This post may contain affiliate links. Please read our disclosure for more information.

Here is the final installment to our “Stop It” guide:

Stop It Rule Five: Stop worrying that the stock market is rigged and invest the bulk of your savings.

If you have a brokerage or retirement account with Fidelity you will see that Fidelity provides the annualized returns of a number of benchmarks so you can gauge the performance of your account. Here are the annualized returns of an S&P 500 index as of 10/31/2021:

For the past 10 years, an S&P 500 index fund has returned 16.21 percent annually. What has a savings account returned annually over that same time period? One percent—if you’re lucky?

Now let’s compare investing $500 a month for 10 years at 16.21 percent versus investing $500 a month for 10 years at one percent:

| Type of Investment | 10-Year Annualized Return | Monthly Investment | Amount Invested Over 10 Years | Value of Investment After 10 Years |

|---|---|---|---|---|

| S&P 500 Index | 16.21% | $500 | $60,000 | $148,188 |

| Savings Account | 1% | $500 | $60,000 | $63,074 |

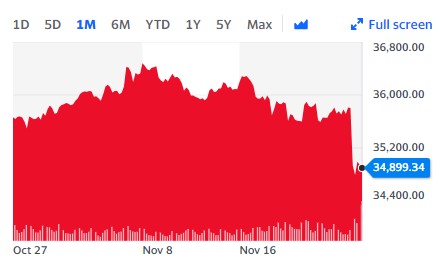

I ain’t gonna lie to you. The stock market is scary. And it’s scary because competition and reality are scary. A business model that was highly profitable for the past 10 years may be highly unprofitable for the next 10 years. A technology that appeared promising last year may turn out to be a dud this year. So the stock market will occasionally take a big hit, as new information emerges and the prospects of the market’s most influential or exciting players wane.

But here’s the good news: The world isn’t static. Companies adjust. Crappy business models are discarded. New dynamic companies fill the void left by old sclerotic companies. As long as your investment horizon is five years or longer, the market is your friend. Just remain calm and stay the course—invest a set amount of money every month in a broad-based index such as the S&P 500—and you’ll be amazed how much richer you are 5, 10, or 20 years hence.

If you’re afraid of investing in the market, “stop it!” The market is only rigged against the impatient and timid. So ignore your lizard brain, embrace the long term, and show a little testicular fortitude.

Stop It Guide Series

Stop It Guide to Personal Finance: Part One

Stop It Guide to Personal Finance: Part Two

Stop It Guide to Personal Finance: Part Three

Stop It Guide to Personal Finance: Part Four

The most you could possible lose is the amount your invested. (That, by the way, is very unlikely). The most you could possible gain is unlimited!

Excellent point, my friend. A total collapse that isn’t followed by a favorable comeback does occasionally happen to an individual stock. But a total collapse that isn’t followed by a favorable comeback has never happened to all the stocks combined trading on a major stock exchange. Hold any broad-based index fund for five years or longer and your odds of losing money are very small.

I think we do not understand risk or the meaning of equities. You can define “risk” as the price-variance of a thing. Most finance guys do so. Stop it.

If the price varies widely over time you may buy at a peak and sell at a valley. Stop it. You can’t time peaks and valleys. Buy as soon as possible and at regular intervals thereafter, b/c you can’t time low points. Refrain from selling when everyone else is panicked. Stop it. Sell only when you reach your goal AND the price is favorable. (Which is probably not yet at a peak.) Money in equities is in a state of quantum superposition until you reify it by buying or selling.

1) I define risk differently: the likelihood I’ll lose my money.

Index funds will only go bankrupt if the hundreds or thousands of companies in the index go bankrupt.

2) Plus the likelihood my shares will be stolen.

Taxation is theft. It’s only safe if the thieves in Washington have their wealth in similar vehicles.

Paper money is worth only as much as the printer’s self-restraint limits its supply. Don’t use paper money as a store of value. Inflation is theft, too.

Buy and hold productive assets and repeat until you can live off the produce.

Couldn’t agree more, Mr. Steve. And your inflation points were spot on. When the printing press goes “brrrrrr,” your savings account gets slaughtered.

Yep yep yep Mr. G. I’ve been in mutual funds for a long long time and I’ve got mucho dineros from being there. I only wish there had been a thing called 401K when I started work instead of starting up ten years later. Even though I missed the first ten years and many times was prevented from maxing out my 401K due to top heavy testing, still I retired at 60 with well over a million in just that one account, which was 100% invested in mutual funds and index funds. I did the same thing in a taxable brokerage account and ended up with a bunch there as well. Never even missed that invested money, but loved watching it grow and winced through some painful crashes without selling a share. As long as you give it time it works as advertised.

When Mrs. Groovy and I retired back in 2016, our net worth was over 25 times our annual spending. Now our net worth is over 35 times our annual spending. And we haven’t put an additional dime into our retirement accounts. All we have done is rebalance once a year or whenever the market has taken a big dip. It’s amazing what simple broad-based index funds can do over time.