This post may contain affiliate links. Please read our disclosure for more information.

Note. The title of this post was changed from Two Awesome Benefits of Being Income Poor But Asset Rich to One and a Half Awesome Benefits of Being Income Poor But Asset Rich on 6/5/2016. This was done because Brad over at Maximize Your Money found a serious error in my second supposed benefit. Correcting that error didn’t render that benefit completely meaningless. The benefit still exists, but in a much more constrained form. It’s now only a partial benefit, hence the change of the post title to One and A Half Awesome Benefits.

More than anything else, I want to provide my readers with accurate information. Getting it right is more important than protecting my ego. So my sincere thanks go out to Brad for discovering this error. He made this a better post, and he made me a better blogger.

♠ ♣ ♥ ♦

When Mrs. Groovy and I retire this October, our household income will take a dramatic hit. We’ll go from earning more than 85 percent of American households to earning less than 65 percent of American households. Ouch!

But don’t shed a tear for Mrs. Groovy and me. We have saved over 25 times our annual household expenses. So we should be able to muddle through. And, besides, the federal government has bestowed upon us—and everyone else in our income class—two awesome benefits. Here they are.

Free Healthcare

When Mrs. Groovy and I retire, our annual income will consist of a $19,100 pension and around $15,000 in dividends. From this $34,100 total, we will put $8,700 into our health saving accounts (HSAs). This will give us an adjusted gross income (for Obamacare purposes) of $25,400.

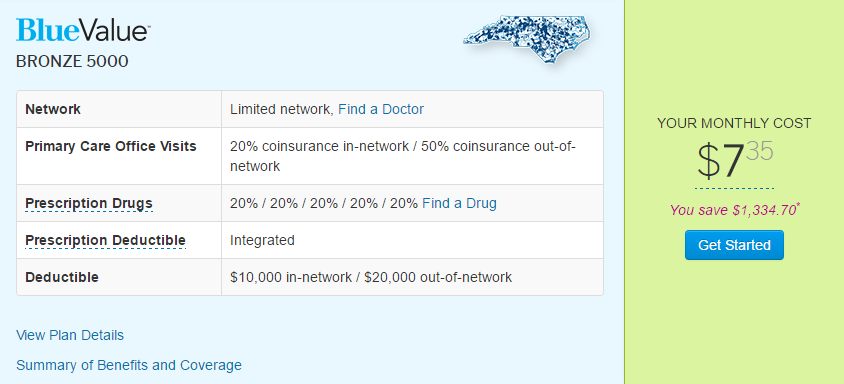

According to the BlueCross BlueShield of North Carolina website, having an adjusted gross income of $25,400 entitles us to a monthly healthcare subsidy of $1,334.70. So thanks to Obamacare, and our low income, we will pay about $100 a year for health insurance.

Political Crap (skip this if you’re not in the mood for one of my rants)

Should someone with my net worth be given a taxpayer subsidy of $16,016.40? Hell no! But I’m going to take this subsidy and here’s why. I’m a vigorous opponent of Obamacare. I believe that price transparency and competition between doctors and hospitals would do more to fix our healthcare woes than increased statism. But the political majority thinks otherwise. It fought for more government and it won. How it won its victory, in turn, also leaves me cross. The political majority did its level best to vilify me and anyone else who opposed Obamacare. We weren’t against Obamacare because we were misguided; we were against Obamacare because we were rotten people. In my mind, then, taking Obamacare subsidies is a legitimate form of protest. You can’t eff with my freedom and malign my character, and then expect me to pay for your overreach when I don’t have to. In the immortal words of a great American freedom fighter, “Homey don’t play that.”

Zero Capital Gains Tax Zero Capital Gains Tax if Your in the 15% Tax Bracket

For those in the 10 and 15 percent tax bracket, your federal long-term capital gains tax is zero. But this zero tax rate only applies to the portion of your capital gain that, when added to your adjusted gross income (AGI), is within the upper limit of the 15 percent tax bracket. For the 2016 tax year, the 15 percent tax bracket will top out at $75,300. Mrs. Groovy and I will easily be under this threshold once retired. Now, to give you an idea of how awesome this benefit might prove to be for Mrs. Groovy and me, consider the following.

In 2012, Mrs. Groovy and I began to buy stock in a company called Western Lithium (WLCDF). This company owns rights to a large lithium deposit in Nevada, just down the road from Tesla’s gigafactory.

When we first purchased WLCDF stock, its share price was $0.17. So we bought a lot of shares. And we kept on buying shares of WLCDF as its price rose to thirty, forty, and fifty cents. Today, we have 71,800 shares of WLCDF. Our total investment in the company is a little over $20K.

Now, the odds are that nothing will come of this stock (it’s currently trading at $0.39 $0.62). But let’s suppose the stars align over the next few years. Sales of the Tesla 3 take off. The gigafactory starts humming along and develops a voracious appetite for lithium. Western Lithium builds a functioning mining operation and becomes a major supplier of battery-grade lithium to Tesla. Given these favorable circumstances, it’s not inconceivable that the WLCDF share price would skyrocket, perhaps going as high as $10. And if this scenario miraculously did transpire, here are what the tax ramifications would be if Mrs. Groovy and I unloaded our stake. Note: the below deductions, exemptions, and tax rates are based on the 2016 tax year.

- Capital Gain: $698,000 ($718,000 – $20,000)

- Federal Tax: $116,261

- AGI: $10,600 ($40K income – $12.6K standard deduction – $8.1K personal exemption – $8.7K HSA contributions)

- First Capital Gains Tax: $0.00 (0% of $64,700)

- Second Capital Gains Tax: $58,748 (15% of $391,650)

- Third Capital Gains Tax: $48,330 (20% of $241,650)

- Medicare Surtax: $9,183 (3.8% of $241,650)

- State Tax: $40,135 (NC has a 5.75 flat tax)

- Free and Clear: $541,604 (This amounts to an effective capital gains tax rate of 22.4%.)

Final Thoughts

Okay, groovy freedomists, is financial independence great or what? Once you achieve it, the federal government christens you an honorary one percenter. It gives you money you don’t need (Obamacare subsidies), and it taxes you less than Warren Buffett’s secretary (at least when it comes to capital gains). That’s pretty freakin’ groovy in my book. Own your time, work when it suits you, and be treated like a one percenter. If that doesn’t inspire you to pursue FIRE with gusto, I don’t know what will.

Totally love this! And I enjoyed the political rant, too! It is freakin’ amazing the benefits bestowed upon someone with a low income, despite having a tremendous net worth. Doesn’t seem right but I’m willing to go along with it 🙂

Mrs. Mad Money Monster

Thank you, Mrs. MMM, for your kind words. It’s always dangerous veering off into a rant, so I don’t do it too often. And I don’t get upset if people don’t agree with my weird views. In fact, I actually welcome the dissent. It helps me to see the flaws in my reasoning (if by rare chance such flaws exist–haha).

In 2017, our household income will be around $30K. This will put us about $45K under the 0% federal capital gains tax. So if realize $45K or less in capital gains in 2017, we will pay zero federal taxes on those gains. Not too shabby. Is it ethical? Is it fair? I’m not going to delve into that now, but it does show that there are some benefits to being income poor.

Thanks for stopping by, Mrs. MMM. It was a pleasure hearing from you.

Good points. One question… I might be missing something, but: how do you estimate such low taxes if you sold the WLCDF stock? Capital gains can push you into higher tax brackets so it seems that the liability on almost $700k would be about 24% (with the medicare surcharge).

Hey Brad. Holy crap, you’re right. I missed a key point about how capital gains are taxed. Damn, blogging about PF is hard! I just went to my old standby Michael Kitces for clarification and I think I have a better understanding now. I’ll have to do an update on this post next week.

Thank you for pointing out this error. I really appreciate it.

Mr. Groovy, I have a suggestion for you where you can shelter the massive tax bill on this investment.

You say that you’ve invested $20k in this company. I say you sell this security tomorrow, but you BUY an equal stake inside of a ROTH IRA at the same time. No IRS wash sales here because you are dealing with a taxable gain rather than a loss….

Once you put this potentially high reward stock inside of a Roth account, you won’t owe taxes on the massive gains and you can sell the asset after it hits your target price and put it in a more conservative investment right away and withdraw from the Roth as desired. The negative is if it goes to 0, you don’t get to deduct the loss.

What do you think?

Holy crap, TJ! I never thought of this strategy. I’m going to have to think it over, of course, but my gut instinct says it makes a lot of freakin’ sense. Let me put together the numbers on my lithium stock. Would you mind if I emailed you the particulars? I’d love to get a more in depth opinion. Thanks, TJ. You have a very exquisite mind, my friend.

Maybe it’s in a future post that I haven’t caught up to yet, but inquiring minds want to know if you followed TJ’s (awesome) suggestion. It’s this community that always make me sit-up/think why didn’t I have that eureka moment.

Thanks, Jeff. I totally forgot about an update. I wimped out. I discussed it with Mrs. G and we both decided to keep our bets out of our Roths. On the surface, TJ’s strategy makes eminent sense. Pay a small capital gains tax now and reap the benefits of a monster tax-free capital gain later. But in the end I couldn’t pull the trigger. I guess it boils down to this: I’m still suffering from imposter syndrome. In other words, what are the odds that I found the one in a thousand penny stock that actually becomes a viable enterprise and catapults to $10 a share or better? I hope to God one day you and TJ can mock me for my wimpiness.

These are good points. Our current tax system definitely favors “asset rich” people through low capital gains taxes; it punishes “income rich” people. More the reason to save! This has interesting economic implications (and questions), though: US savings, despite this pro-saving tax environment, is already so low! Why?!

Hey, Frank. Excellent question. Why, giving our pro-saving tax environment, is saving so low? If I had to hazard a guess, I would say it boils down to ego. People are crushed when they are looked down upon. And in order to avoid this pain–to signal to the world that they are worthy of esteem–they buy cool stuff and forego saving. Fortunately for me, I gave up on the need to project wealth long ago. I’d rather have a maxed-out 401(k) than a new iPhone or a hot car. But then again, it’s a lot easier to attract women with a shinny new BMW than with a 401(k) statement. “Hey, baby. Check out my retirement balance.” Get women to go ga-ga over net worth and you’ll solve the saving crisis, at least for men anyway. Thanks for stopping by, Frank. You made me think tonight.

Great point on tax rates related to the income generated from ‘assets’ (portfolio income) vice that generated from labor. For most of us, it is labor income that provides the opportunity to create sources of passive income and to build a portfolio from which income can be drawn. The key is to move away from labor income – and toward passive and portfolio income – as soon as possible.

Great reminder here on the capital gains rate being 0 if you are in the 15% tax bracket. I truly hope that WLCDF works out for you! That would be one amazing success story if it all pans out! Do you typically look into penny stocks?

Hey, Larry. No, I don’t typically look into penny stocks. In 2012 I came across an article in the MIT Review that suggested we may have a lithium shortage in the not too distant future. So I did a little research on lithium and discovered Western Lithium. At the time it was trading at $0.17. So I showed Mrs. Groovy the lithium shortage article and asked her if she wanted to invest. She agreed and our stake in Western Lithium began. Will it pan out? Who knows? We certainly didn’t do any due diligence. It was (and is) a total gamble. But things seem to be moving in the right direction. We plan on giving it to 2020. If nothing happens by then, we’ll cut our losses (or take our minor winnings) and walk away. Thanks for stopping by, Larry. And thanks for your kind words.

Wow. Congrats, and that is really amazing. That just inspires me to want save more to get there. One day.

Have fun retiring.

Hey, DM. Yes, healthcare subsidies and no federal taxes on capital gains are amazing benefits. And they’re tailor made for the FIRE community. Thanks for stopping by. And good luck with R.R. Donnelley & Sons. I look forward to seeing how you play the pending breakup.

Congratulations as you prepare for your final approach into retirement. I have no doubt that you are as prepared as possible and the next phase of your life will be quite fulfilled.

One half of a couple – the wife – who are good friends just retired last Thursday. I’m looking forward to getting their feedback as they transition into this next phase of their lives.

Hey, James. Thanks for the kind words. We’ll see how the transition goes. We think we have things covered, but you never know. The one thing we know for sure is that we won’t be bored. Between picking up litter, baking bread, travel, and blogging, we’ll definitely have our hands full. I hope things work out for your friend’s wife. Keep me posted.