This post may contain affiliate links. Please read our disclosure for more information.

Mrs. Groovy signed us up for Obamacare for 2020 and stumbled upon an Obamacare wrinkle that we’ve never seen before. Apparently, members of a family need not all be covered by the same plan. In other words, Obamacare allows a husband and wife to have different plans.

What I’d like to do now is show how this wrinkle works. Once that’s done, I’ll explain why I’m so happy Mrs. Groovy stumbled upon it.

How the Obamacare Wrinkle Works

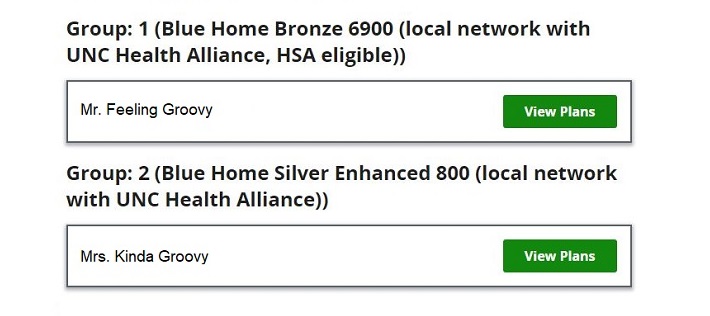

In order to choose a different plan for me, Mrs. Groovy had to divide our family group into two groups. One for me, and one for her. Once that was done, she was able to assign a different plan to my group and thus me. Here are the steps she followed:

- Log into Healthcare.gov.

- Select a plan for 2020. (Mrs. Groovy picked the Silver Enhanced 800 plan because that’s the plan that worked best for her.)

- After a plan is selected, a screen will appear showing your family as one group with each family member having the same plan selection. This screen will also have a button labeled “Change Groups.” If you want to have more than one group and the ability to assign different plans to different family members, click this button. (Since I preferred a Bronze 6900 plan to the Silver Enhanced 800 plan, Mrs. Groovy clicked the “Change Groups” button.)

- The “Change Groups” screen allows you to create two or more groups. How many groups you need is determined by the number of plans you need. If you, your spouse, and your children can get the coverage you prefer with two plans, you’ll only need to create two groups. If you need three plans to get the coverage you prefer, you’ll need to create three groups. Once the groups are created, you assign whatever family members you want to each group. (Mrs. Groovy created two groups. She then assigned me to Group 1 and her to Group 2.)

- Finally, once the groups are created, you’ll have the option to select (or change) plans for each group. (Mrs. Groovy selected a Bronze 6900 plan for Group 1 and a Silver Enhanced 800 plan for Group 2.)

Why the Two Plan Option Works Best for Us

I have few if any healthcare needs and don’t mind risk. I, therefore, find high-deductible plans that are HSA eligible very attractive. Instead of throwing money at premiums for healthcare services I don’t currently use, I’d rather throw money at an HSA for healthcare services I will surely use several years from now—and aren’t covered by Medicare (e.g., eye care and dental work). Mrs. Groovy, on the other hand, has a handful of healthcare needs and is risk-averse. She thus prefers a low-deductible plan.* And because I think a husband should accommodate the security concerns of his wife, I have lovingly submitted to Mrs. Groovy’s desire for a low-deductible plan ever since we enrolled in Obamacare three years ago.

But now, because of the Obamacare wrinkle that Mrs. Groovy stumbled upon, we both get the plans we desire, and we save even more money.

Because Our Obamacare Subsidy Is the Same, Regardless of the Plans We Choose, We Have Eliminated Our Monthly Premium Cost

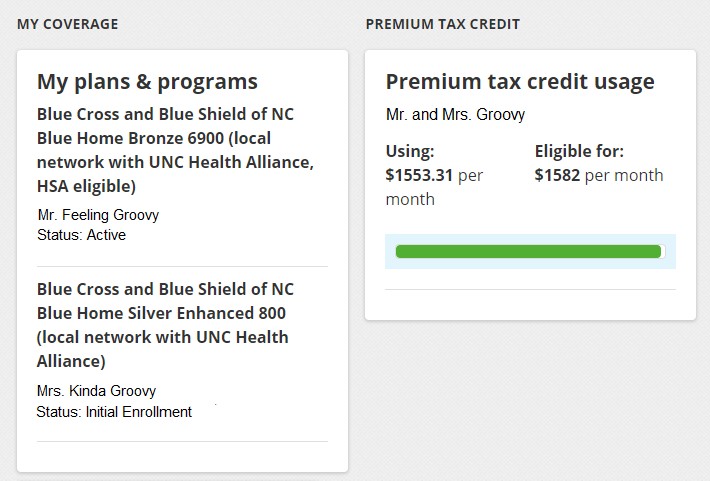

For 2020, Mrs. Groovy and I are entitled to a monthly premium subsidy of $1,582. This amount is subtracted from our combined monthly premiums, and we have to pay the difference.

In previous years, our combined monthly premiums exceeded our monthly premium subsidy and we had to pay a nominal amount each month ($115 in 2017, $123 in 2018, and $25 in 2019).

If we did what we did the previous three years under Obamacare and remained in one group with one plan—the Silver Enhanced 800 plan—the monthly premium for each of us would have been $928.11. Times that monthly premium by two and you get $1,856.22. Subtract our premium subsidy of $1,582 from $1,856.22 and you get $274.22.

By today’s standards, $274.22 a month for decent healthcare insurance is still an incredible bargain. But it’s more than ten times what we paid last year. The horror!

But thanks to the Obamacare wrinkle, we won’t be paying $274.22 a month for healthcare insurance. We’ll be paying zero. And that’s because my monthly premium under the Bronze 6900 plan is only $625.20. Add $982.11 to $625.20 and you get $1,553.31. Our combined monthly premiums are thus less than our monthly premium subsidy. Here’s a screenshot from Healthcare.gov showing our premium tax credit usage for 2020.

HSA Contributions Will Lower Our Adjusted Gross Income

Our monthly premium subsidy of $1,582 is based on an estimated income of $30,000 for 2020. If we make more than $30,000 in 2020, we’ll have to reimburse the feds a portion of 2020’s total premium subsidies. In 2017, for instance, we had a fairly large capital gain and this pushed our adjusted gross income (AGI) over our estimated income by more than $4,000. We had to reimburse the feds nearly $600 when we filed our tax return.

But now, because I’m eligible for an HSA and HSA contributions are deducted from your AGI, we’ll have a lot more wiggle room. Consider the following:

- My government pension amounts to $19,750 for the year.

- Interest and dividends from our taxable accounts usually amount to $10,000 for the year.

This is why we estimate our income for Obamacare purposes to be $30,000 annually.

Now suppose for the moment that Mrs. Groovy and I sell $25,000 worth of bonds in 2020 to replenish our Cash Bucket. And let’s further suppose that this sale generates a capital gain of $2,000.

Without access to an HSA, this capital gain would leave us with an AGI $2,000 greater than our estimated income. We would owe the feds money.

But now, because I’ll have access to an HSA thanks to the Bronze 6900 plan, I can contribute $2,000 to my HSA in 2020 and make sure our AGI equals our estimated income.

The HSA contribution limit for 2020 is $4,550. This means Mrs. Groovy and I will be able to exceed our estimated income by up to $4,550 next year and not incur a dime’s worth of reimbursement liability.

And to make this deal even sweeter, the HSA contributions we make to offset a reimbursement liability will not only grow tax-free but they’ll also be withdrawn tax-free—providing they’re used for healthcare, of course.

The rich really do get richer.

Final Thoughts

Okay, groovy freedomist, that’s all I got. What say you? Were you aware of this wrinkle or feature of Obamacare? And if you weren’t, do you think this wrinkle or feature is something the FIRE community should know about? Let me know what you think when you get a chance. Peace.

* Post Addendum

Out of curiosity, I asked Mrs. Groovy why she preferred Obamacare Silver plans to Obamacare Bronze plans. Here was her response:

- The deductible is lower.

- Low copays for doctor visits and prescription drugs without needing to meet the deductible.

- Less worry even when it comes to “free” preventive services. The free yearly wellness exam covers a few basic preventive services such as blood pressure screening, flu shots, etc. If you discuss a health concern not considered preventive (i.e. something as simple as an ache or pain), you may be charged for a separate visit. With a Silver plan, a co-pay would cover the charge for that separate visit. Under a Bronze plan, the visit may cost over $100 (or $200) and go towards meeting a deductible.

Leave a Reply