This post may contain affiliate links. Please read our disclosure for more information.

If you’re a FIRE enthusiast, and you don’t want to be mocked and vilified by other FIRE enthusiasts, you better know the following numbers like the back of your hand.

Monthly Expenses

In order to know your FI target number—the amount of money needed to be considered financially independent—you need to know your monthly expenses. Your FI target number is based on your annual expenses which are based on your monthly expenses. Here’s the formula for your FI target number.

FI Target Number = Monthly Expenses x 12 x 25

Knowing your monthly expenses is critical for another reason. One tried and true way of increasing your savings is to reduce your spending. And how do you know where you can economize? You can’t unless you know where your money is going. So you better track your spending and become intimately familiar with what you spend every month on average. If you fail to do this, three lamentable things will happen.

- You’ll have no idea what your FI target number is.

- You won’t have the knowledge necessary to give your frugality muscles a proper workout.

- And you’ll be shunned at FinCon. No one will sit next to you at whatever breakout session you attend.

Quick aside. If you don’t have an expense-tracking spreadsheet, here’s the one I use.

Groovy Expense Tracker Groovy Expense Tracker GuideMonthly Savings

You won’t get to your FI target number by being a spendthrift. You need to save money—a lot of money. And you can’t allow all of your savings to languish in a savings account earning one percent annually. If you’re going to reach FI before you’re old and withered, your savings need to be earning seven to ten percent annually. Your savings, in other words, need to be horny little buggers who make more dollars than inflation kills.

To calculate your monthly savings, sum all the money you contribute to the following accounts during a typical month:

- Workplace retirement accounts (e.g., 401(k), 403(b), and 457(b))

- Non-workplace retirement accounts (e.g., Roth or traditional IRA)

- Taxable brokerage accounts (e.g., Vanguard or Fidelity)

- Health Savings Accounts

- Insured accounts that sacrifice returns for safety (e.g., savings accounts, CDs, and money market funds)

Net Worth

Net worth—assets less liabilities—is a critical number for two reasons. First, it’s a great scorecard. If your net worth is increasing every year, odds are you’re handling your finances wisely. If it isn’t, odds are you’re a financial moron and you need to seriously reassess how you do personal finance. Second, you need to know your net worth in order to calculate your years to FI (see the next section of this post).

Quick aside. I butt-published this post a couple of times before I actually finished it. And the last time I butt-published it, The Crusher commented (see the date of his comment below) and made an interesting point about the effects of a primary residence on one’s net worth. Historically, a house returns roughly 3 percent annually while the stock market returns roughly 9 percent annually. If one’s house is a large percentage of one’s net worth, the growth of one’s net worth will lag behind the stock market’s growth. The takeaway, then, is this: If your house is a large percentage of your net worth, you need to lower the interest rate in the Years-to-FI Calculator below. If your house is 50 percent of your net worth, an interest rate of 6 percent is much more reasonable than an interest rate of 9 percent.

Years to FI

Okay, you know your monthly expenses, your monthly savings, and your net worth. Now you just have to know how many years of toil you have left. The good news is that in order to calculate your years-to-FI, you need to know your monthly expenses, your monthly savings, and your net worth. The bad news is that that calculation isn’t derived from a handy-dandy little formula such as the Pythagorean Theorem.

My goal was to create a simple in-house form for you to use, much like my MRI-RI Calculator. But the key to my proposed Years-to-FI Calculator was an Excel function called the NPER Function, and the math behind that function was difficult to find and impossible to incorporate. So rather than scrap my Years-to-FI Calculator altogether and just direct you toward Excel and the NPER Function, I decided to craft an Excel-based Years-to-FI Calculator myself and make it available for download.

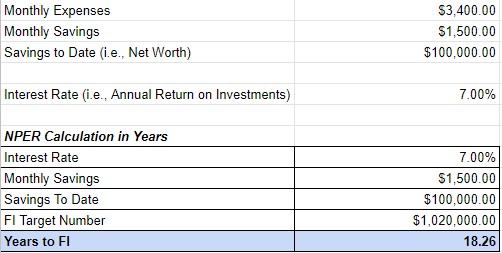

The screenshot below shows my Years-to-FI Calculator in action. I plugged in three of my four must-know FIRE numbers and picked a reasonable rate of return for my portfolio. The table in the bottom portion of my Years-to-FI Calculator did the rest.

If you spend $3,400 a month, your FI target number is $1,020,000. If you’ve already saved a hundred grand toward that target and invest $1,500 a month, you’ll need roughly 18 years and three months to reach FI.

Your years-to-FI can be reduced by lowering your monthly expenses or increasing your monthly savings. Your years-to-FI can also be reduced by assuming a higher return on your investments. I would caution against doing this, however, because you have no control over what returns the market will provide. Better to err on the side of caution (i.e., pick a return slightly less than the historic average) and be pleasantly surprised than to expect rosy returns and be profoundly disappointed. But that’s up to you. Anyway, download my Years-to-FI Calculator and play around with it. It’s a crude but helpful tool.

Quick aside. My Years-to-FI Calculator doesn’t account for inflation. But this shouldn’t be too much of a problem. As long as your income and savings keep pace with inflation, your years-to-FI number should be fairly accurate. Also, it wouldn’t hurt if you used this calculator once a year with updated numbers. Do that and you’ll render inflation a non-factor.

Final Thoughts

Okay, groovy freedomist, that’s all I got. What say you? Are my four FIRE-related numbers absolutely necessary to know if one wants to hobnob with FIRE enthusiasts and retain one’s self-respect? Or are my four FIRE-related numbers unmitigated piffle that should be ignored with extreme prejudice? Let me know what you think when you get a chance. Peace.

For any of my fellow programmers out there, or folks who are thinking about learning, there are a lot of great tutorials out there to help you learn to do some basic coding. The result is that you can have more complicated models to do this. I used this very idea to increase my skills in a new to me language, Python, that I have to learn for my job. I know many other languages, and have been coding for over 20 years, but having a fun reason to learn something always makes your progress and results better. I use that language to make tables, charts, and to perform tests to help me see exactly this kind of stuff. My style is to start off simple, and just add to it. Again, this is fun for me, so if you’ve read this far, you probably think I am crazy.

In my case, I use google worksheets that I manually populate with my data from my various accounts that my program that runs on my computer reads to then generate my tables and charts.

I guess, I am just a geek saying, hey this is fun for me, and you might thinks so too!

GenX FIRE recently posted…The Value of a Dog’s Life

I love it, GenX. The last programming language I played around with before I retired was Php. I was always intrigued with Python but never pulled the trigger. Quick question, do you use a scripting language and SQL? It looks to me as if Javascript has become a pretty robust technology, almost equivalent to a full-fledged programming language. Anyway, we’re definitely kindred spirits. I get a kick out of this stuff too.

You’ve seen my house – it’s worth 1M here but if I was betting woman I’d lay HUGE odds that I could buy it for a fraction of this in the US.

So, because I’m living in a real estate bubble (and you can’t eat your house) I don’t count my house’s value in my net worth calculations.

I figure that when I pull the pin on my job, I’ll be living IN my house but OFF my outside investments.

If I need to go into an old folks’ home in my twilight years I can use the house’s sale price for that. If not, the boys will get a nice little windfall.

So for me, my net worth is everything I’ll be living from to fund my lifestyle. House (and car) isn’t counted.

Love your house, and love your community (I can still savor the gummy shark, BTW). If your house were on the North Carolina or South Carolina coast, it would probably be worth around $500K. The same would be true if it were on the gulf coast in Florida, Alabama, or Mississippi. But if it were in California, it would probably be worth around $2 million. Either way, though, it’s a wise move not counting it in your net worth calculation. Being able to live off your savings and pension means you’ll never be a desperate seller or borrower. You’ll have the luxury of selling your house at your leisure when the time is right (i.e., to pay for the old folks’ home). Although right now, I can’t possibly conceive of you in an old folks’ home. You’re too vibrant and full of life!

Given that the last financial meltdown came from a residential real estate bubble, you may want to take this with a grain of salt.

Some residential real estate investor blogger (sorry, I forget whom) suggested that an SWR for rental real estate is probably closer to 6% than 4%. Given that assumption, the 25x multiplier in your target number shrinks to 16.7x. That’s a big deal.

Moreover, rentals lend themselves to a more incremental approach toward FIRE & sweat equity is a great side-hustle. You can mix your portfolio with rentals and equities and when your bare living expenses are covered by rental income, you can claim FI status!

Of course, rental properties are subject to large capital outlays and leverage causes an exponential (literally) increase in risk, so proceed with caution.

I think rental real estate (owned free & clear) may a better mechanism for balancing the market risk of equities than bonds. After the 2008 meltdown, my mutual funds were savaged, but my rent income went way up.

“I think rental real estate (owned free & clear) may a better mechanism for balancing the market risk of equities than bonds.”

Excellent point, my friend. And now with the advent of Airbnb and tiny homes, one doesn’t need large capital outlays and leverage to make real estate an integral component of one’s portfolio. You can’t have too many streams of income and real estate makes a great backstop against market crashes. Love the way your mind works. Peace.

Good post. We’ve been tracking every expense for several years with an app called Monefy, and it really makes a huge difference. We’re FI but still track, and will probably continue to track closely for another couple of years.

As another semi-self respecting reader, I agree with Crusher’s comment about home value as a portion of net worth. It can be misleading, and the myth that home value is equivalent to the market is still perpetuated widely by some in the mortgage industry and uninformed friends and relatives.

Another great one, Mr. G.

Excellent points, Mr. G. Yep, you gotta be careful when including your home in your net-worth calculation, especially if you’re basing your retirement on the 4 percent rule. It’s kind of hard to spend 4 percent of your portfolio when your house makes up 50 percent of your net worth. If your house makes up 20 percent or less of your net worth, I think the 4 percent rule still stands. Beyond that, though, you’re not giving yourself much wiggle room. Thanks for stopping by, my friend.

Things really changed for me financially when I started tracking my monthly expenses. Without that, it’s too easy to spend more than you think you’re spending. I love tracking net worth too, well, cuz it’s fun. 🙂

Same here, Laurie. Mrs. Groovy and I started tracking our spending in 2003 and it was a real eye-opener. Prior to that, we had no idea how much money we were wasting. And I couldn’t agree more with you about tracking one’s net worth. It is fun!

I like the format of the post – damn brief! 🙂

Like most who would read this blog, I like to think of myself as semi-self respecting. The only data that I would perhaps ignore is the “current gap”. I think if you know your savings rate and if it is measurably accelerating over the past several years then you know you are on the right path and that your gap is growing.

I think I would add (in its place). Investable Assets. Net Worth is important but if your primary residence is a huge part of that figure and you plan to stay there when you FIRE then you are fooling yourself that you actually have 25x or 30x saved for your big move.

Seriously nice post!

Thanks for helping me out, Crusher. You made a really good point about one’s primary residence and I hope I addressed it adequately. Cheers.

Hey Mr Groovy:

Thanks for the follow up. It is funny to see the full posting now. Very nicely done.

Yes, you covered off on the wrinkle that I was pointing out. We are likely 3 to 4 years from FIRE so I am pretty in tune with these topics.

Thanks!