This post may contain affiliate links. Please read our disclosure for more information.

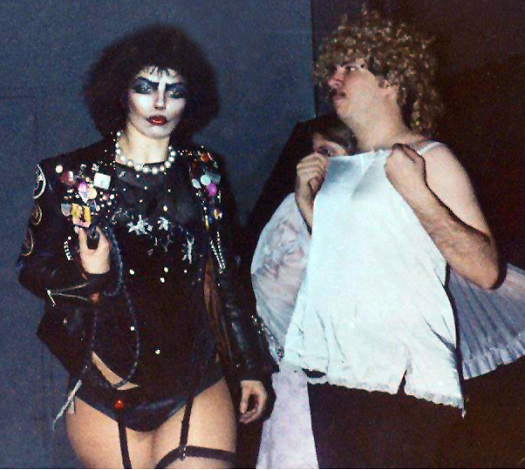

In the late 1970s, young people in New York used to go to movie theaters at midnight with newspapers and water guns. Yes, that sounds bizarre. But it’s true. What’s even more bizarre is that many of these young people would be dressed up like the two bon vivants pictured below.

I never understood The Rocky Horror Picture Show craze. But, hey, there’s much from the 70s that leaves me baffled. Pet rocks, mood rings, clogs, streaking, Billy Beer, and Sha Na Na—these are just some of the things that personified the 70s and traumatized my youth.

And millennials think they’ve had it rough!

But I digress. My point here is not to poke fun at millennials. Hasn’t that path been trodden by enough feet already? My point here is to help millennials and anyone else struggling financially.

So getting back on point, I still don’t get The Rocky Horror Picture Show craze. But with age comes a certain degree of wisdom, and I’ve developed a begrudging admiration for the movie’s lead character, the sweet transvestite from Transsexual Transylvania, Dr. Frank N. Furter.

And, no, this begrudging admiration is not because I’m about to let some long simmering desire bubble forth. I will not be known as Caitlyn Groovy going forward.

No, I admire Dr. Furter because he mastered the art of simple, and this mastery has a personal finance angle. Let me explain.

Dr. Frank N. Furter and Personal Finance

In the movie, Dr. Furter is a cult leader with a very intense following. And he got this very intense following because he devised a very cunning dance called the Time Warp. Here it is.

Let’s do the Time Warp again.

It’s just a jump to the left.

And then a step to the right.

With your hand on your hips.

You bring your knees in tight.

Do you see the genius of the Time Warp?

I mean, it’s an incredibly simple dance. A jump to the left and then a step to the right. How freakin’ hard are those moves? Any clod could do it.

And that’s the point. Dr. Furter knew if he could devise a dance with simple moves, the average schnook would be attracted to it. And as the average schnook repeated those simple moves over and over again, he would get sucked in. He would develop a keen sense of accomplishment; he would enjoy the camaraderie of others who knew the dance; and he would be overwhelmed by a sense of loyalty to his new tribe. A cult member would be born.

Improving Your Finances is Just a Jump to the Left

Okay, now for the financial angle.

What happens when you take the lessons learned from Dr. Furter’s Time Warp and apply them to personal finance? You get something I call the Financial Warp—a financial dance so to speak that comprises two simple little moves that any financial clod can master and propels the “dancer” toward the Holy Grail of personal finance: spending less than you earn.

The first move of the Financial Warp, our jump to the left, is any little move that saves you money.

Everyone’s situation is different, of course, so your jump to the left will be different from my jump to the left. Here, for example, are some of the jumps to the left that Mrs. Groovy and I performed when we soured on living paycheck-to-paycheck and began doing the Financial Warp (circa 2003).

When we first began to track our spending, we discovered that we were spending nearly $600 a month on groceries—for two people! It didn’t take much brain power to quickly reduce that bill to $350-$400 a month. More pasta, more store-brands, and more coupons equaled more savings. And with really no impact on the quality of our lives. In fact, I found a $2.99 bottle of blackberry merlot that blew away the $10-12 bottles of wine I had normally purchased.

We got rid of premium cable channels. Goodbye Sex in the City and New York Islanders. The mating habits of four New York City women and the lamentable outcomes of Islander games were becoming boring anyway.

We stopped exchanging gifts. No gifts for Christmas, Hanukkah, Valentine’s Day, our birthdays, and even our anniversary. Exchanging gifts just didn’t make sense. We didn’t have separate financial lives. We commingled our incomes. If I bought a gift for Mrs. Groovy, I would be using some of her money to do so. And likewise for her. This doesn’t mean we were any less romantic. We made our own greeting cards and went to White Castle every Valentine’s Day. And believe me, hand-made greeting cards and dinners at White Castle are the embodiment of romance. They’re great memories too.

Instead of meeting family and friends in bars and restaurants, we took turns hosting The Poverty Tour as we dubbed it and confined our confabs to our homes. BYOB and takeout pizza proved to be about one-fifth the cost of the typical bar or restaurant tab—and just as much fun.

And then a Step to the Right…

Spending less than you earn is not merely about keeping a lid on your spending. It’s also about increasing your household income. So the second move of the Financial Warp, our step to the right, is any little move that boosts your income and gives you more money to save and invest. Here are some steps to the right that Mrs. Groovy and I made when we started doing the Financial Warp.

Not too long after we were married, Mrs. Groovy took a job for a small non-profit in Manhattan. Take away the extra commuting costs, and the Manhattan job was about as remunerative as her Long Island job. But Mrs. Groovy wanted to work in the non-profit world and Manhattan was the epicenter of that world. Long Island wasn’t. She thus made this lateral move to get herself in the game. And sure enough, within a couple years she got a gig at a larger non-profit and doubled her salary.

I got a part-time job at a warehouse. It wasn’t fun, moving product from the racks to the tractor-trailers was work, but surrendering a couple of nights during the week gave us an extra $600 a month after taxes.

At my government job, some of my co-workers had landscaping businesses. And every once in a while they would find themselves shorthanded. I’d fill in when I was up for a workout and the four to five hours of cutting grass would put an extra $60-$80 tax-free cash in my pocket.

Government is very liberal when it comes to fringe benefits. I got 13 sick days and 5 personal days every year. Unused sick and personal days, in turn, weren’t lost; they were banked. And when you left the government, you got paid for all the unused time you banked. So in 2003, I vowed not to take another sick or personal day again—unless I was truly sick, of course. And because the ensuing three-plus years proved to be especially healthy (I used one sick day), I left my government job with an additional $18K in banked time.

Final Thoughts

Before Mrs. Groovy and I started doing the Financial Warp, we were everyday Americans. We had debt up to our eyeballs and we were living paycheck to paycheck. But then we started doing those little jumps to the left and those little steps to the right. And we did a lot of them. By the time we abandoned Long Island for Charlotte, NC, in 2006, we were saving $2,000 a month.

And, again, the beautiful thing about the Financial Warp is that it was easy. We didn’t do anything spectacular. We just used our functioning brains to ferret out any reasonable way for us to spend less or earn more.

Okay, groovy freedomists, that’s all I got. A while back, I said the personal finance community has a lot to learn from a man who eats human flesh. Now I say the personal finance community has a lot to learn from a man who wears fish-net stockings and has a very fluid sexual identity. Am I losing it? Or have I found a clever way to make spending less than you earn a little edgy, a little—dare I say—deviant?

Oh, and one more question. If the Financial Warp is a legitimate thing, who’s the sweet transvestite of our twisted financial cult? Dave Ramsey? Mr. Money Mustache? J Money?

Let me know what you think when you get a chance. I’d love to hear your feedback. Grease for peace.

P.S. Mrs. Groovy and I were interviewed by The Green Swan recently. Check it out here.

We’re obviously foreigners, and this is one of our national dances. I remember in the early eighties in college, my roommates headed out at midnight to a showing, taking with them toast, rice and umbrellas. I never went and now regret missing out on that experience. Too busy studying, now I realize I could have been FI years sooner!

LOL! Thanks, Chris. Mrs. Groovy was very concerned when she learned the title of this post. But she came around after she read it and allowed me to post it. Whew.

I love it. Honestly, I had no idea what I was getting into when I started reading this post, but I’m going to be thinking about the “financial warp” any time someone mentions time warp from now on. Thanks Mr. Groovy!

70s movies are probably my least favorite period of pop culture. They’re just too creepy in a weird way for me. Maybe because Sean Connery wasn’t James Bond anymore.

But I do like the analogies you have used and glad you could do the Financial Warp.

LOL! I hear ya about Sean Connery. Roger Moore was okay, but when I think of James Bond, I think of Sean Connery.

Hey Groovys! I never understood the appeal of RHPS either but I do enjoy seeing the camerdaerie that goes with these cult like phenomenons. It’s all harmless fun in the end…Star Wars, Star Trek, Lord Of The Rings. Fans get so excited and it’s nice to see happy people instead of miserable ones. 😁Anywho, love that we now have a new FI dance! If it can pick up a cult Iike following perhaps it will influence generations to come!! I hope fishnet stockings aren’t a necessity for this one…I get cold easily!

Haha! I’ll take your word for the unsuitability of fishnet stockings. I don’t have any experience there. And, yes, it’s nice to see happy people instead of miserable ones. May our cult spread far and wide. Thanks for stopping by, Miss M. You never fail to lift my spirits. Tootles.

I admit, I loved Rocky Horror Picture Show – mostly because it brings back great memories with friends. I found myself singing along to the Time Warp in your post. 🙂

And I love the analogy – if anyone can tie Rocky Horror Picture Show to personal finance and have it make complete sense, it’s you, Mr. Groovy! Your creativity is phenomenal. Great post.

Personal finance is a pretty simple dance, as long as you allow it to be. It’s all the things money represents that makes it more complicated.

“Personal finance is a pretty simple dance, as long as you allow it to be.”

Great line! I’m going to have to remember this one (and give the appropriate credit, of course). Thanks for stopping by, Amanda. I really appreciate your kind words and wisdom.

I love the Rocky Horror Picture Show! I used to watch it on VH1 😉 I really needed a new earworm. Thanks for the song.

And you’re right. Finances can be really simple. People and/or life complicate them, right?

Haha! I forgot all about VH1. I remember when VH1 and MTV used to play nothing but music videos. In fact, I remember when MTV first premiered. I don’t remember who the first VJ was (Martha Quinn?). But I remember the first video, Video Killed the Radio Star. And you and Tonya summed up perfectly why personal finance is so vexing. Money is simple but people are complicated. Thanks for stopping by, Penny. It was fun reminiscing.

My dad thought Rocky Horror was too deviant, and wouldn’t let me go with my friends in the mid-80s. He and my stepmom also didn’t approve of D&D or Harry Potter later and still don’t get our early semi-retired status…

Yeah, by all means, figure out how to live below your means and then increase those means. Time and freedom are awesome.

LOL! It’s hard for parents not to protect their babies from the world’s wickedness. I was kind to my parents. I didn’t explore the edge of deviance until I went away to college. It was my way of saying thank you. And you nailed it, Emily. Time and freedom are indeed awesome.

LOL – a little personal finance humor is just what I needed today 🙂

You make such a good point about how improving your money situation doesn’t have to be complicated at all. Yes, there is plenty out there to learn about, if you’re interested and have the time. But big wins can be made with little tweaks.

“[B]ig wins can be made with little tweaks.”

Thank you for summing up the essence of personal finance. You made my day, Harmony.

Your readers are dying to know….what does Mrs. G think of this post? 😀

I was pretty mortified when Mr. G first told me the title. Now that I’ve read the post I see it’s not as offensive or un-PC as I originally thought. Still, that husband of mine comes up with some doozies!

Great question. She wasn’t happy when I pitched the idea. But I gave her total veto power over its publication. Thankfully I didn’t stray too far from the bounds of good taste and she let the post go through–begrudgingly.

The key to a quality cult is not knowing that you’re in a cult, and I think that the FIRE community achieves that quite well. I have to admit that I haven’t seen Rocky Horror Picture Show, but now I want to.

I would nominate Mr. Money Mustache because he’s the one who got me into this whole world, but I’m not sure how good of a leader he would be since he advertises that it’s a cult on his front page.

Props on the step to the right where you only took one sick day for three years. I would go mad if I worked every day! Then again I guess government workers do get a lot more holidays than most.

Thanks for the post, it was entertaining as always!

Haha! So true about government workers and time off. We could bank up to 60 vacation days. Once you hit the max for banked vacation days, you had to use your vacation time or lose it. Since I got 25 vacation days a year, it wasn’t hard to reach the 60 vacation day limit. So by the time my no-sick time vow was made, I had to take 25 vacation days a year. And we did get 12 holidays. We actually got Lincoln’s birthday off in addition to President’s Day. But here’s the amazing part. I worked 20 years and left with about 150 sick days. There were guys who worked 30 years and left with no sick days. As soon as they earned a sick day, they used it. Talk about throwing free money away!

Caitlyn, you never cease to amaze. What an awesomely humorous post, and yet very valid points about the easy dance steps!!

Funny you mention J$’s hair, that was my first thought when you asked for nominees. I like the guy, tho, so I’m not going to nominate him.

I nominate Caitlyn. Smiles.

LOL! Caitlyn would be the perfect spokesperson for the Financial Warp. Too bad I’m a man trapped inside a man’s body. Oh, the slings and arrows of outrageous fortune!

Nice take on a fun film! I never got the craze of going to the theatres and participating, but it is a great movie. Although, being born a yr after the bicentennial, I didn’t get introduced to it until mid 90’s in college.

My vote would be MMM, but prefaced with early MMM not the later posts. Vintage MMM is what got us into this whole thing, and what turned me off of this whole thing for the first couple of years, lol.

My reply to Mrs. SSC when she introduced his blog to me, “I’ve lived off of $25k/yr, it sucks! It’s not glamorous or cool…” Hahahahaha I still stand by that statement.

We did our own jump to the left and found almost $24k we were just frittering away… Yipe! A few more of those discoveries along with a new position for me was our step to the right. Investing all that extra “found money” really went a long way and our lifestyle wasn’t cramped or stifled.

While Mrs. SSC decreased her income dramatically recently, we’re far enough along that it isn’t affecting our FIRE date much.

Again, nice post!

Those were pretty awesome jumps to the left Mr. SSC. 24K saved! I love it. And I hear ya about MMM. I really admire Pete and respect him the financial wisdom he’s promoted. In fact, before I stumbled upon his blog, I thought I was working until I was 65. The 25 times living expenses thingy really opened my eyes and my mind. But I, oddly enough, have problems with his recent work. I can’t put my finger on it precisely, but he seems to have gone Hollywood. Oh, maybe it’s just jealousy. I want to have a million views a month! Thanks for stopping by, Mr. SSC. I love people who do the Financial Warp so well.

I think it’s going from espousing frugality to writing posts about wanting Tesla’s and recommending investing with companies that require you to be an accredited investor and that sort of thing. At least for me it’s those sort of posts that seem to have flipped from his “don’t be a sheeple” type of posts. 😉

So true. I forgot about that Tesla post.

You never fail to amaze me in how you see personal finance connections in almost anything. I’ve never seen the movie but I am familiar with the dance, since that was still popular when I went to college in the 90’s. What a great analogy 🙂

P.S. Like Ty, I’m also a bicentennial baby. Yay for 1976!

I love bicentennial babies. Philadelphia freedom! Oddly enough, the Time Warp wasn’t big in college for my generation. I went to college from 1979-84 and Animal House was far more influential. So no Time Warp dancing but a lot of Toga Parties.

Fun post. I don’t really get the Rocky Horror craze either, but I know it lasted well into the 80’s and even the 90’s courtesy of the fact that my sister-in-law used to perform in it on Saturday nights. Anyway, the Financial Warp is simple enough if people just embrace it. As far as the leader of the cult, you may remember that there were conventioneers at the castle, so perhaps we should be considering PT for the ringleader as well.

Haha! Totally forgot about PT. Good call, Gary. I don’t remember if I was a senior in high school or a freshman in college, but I did attempt to go to a midnight showing of Rocky Horror once. I believe it was at a theater in Syosset, Long Island, and a huge fight broke out on line just before we were about to go in. Two guys ended up going through a plate-glass windows. No one was seriously hurt. But the cops were called and the showing was cancelled.

Ooh, as much as I love Mr. Money Mustache, my vote goes with J. Money. He definitely marches to the beat of his own drummer and was the very first financial inspiration I found on the World Wide Web. I’m a sucker for mohawks 😛

It is amazing how much can be saved/invested just by tweaking a few things. Kudos to you guys!

On a side note, White Castle for Valentine’s Day sounds fantastic, and I never understand the Rocky Horror craze either 😉

Mrs. Mad Money Monster

Thank you, Mrs. MMM. We really do look back with fondness at our dinners at White Castle on Valentine’s Day. We used to go to the one in Valley Stream by the Long Island Railroad. It attracted a very eclectic clientele. In fact, many of them would fit right in with the people doing the Time Warp in the video. But they were harmless, and everyone seemed to be enjoying their belly-bombs. Fun stuff.

The Long Island Railroad! I have fond memories of riding those rails. I was hopping the train to MSG and then the LLRR out to Huntington Station for a few years when I was around 20 years old. There was a place called Totally Wings I used to frequent. Ahhh. Thanks for that little reminder of how much fun I had there. 🙂

Ah, the north shore line. I know it well. I used go to Ranger games from the Hicksville station. I could be wrong, but there seemed to be more freaks on the south shore line. I used to hit Manhattan from the Long Beach station when I was going to grad school and dating Mrs. G. It was amazing how freakish and creepy the riders became after midnight.

The best thing to come out of the 70’s was yours truly! (Bicentennial baby right here).

The Financial Warp is way better than the Financial Two Step (two steps forward, two steps back) that most people dance.

Good stuff Mr. Groovy

Wow! While I was enduring the Time Warp craze, you were in your diapers. LOL. And great point about the Financial Warp. It’s way better than the Financial Two Step. Thanks for stopping by, Ty. Great contribution as always.

P.S. 1976 was an awesome year, and the bicentennial was an awesome celebration. I still vividly remember the Tall Ships and fireworks in New York Harbor.

Money isn’t complicated. Humans are complicated. We mess it up but, ya know, thinking and feeling. I think most people would agree that eating better and exercising can help with weight, chronic diseases, and longevity, but mmm that cake was sooooo good, and I’ve had a rough/great day! 🙂 If we can remove some emotional ties to money, we might all be doing a little better! 🙂

Whoa! Great comment. If we can figure out a way to remove emotions from money, game over. In the meantime, we’ll just have to trick ourselves into forging good habits. And that’s where things like the Financial Warp come in. Thanks for stopping by, Tonya. In a few measly sentences, you packed a lot of wisdom.

I feel like Mr. Money Mustache is the sweet transvestite of the FIRE world. He’s gotten a lot of us into this crazy, crazy Time Warp.

As a Millennial myself, I absolutely LOVE The Rocky Horror Picture Show. I used to to go the showing every Halloween in full regalia. 🙂

LOL! My vote’s for Mr. Money Mustache too. But J Money does have the spiked Mohawk thing going. Thanks for stopping by, Mrs. PP. I’m sure you looked adorable in your Rocky Horror regalia.

P.S. Were you dressed as Dr. Furter or Riff Raff?

Lol! So true!

Agreed. Mrs. PP nailed it.

Agreed! You hit the nail on the head.