much! I remember when I first started getting serious about saving for retirement (at age 21) that graph was one of the things I came across that really struck with me and I set out a goal to put $10-15 a day towards retirement accounts.

I’m alllll about those daily actions!

I’ve been working to practice gratitude and reach out more with people. It makes a world of difference!

Colin, I’ve said it before, I’ll say it again. You freakin’ rock. Saving for retirement at 21! You are so far ahead in the money game it’s scary. I love it. And you are so right about the daily actions. Do small, simple, financially friendly things repeatedly over several years and great fortunes will result. Thanks for stopping by, my friend.

I love how this list is comprised of fairly simple things, but following it can make such a huge impact.

But how are you supposed to read only ONE personal finance blog post per day? Once I start, I find myself wandering all over the internet reading awesome stuff from the bloggers in this community.

So true! There are so many great bloggers out there, providing such great content, that it’s impossible to just read one. The reasoning behind the one blog post requirement was that I didn’t want the checklist to be too intimidating. Most people can mentally handle a one blog post requirement. Say they got to read 5 or 10 and they may start hyperventilating.

Great checklist! I do most of those things, even clean somethng daily, although with a 3 and 5 yr old and 2 dogs… It’d be horrid if I didn’t, lol.

I echo the love for the “well manicured ape” comment, I’ll stash that in the brain for further use and reminder when is tart taking myself too seriously.

Glad you loved the “well manicured ape” comment. Please do stash it in your brain. But remember, it didn’t come from me (see my reply to Fritz above). It actually came from a professor I had my freshman year in college. It’s a great line. One of the few things I remember from college. Thanks for stopping by, Mr. SSC. Always great hearing from you.

“Don’t take yourself too seriously. You’re not a celebrity. You’re not a tech titan. You’re not a Master of The Universe. You’re a well-manicured ape whose death will go completely unnoticed by all but a small sliver of humanity.”

HAHA! Thanks for the great laugh!

It took me a long time to learn this lesson. Ditching those negative vibes made a surprising difference. Thanks for the challenging post!

Hey, FS. I totally agree. Humility helps you focus on what’s important. Once you drop the ego, it’s amazing what you can accomplish. I didn’t learn this lesson until I was almost forty. Glad you learned it a lot sooner than I did. Thanks for stopping by, my friend.

Great thoughts here! I love the checklist – its broken down in to easy actionable items to get you on your way to FI. I particularly like #6 on the finance front but #9 steals my heart. Keeping your childlike enthusiasm for life makes all the hard-core adulting a bit easier.

“Keeping your childlike enthusiasm for life makes all the hard-core adulting a bit easier.”

What a great comment. You definitely have a way with words, Miss M. I’m going to have to remember this quote for my 2017 review. Thanks for stopping by. You made my day.

Aww, so kind!! Congrats on the RSF feature today. Well deserved!! 😘

Thank you, Miss M. Mrs G felt it in her bones that today would be a Rockstar day. I was so happy to wake her up this morning and let her know she was right.

I am so bad about cleaning. My poor husband is the tidy one and gets stuck doing all the cleaning. That is definitely something that I want to change in 2017. I also like how you mentioned that being healthy and able to enjoy retirement is so important. My parents and my husband’s parents are no longer able to enjoy hikes, skiing, and many of the things we enjoy now. I can’t imagine retiring and not being able to do those things. I need to make sure I maintain my health. Thanks for the insightful post!

I have the reverse situation in my house. Mrs. G is definitely less tolerant of filth than I am. What really helped us was devising a cleaning schedule. Every day of the week (M-F), we each have particular things to clean. Today, for instance, I have to clean the refrigerator and the downstairs floor. We used to wait until the weekend to clean. But that wore us out and ruined the weekend. Our current cleaning game plan is much better. The house is never immaculate. But it’s always tidy. Thanks for stopping by, Julie. Always a pleasure hearing from you.

I apologize for running straight to the comments and perhaps missing another great insight before leaving my comment, but I really love #1! I’ve been doing that without even realizing. My days that start with breakfast and then some form of activity other than “get ready for work” are usually my most productive days of work, blogging, and generally LIVING, which is key!

No worries, my friend. Number 1 definitely sets the tone. For most of my life, especially when I was younger, I abhorred the morning. But then, sometime around my late 30s, I discovered that my productivity hinged on waking up early and doing things “before” work. And ever since I stumbled upon that secret, the trajectory of my finances and my life changed for the better–and in dramatic fashion. Thanks for stopping by, Mr. TV. It’s always great hearing from another morning person.

The infographic is impressive, Mr. Groovy, and I think this wisdom applies to life in general, not just the FI niche.

I could definitely use some more silliness in my life. And cleaning if I’m honest. 😀

I hear ya about the cleaning, TJ. But I got a loving taskmaster who makes sure I fulfill my assigned cleaning duties every day. Thanks for stopping by, my friend. And good luck with your quest to bring a little silliness into your life. Silly, when done right, is a great way to nourish the soul.

Great list. We do all of these things. All are important and crucial to keeping your eye on the prize of FI.

Amen! Thank you, Laurie. “Keeping your eye on the prize of FI.” That’s what it’s all about.

This is a great all-around list of habits not just for FI, but for living well in general. I’ve definitely got the “do something silly” angle covered…that’s one of my best habits! But all the elements in your list are worthwhile pursuits and will set you up for a bright future.

Being silly is definitely cool. I’ve been silly a lot lately. I’ve been working on my dance moves for my nephew’s upcoming wedding. I swear to Mrs. G that I won’t embarrass, but she doesn’t believe me. Thanks for stopping by, Gary. It’s always great hearing from another silly person.

Love the check list! Not only good for your wallet, but good for yourself and mindset. I agree we need to find a balance with humor, giving, health, self-improvement. Often people fall in line and become complacent, begin complaining and want others to fix our problems. That’s not someone I want to be or be around.

I hear ya about those who complain and want others to fix their problems. The sad truth is that for most people of this bent, their biggest problem is themselves. And I know this from personal experience. Up until my late 30s, I was a very accomplished complainer. Of course, “the system” was keeping me down. But as soon as I started to adopt the principles of financial independence, and as soon as I started to drop my jerky attitude, “the system” decided to start smiling upon me. Funny how that worked out. Thanks for stopping by, Brian. Always a pleasure. And good luck with the complainers in your life. They’re a tough bunch.

I love it! All such good points. One thing I try to add each morning in review goals/habits/schedule. If I give it just a few minutes of focus it helps set the direction for the day. Otherwise I end up at the end of the day/month or even year and go, “Well, where the heck did that day go?” =)

Exactly! Just a little focus in the morning makes all the difference between a productive day and a wasted day. I’ve learned this is especially true without the rhythm of a 9-5 job. Humans do better with a little structure. I think I remember something from a really old book that pertains to this. Oh, yeah, now I remember. “Idle hands are the devil’s workshop.” Thanks for stopping by, Ms. M. Hope the Montana winter is treating you guys well.

-12 today. I wore a dress to go speak to a group. =) It’s the kind of cold that makes your nose hair freezer together.

Arrrgggghhhhh! I feel for you, my friend. I experienced some rough winters in Buffalo, but Buffalo winters pale in comparison to Montana winters. Haven’t seen snow in a number of years here in NC. The worse thing I remember about real winters was cold feet. That’s the worse. I can take the frozen nose hairs. But cold, wet feet? Don’t miss that. Hang in there. Hope your furnace is in good working order.

“You’re not a celebrity. You’re not a tech titan. You’re not a Master of The Universe. You’re a well-manicured ape…” Laughing Out Loud! (I really shoudn’t be reading your stuff at work…boss will hear the cackle!). Great post. Wow, what a list!

AND an infographic. Wow. Crushing it in your retirement, Mr. G. Great stuff! Happy New Year.

I love it, Fritz. Unfortunately, I can’t take credit for the well-manicured ape phrase. I had a professor during my freshman year at Buffalo University who wrote on our class syllabus that “any well-manicured ape should be able to get a B in this class.” Well, I got a D. But I never forgot how he distilled the true definition of man down to three simple words. Too funny. Glad I was able to bring some humor to your life today. Stay well, my friend. Talk to you soon.

This is so beautiful…. Especially $4 😉

Couldn’t agree more, J. Number 4 is my favorite too. I don’t know who is running Rockstar Finance, but whoever it is, they’re doing one heck of a job.

Flattery will get you nowhere with J$!

…believe me, I’ve tried. 🙂

Haha! Mrs. G said the same thing. Admittedly, it does appear a little kiss-assy. But that was surely not my intention. Just having fun.

Argh, I struggle so much on making my own lunch, but when you put it like that, it’s crazy how much I spend. I always get bummed out when I’m eating my sad sandwich!

I hear ya, FP. When I worked for government, very few people brought their lunch to work. When I started working in the private sector, very few people didn’t bring their lunch to work. So brown-bagging it my last nine years of gainful employment was fairly easy. I didn’t feel like a weirdo.

This is such a nice life checklist, not just a FI list, but I guess the two go hand in hand since most FI-ers are trying to create their version of an ideal life. It all comes full circle.

Some of your items come naturally to me, but silliness and work-related reading come in fits and spurts rather than daily, so those are the ones I need to put on my to-do list to keep them on my mind. Thanks!

Don’t be so hard on yourself. With your schedule and line of work, something’s got to give. There are only so many hours in the day. And while I certainly want you to be a little silly now and then, I don’t want you being silly in the ER. But being a little silly on one of your hikes, that’s a different matter. How about chasing after Mr. CBL for a minute or so with some bear spray?

Totally different than a lot of the blah, blah checklists out there – very nice!!

I’ve been focusing on the money-only aspect of reaching financial independence for a number of years, but I think this is the year to look at the other important parts as well. I have an office job and sit waaaaay too much. I’m going to try to at least do some walking on the treadmill every evening to get the ball rolling.

Great post!!

— Jim

If I had a child, and I could bestow this child with one of two things in life–honor or wealth–I would choose honor. Wealth is surely important, but honor is more important. I wouldn’t want a child of mine becoming wealthy by selling heroin or trafficking young girls. I’d much prefer my child to live a noble life and accumulate little to no wealth. Like you said, Jim, it’s not all about the benjamins. Staying healthy, being kind, enjoying life, and being honorable are just as important as being a financial rockstar. Here’s to a healthier, wealthier, and wiser 2017, my friend. It’s always a pleasure hearing from you. And good luck on the treadmill this year.

Great Checklist. Many of these are already on my goal list. I might tweak one thing. Instead of saying read, I’d say learn. My personal goal is to learn one new thing each day. Reading may or may not be the outlet for that.

Excellent point. Mrs. G and I listen to a podcast every day during our walks. And they’re a great way to learn about anything–not just personal finance. Damn this list-making is hard! Thanks for the awesome suggestion, FTF. I owe you.

I think this is a fantastic checklist! It’s funny because FI is all about questioning the mainstream and developing your sense of self–which can be achieved with many of these activities.

I would add that you should take time to create or build something. That can take the form of journaling, cooking, drawing, etc. There’s nothing like the feeling of pride once you become a creator instead of a consumer.

Consider my mind BLOWN! Excellent insight, Mrs. PP. Somehow I got to incorporate creating and building into my revised checklist (perhaps habit #11). One of the things that troubles me most about the de-industrialization of America is that we build fewer and fewer things. There’s only one person in my social circle who actually makes something for a living. Everyone else provides a service. Of course, creating and building isn’t only limited to the workplace. But here too, the act of creating and building seems to be waning. How many Americans do you know have a workshop in the garage or basement? When I was growing up, workshops were very common. Practically every home on the block had one. Nowadays? Not so much. Sigh. I don’t think you can be fully human unless you create and build. Thanks for pointing out this glaring omission, Mrs. PP. I really appreciate it.

Great great great ideas! I think if we kept these in the back of our minds everyday and made it a part of our daily routine, we’d hit our FIRE goals no problem. I’m trying to pick out ones in particular that I think are important (learning new skills & exercise), but really every item hits on such an important areas!

Agreed. If these habits can become an unconscious part of your daily routine, you’ll probably have a very rewarding life–financially and socially. Thanks for stopping by, SS. And good luck on the learning and the exercise this year.

I love this checklist. Though, if I’m being totally honest, I was feeling pretty cocky until I got to 5 and 6! Those are definitely the hard ones for me 🙂 So glad you created this!

Thank you, Penny. You really inspired me on the last two. People are more than their net worth, and not everything is about increasing your net worth. Having fun and being kind is important too.