This post may contain affiliate links. Please read our disclosure for more information.

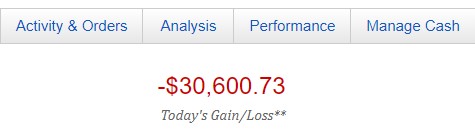

I knew yesterday was bad. So I logged onto my Fidelity account to see just how bad. Here’s a screenshot of the bloodletting.

Ouch.

Since our Vanguard account mirrors our Fidelity account in size, funds, and allocation, I’m assuming that our total “loss” for yesterday was right around $60,000.

No one ever said investing was for the faint of heart.

The good news is that we’ve been immersed in the financial blogging community for five years now and this immersion has prepared us well for these situations. Mrs. Groovy and I literally felt nothing when we learned that Wall Street was having another huge selloff. In fact, Mrs. Groovy, who has ice in her veins when it comes to investing, just turned to me and asked, “How much do you want to throw at stocks today?”

Yep, two formerly broke wretches are now little Warren Buffetts:

“Be greedy when others are fearful.”

I like to think that we’re little Warren Buffetts because we’ve learned how to control our emotions. But I’m really not too sure about that. Mrs. Groovy and I have at least five years in our Cash Bucket…and our monthly pension check and portfolio dividends easily cover our monthly expenses…and we’re not too far removed from Social Security benefits. In other words, we’re coming at this stock market correction with a rock-solid financial foundation. Would we have the moxie to “be greedy” if we weren’t so financially secure?

Final Thoughts

Okay, groovy freedomist, that’s all I got. What say you? I say Mrs. Groovy and I are “greedy” because we can afford to be greedy. If we were financially weak, we wouldn’t be nearly as stoic. We’d probably be selling stocks just like all the other panicked investors out there.

But let’s not end this on a sour note. I turned to Twitter to see what one of my financial heroes was doing about the correction and he didn’t disappoint. I also saw another one of my financial heroes in this dude’s Twitter feed and this hero didn’t disappoint as well. Enjoy.

You just gained that 60K back on the 13th.

Financial planning is mostly theory until the bear comes and tests the plan.

Now to the end of the year (beyond the presidential election), if your every day way of life is not impacted by the bear. Congratulation, you have a solid financial plan for the next 10 years – until the next bear will come to test your plan again.

Haha! Markets in the time of coronavirus. We had another big day yesterday. I’m still down around $300K now, but I’m sure my portfolio will be reaching new heights in 2021. Thanks for stopping by, TE. I always appreciate whatever springs from your fertile mind. Cheers.

Wow, I’m one of your financial heroes!? Thanks for sharing my tweet. It sure is nice to have that solid cash cushion in times like these! I’m buying ~1% of my Net Worth with every 5% downturn.

#ColdWaterSwimmingPutsIceInTheVeins

Yes!!! You may not be the hero we wanted, but you’re the hero we need. Keep on tranching, my friend.

I’m just taking the leap to retirement. Part of me worried, but in reality, I’ve planned for this so I’m sure we’ll ride the storm and come out of the other side.

There’s only one way to find out though!

Baldrick recently posted…Letting go of anxiety

Love the cut of your gip, Baldrick. Worried yet brave. The perfect yin and yang of any great investor.

As a newcomer to investing, and one who is not yet financially secure, I too am “greedy”. Because I don’t have as much invested yet, I didn’t lose as much (simple math). I am salivating at the bargains in the market right now, and how much they will be worth later. I almost feel guilty for profiting from other peoples misery 🙂

You’re in a great position, Emmanual. Your portfolio is going to look awesome five years from now. Bravo, my friend.

You’re right on the money (no pun intended)!

Too many people are terrified the entire market is going to crash and set us back into the great depression. Best advice I ever heard was “Don’t invest with money you can’t afford to lose”.

It’s just a question of time until the market rebounds.

Shannon@RetiresGreat recently posted…7 Ways to Reduce Healthcare Costs in Retirement

“Best advice I ever heard was ‘Don’t invest with money you can’t afford to lose’.”

Amen, brother. Just wait it out and the “loss” will become “profit” soon enough.

i’m with brad on this one and that is to stick to the plan. although we’re still working we’re not adding much fresh cash flow to investments the past couple of years. in that way we’re more like y’all. i came close to selling a couple of % in equities before the fall to keep our desired asset allocation. even with the drop we’re still looking at the 15/15/70 mix. it goes to show you that even with a huge drop it takes more than that to need to make any moves. we have some extra income later this month so we’ll probably invest some of that. carry on and be well.

freddy smidlap recently posted…When the Chips are Down, Sell Some Paintings

Thanks for sharing, Freddy. You make the FI community proud.

We “lost” a similar amount and yawned. Then we drank some coffee, made some flooring and tile choices and took a nap.

We don’t keep as much in cash as you and Mrs. G, but we shifted quite a bit from our investment account a few months ago to the equity contribution of our home construction, inadvertently shielding that amount from the recent volatility.

Mr. Buffet and Mr. Groovy are wise. I’ll follow their examples.

Event: market crashes. Reaction: yawn, sip coffee, and make some tile decisions.

Thank you, Mr. G. I admire your moxie.

Money in equities is Heisenberg money.

Equities have a dollar value at only two points: when I buy & when I sell. In between it’s like Schrödinger’s cat in the quantum mechanic gedanken experiment that’s neither alive nor dead until you open the box.

Sure, I will look at my Vanguard numbers, but I won’t take them seriously UNTIL it’s time to sell. My plan when I retired was to keep enough cash on hand to live on during any downturn of the economy without touching any of my VTSAX.

Meanwhile, I’m worrying a lot more about washing my hands all the time, and consuming 3000mg of Vitamin C daily.

“Meanwhile, I’m worrying a lot more about washing my hands all the time, and consuming 3000mg of Vitamin C daily.”

Your stoicism is quite refreshing. Thank you.

We are not quite as far along our path as the Groovy’s as we are 2.5 years away from FIREing. But we are close enough that we consider things very differently than when we were 30 years old and just getting started on this wild journey.

Took advantage of my W2 job bonus time this week to temporarily increase my 401K % so that I would force a larger lump into my 401K while equity prices are under this current pressure. Small tweak but it is an indication of how unworried we are for the next 5 to 10 years. 🙂

The coronavirus is bad, of course. But I really believe it’s going to be a brief setback. Sometime in 2021, the Dow will hit 30,000.

We lost $111K that day so what did we do, we put another $300K from our cash stash into the market! Great post, Mr. G.

Steveark recently posted…Does Anyone Want to Win?

You’re my hero, my friend. Very well played.

Ice in her veins, little Warrens – reinvigorating. We lost a fortune as well and didn’t feel any heat. Are we now cool or what?

Yes, you are cool!

I’ve not checked my accounts in a few days. I did see however that my stock funds are down about 1% from a year ago. Makes it more palatable to see it that way.

Agreed. The more you zoom out, the long-term trends are undeniable. The market zig-zags up and down on an uphill march.

My suggestion for most people is “stick with your plan”.

Many people were asking “Is this a buying opportunity” back on 2/28 (and likely since then).

Sure, that was a pullback, but the S&P500 closed on that date where it was last October – just four months ago.

Was *that* a buying opportunity?

I’d say yes, but only if that was part of your existing plan.

The market could bounce back from here. Or drop another 10%+. We don’t know.

That’s why having a plan and following it are important.

[steps off soapbox :>]

Brad Kingsley, CFP® | Fee-Only Financial Planning recently posted…How to Value a Business (Five Main Methods)

Couldn’t agree more. Yes, stick with the plan. Even when it hurts–like now.