This post may contain affiliate links. Please read our disclosure for more information.

When two of my favorite bloggers, Chris from Apathy Ends and Mr. BOAS from Budget on a Stick, decide to map their personal finances for the world, and artfully issue a clarion call for other bloggers to do likewise, I don’t ask questions. I simply obey my esteemed brothers-in-arms with all deliberate speed.

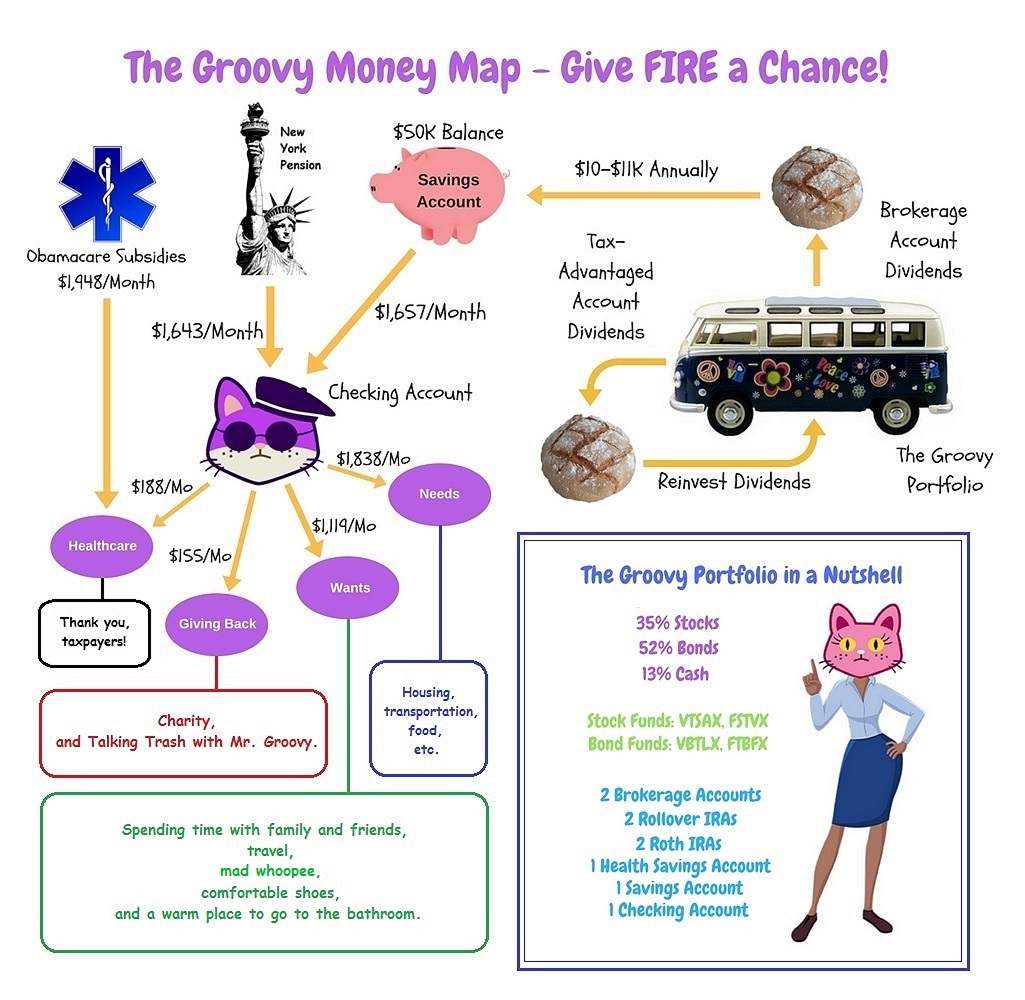

Here, then, is my contribution to the latest chain gang concept to alight the passions of the personal finance community, The Money Map.

The Groovy Money Map

The thing to note about our Groovy Money Map is that we’re being very cautious. We’ve been retired for a year now and we don’t want another 2008-like market crash to eviscerate our portfolio and hurl us back into the wretched world of gainful employment. So to guard against this sequence-of-return risk, Mrs. Groovy and I are following the glidepath strategy put forth by Wade Pfau and Michael Kitces.

For those of you who aren’t familiar with the glidepath strategy, here it is in a nutshell. You start retirement with a low equity allocation (30-40%), and then you gradually increase your equity allocation to 50-60% of your portfolio over a decade or so. Once you hit the upper limit of your equity threshold (say, 60%), you simply re-balance once a year to maintain that equity allocation. Pretty simple.

The glidepath strategy works for us for two reasons. First, because our equity allocation is low, a huge mega-correction of 50% would only deliver a 15-18% ding to our portfolio—and we can handle that size of a ding at this critical stage of our retirement, both monetarily and mentally. Second, the glidepath strategy works for us because we don’t need a lot of money. We’re budgeting $3,300 a month for expenses, and my mini-pension from New York State covers roughly half of that. So our portfolio doesn’t need killer returns for us to make ends meet. We can afford several years of below-average returns. And if we do encounter a 2008-like crash in the next few years, we’ll have plenty of money (i.e. bonds and cash) to accelerate our glidepath and load up on ultra-cheap stocks.

The Chain Gang

Here are the members of the Money Map chain gang.

Anchors: Apathy Ends, Budget on a Stick

#1: The Luxe Strategist

#2: Adventure Rich

#3: Minafi

#4: Othalafehu

#5: The Frugal Gene

#6: Working Optional

#7: Our Financial Path

#8: Atypical Life

#9: Eccentric Rich Uncle

#10: Cantankerous Life

#11: The Retirement Manifesto

#12: Debts to Riches

#13: Need2Save

#14: Money Metagame

#15: CYinnovations

#16: I Dream of FIRE

#17: Stupid Debt

#18: Spills Spot

#19: Making Your Money Matter

#20: Life Zemplified

#21: Trail to FI

#22: The Lady in the Black

#23: Smile & Conquer

#24: Her Money Moves

#25: Full Time Finance

#26: Abandoned Cubicle

Final Thoughts

Okay, groovy freedomists, other than another riveting episode of Talking Trash, that’s all I got. Have a glorious weekend. Grease for peace.

Wow, great map! I might take a shot at one, although it won’t top some of the ones I have seen on the chain gang…

I am conflicted about the rising equity glidepath… It makes perfect sense to me and Michael Kitces knows his crap (excellent interview on the Mad Fientist podcast recently), but Jim Collins also makes a good case for his approach. We are currently about 52% equities,43% Bonds and 5% cash at this point…

Haha! We definitely need the Grumby take on the Money Map. And you are so right about the glidepath strategy. Kitces, one of its creators, is awesome. But JL Collins, who doesn’t like th glidepath strategy, is awesome too. Damn, this personal finance stuff is hard! Right now we’re siding with Kitces. Will that work out? We’ll see. I got my fingers crossed. Thanks for stopping by, Mr. G. It’s always great learning what your fertile mind is thinking. Cheers.

Great money map, I like how you have the groovy van as your portfolio. LoL’ed at ‘a warm place to go to the bathroom.’ Hilarious!!

I never heard of the glidepath strategy, thanks for that info!

Nothing much better than a warm place to go to the bathroom. I definitely have my priorities right. Anyway, I’ll be doing a more in-depth look at the glidepath strategy soon. We think it’s the perfect strategy for the critical first five years of retirement. But there are a lot of financial heavyweights (i.e., JL Collins) who don’t like the glidepath strategy. Damn, this FIRE stuff is hard! Thanks for stopping by, Kris. It’s always great hearing from you.

Oh wow, that’s really nice graphic. It looks great. And I’m sure it’s working really well for you too. Nice job.

Thanks, Joe. I really appreciate your kind words. And, yes, so far it’s working out. Despite a low equity exposure, our portfolio has still returned over $100K to date. Not to shabby for being very defensive. Will our good fortune continue? We’ll see. The plot thickens.

This money map is further validation that they key to a happy life is a narrowly-honed list of wants that covers the truly important things in life

LOL! You have a very perceptive eye, my friend.

You threw me when you ended with “Thriller”, a fantastic album but so vastly different from the others. Boston was (and still is ) a top fave for me (and I’ve wisely taught the children to love it too.

Boston was (and still is ) a top fave for me (and I’ve wisely taught the children to love it too.  Cars, The Cars (circa 1978) was another phenom album, and I remember we loved Tom Petty and the Heartbreakers Damn the Torpedos. There’s no other decade like the 70’s for awesome music.

Cars, The Cars (circa 1978) was another phenom album, and I remember we loved Tom Petty and the Heartbreakers Damn the Torpedos. There’s no other decade like the 70’s for awesome music.

Yeah, Thriller was the oddball in that list. But don’t forget, I wasn’t pointing out my favorite albums during my formative years. I was pointing out the most influential/popular albums during my formative years. I loved Boston and Bat Out of Hell. I didn’t like The Wall. I thought it was too dreary. I wasn’t a big fan of Saturday Night Fever and Thriller when they were released. But I do appreciate them now. And, yes, I definitely missed a lot of great albums. I love the Cars and Tom Petty. I’m also a big Eagles fan. Love your taste in music, Laurie. The 70s were right up there with the 60s. Hope all is well on the farm. Cheers.

You shouldn’t be mad when you make whoopie

Welcome to the chain

Haha! My bad. I meant “mad” in a crazy sense, not an angry sense. I’ll have to make some adjustments to my Money Map. And thank you for getting this chain gang going. Great idea, and great exercise that all FIRE enthusiasts should try.

What took you so long?! JK – Nice work, Mr. Groovy! I hope Mrs. Groovy is well compensated for modeling your nutshell.

I’ll have to study up on the Glidepath approach. It looks like a smart move to avoid major volatility.

Wade Pfau has some of the best articles on this. His site is retirementresearcher.com. He wrote a good article with Michael Kitces called “Reducing Retirement Risk with a Rising Equity Glide Path.”. You might also research “sequence of returns risk”.

I think even Pfau and Kitces recognize that the glide path strategy has limitations. But we believe it’s right for us.

Thanks, Cubert. The rising glidepath strategy is very defensive. A lot of people that I respect think it’s too defensive. I’ll be writing a post on the pros and cons of the glidepath strategy soon. And, yes, I have to be real nice to Mrs. Groovy for the foreseeable future. If I didn’t surrender to those terms, she never would have posed for the Money Map. Sigh. No one ever said marriage was going to be easy.

Bwahaha! “A warm place to go to the bathroom” is perhaps the most important want.

Thank you, Julie! I was hoping someone would make note of my warped sense of humor.

Your groovy bus makes groovy cookies? Wow, that’s groovy!! Glad to have you in the chain!!

Hey, Fritz. Mrs. Groovy thought they were cookies too. But they’re actually loaves of bread. I was thinking hippies call money bread, so I was trying to be cute. Fail! I may have to update my map and just replace the cookie-looking bread with images of dollars bills. Hey, no one ever said joining a chain gang was going to be easy. Hope all is well at World Headquarters, my friend. Cheers.

Great money map Mr. G, glad to see you join the chain! I enjoyed hearing your list of albums too. Thriller was amazing. Do you still own any of the albums mentioned?

Hey, Amy. Sadly, no. All my 45s and albums are long gone. I still have a Bat Out of Hell CD, though.

Bahaha! I swear, it’s like I’m always seeing a new member of the money map chain gang.

That’s because all the cool kids are doing it!

The groovy kids too! Join the chain, Mrs. PP!

Haha! I always wanted to be a cool kid.

Absolutely! This could be the best chain gang yet.

Question for you: What was your allocation before retiring? I’m guessing it was more in equities vs. bonds during the accumulation phase, which leads to this question: to get to the lower equity ratio, did you reallocate right before retiring, or shift your investing the last few years before retirement to slowly get to the lower equity ratio?

I’m guessing you modified your investment allocation during the accumulation phase, rather than selling equities (and paying tax on the gains), but was wondering if you could talk more about this. Maybe a future post? It’s been on my mind as I read more about the glidepath strategy.

P.S. Say to to Mrs. Groovy for me. I’ve been thinking about you two. Moe says hi

Thanks, Kate. Say hi to Moe for me!

We did a lot of the rebalancing in our tax advantaged accounts but Mr. Groovy can explain better.

Hey, Kate. Yeah, we definitely took a couple of years to reduce our equity exposure. Going into 2015, we were around 70% equities and 30% bonds. We then shifted our contributions in our tax-advantaged accounts to almost all bonds. When 2016 arrived, we were around 55% equities and 45% bonds. We continued buying bonds with our tax-advantaged accounts in 2016, and when we sold an energy fund, we put most of the proceeds into bonds. When 2017 arrived, we were at 40% equities and 60% percent bonds. In 2017, we continued to reduce our equity exposure. The stock market scares us now. The Case-Schiller index is very high, and we think the market is going to have a major correction soon. So every month we’ve been exchanging equities for bonds in our Roth accounts. Right now we’re at 35% equities and 65% bonds. We’ll probably maintain the current allocation until there’s a major correction. This will put us in a great position to accelerate our glidepath strategy and load up on equities when they’re dirt cheap. I’ll right a more detailed post soon on the glidepath strategy and our implementation of it. Thanks for stopping by, Kate. And thanks for reaching out to Mrs. Groovy. When she saw that you and Moe were sending your regards, she was tickled pink.

Boston, Meatloaf and Thriller – what good memories on a Friday morning I saw Meatloaf in concert in college too! Your money map is awesome – love the creativity and pics! I’m sure Mrs. G is liking that representation too! I need to read more about the glidepath strategy. I guess I didn’t realize you had such a low equity allocation at this point. It makes a ton of sense to me. Happy Weekend Groovies!

I saw Meatloaf in concert in college too! Your money map is awesome – love the creativity and pics! I’m sure Mrs. G is liking that representation too! I need to read more about the glidepath strategy. I guess I didn’t realize you had such a low equity allocation at this point. It makes a ton of sense to me. Happy Weekend Groovies!

It’s those first few years that are critical so we chose to be very conservative.

Yes, love Mr. G’s rendition of me!

Thanks for stopping by, Vicki!

Do you also remember the Thriller video being shown in movie theaters? MTV was in its infancy back then, and a lot of cable providers didn’t even carry it. So to promote the album, the record label got theaters to show the video as a short before the feature presentation. I worked as an usher back then and people got so excited when they found out Thriller was on the menu. Fun memories. And, yes, I’ll have to do a post on our glidepath strategy. We’re currently at 35% equities. And we’re thinking about going down to 30% by the end of the year. I just don’t see how we avoid a 2008-like correction in the next couple of years. And we want to be in a great position to pounce on stocks when they’re dirt cheap. Thanks for stopping by, Vicki. I’m sure that Meatloaf concert was a blast. Have a great weekend too.

Woot! Welcome to the gang.

I actually hadn’t heard of the glidepath strategy before. I’ll have to read more about it.

Thanks for getting this rolling, my friend. It’s a great exercise that all FIRE enthusiasts should try. Very eye-opening.

I didn’t know about the glidepath strategy! Interesting! Keeping expenses low even after FIRE is admirable

I was…hoping someone was going to explain why there’s bread loafs on the map hahaha.

Haha! Bread is hippie slang for money. I don’t think hippie slang translates very well with Millennials. I didn’t think this out very well. Oh, well. And, yes, the glidepath strategy is very interesting. I’ll have to do a post on it soon. It should be noted that a number of people I respect–JL Collins, in particular–don’t like the glidepath strategy. The plot thickens. Thanks for stopping by, Lilly. It’s always a pleasure hearing from you.