This post may contain affiliate links. Please read our disclosure for more information.

As one’s income grows, so does one’s happiness. But this dynamic isn’t immune to the laws of diminishing returns. At an income of $75,000, happiness supposedly peaks.

Don’t ask me why, but my fertile mind got hung up on this factoid recently. On one hand, the correlation between income and happiness makes perfect sense. Make more money, have more money for necessities and frivolities, experience more happiness. Scarcity becomes less of a reality and the mind is freed from a major source of unhappiness: worry.

On the other hand, however, I know from personal experience that income and happiness aren’t perfectly correlated. In 2007, my income dropped over 40 percent and my happiness didn’t crater. In fact, the opposite occurred. I went from making $76,000 in New York to making $43,000 in North Carolina, and, yet, despite this $33,000 pay cut, my happiness meter jumped from run-of-the-mill happy to zippity-f*cking-doo-dah happy.

So what gives? Income is surely important when it comes to happiness. But it’s not the only thing. Something else is at play. Here are my thoughts.

The Keys to Happiness

Assuming for the moment that you’re physically and mentally healthy, socially and technically competent enough to secure friendship, love, and work, free from confinement, and happily untouched by unspeakable tragedy, here are the two things that will determine your happiness.

Personal Maslow

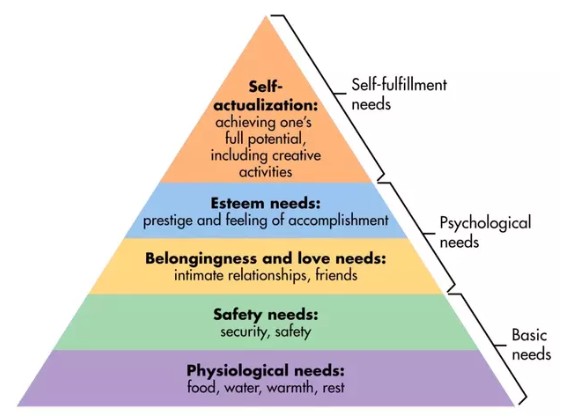

Here is Abraham Maslow’s hierarchy of human needs. Fail to secure any of these needs, especially those at the bottom of the pyramid, and you won’t be a happy camper.

But everybody’s maslow is different. When I was living in New York making $76,000 a year, my psychological needs were more than covered. (How couldn’t they be? I was married to the fabulous Mrs. Groovy, after all). But there were problems regarding basic needs and self-fulfillment needs.

I snore like an ogre. Mrs. Groovy and I can’t sleep in the same room. And this proved to be a big problem back in New York because Mrs. Groovy and I were living in a one-bedroom condo. Sleeping on the living-room sofa was miserable.

I also have a burning desire to tinker and create. A workshop, in turn, goes a long way toward fulfilling this desire. But back in New York, I didn’t have a workshop. Our one-bedroom condo had a community pool. It didn’t have a community workshop.

Once Mrs. Groovy and I relocated to North Carolina, however, my maslow improved dramatically. I was making significantly less money, but I had my own bedroom and bed, and I had my own workshop. And I still had Mrs. Groovy, of course. When it came to basic needs, psychological needs, and self-fulfillment needs, I was kicking ass.

Financial Competency

For our purposes here, financial competency will be defined as follows:

You can save 20 percent or more of your take-home pay.

This is a crude measure of financial competency for sure. Just because you’re a good saver doesn’t mean you’re a good investor. But it does show if you’re skilled or not at living below your means. It’s also income agnostic. The well-heeled aren’t assured victory. Someone making $50,000 a year can actually be more financially competent than someone making $500,000 a year.

Financial competency is key to happiness because it’s key to mitigating worry. Save enough money to handle a major car repair, a visit to the emergency room, or a prolonged job loss and you will have few sleepless nights.

The last year Mrs. Groovy and I were living in New York, we were saving roughly $2,000 a month. Since we were taking home $6,500 a month back then, we had a 30 percent savings rate. Pretty damn good. We had clearly achieved financial competency. But things would get much better once we relocated to North Carolina. Even though our household income took a big hit, our maslow issues were resolved and our savings rate jumped to 50 percent. Not surprisingly, worry went way down and happiness went way up.

Are More Variables Needed?

Without a doubt there are more variables to consider when it comes to happiness. Financial independence, for instance, just about slays the worry monster and gives one complete ownership of one’s time. But how realistic is financial independence for most Americans, and how much does it boost one’s happiness anyway? I was happier once I achieved financial independence, but not outrageously so. If I had to guess, FI Mr. Groovy was 10 to 15 percent happier than pre-FI Mr. Groovy.

No, for the average joe and josephine out there, the happiness riddle boils down to Maslow’s hierarchy and financial competency. Get your maslow right and save 20 percent of your take-home pay and you will very likely achieve 80 to 85 percent of the happiness you’re capable of.

Final Thoughts

Okay, groovy freedomist, that’s all I got. What say you? Income is an important variable when it comes to one’s happiness. But I believe that fixing your maslow and achieving financial competency are even more important variables. Am I onto something? Or am I needlessly complicating this happiness thing? Let me know what you think when you get a chance. Peace.

Agree that financial competency is key and by automatically saving, you’re setting yourself up for success without stress which will allow you to focus on other areas that bring happiness.

Jon recently posted…OddsMonkey Review 2019: Is It Worth It? (Pros & Cons)

Excellent point, Jon. And automating savings is a great way to hack the budgeting process. Mrs. G and I, for instance, maxed out our 401(k)s and Roths and lived off what was left. No need to give every dollar a job at the beginning of every month. Great comment, my friend.

Spot on as usual, Mr. G. I think, more than financial independence, we crave that cushion of security, both financially and otherwise.

Security is a biggie. Enjoying life and getting ahead are very difficult when you are consumed with worry.

I love the financial competency concept. If you can save 20%, then you won’t have to worry much about finance. That’s a sweet spot that a lot of people can strive for. Although, I’d shoot for 20% gross pay. Take-home is too easy.

As for happiness, I think you’re right. Financial competency gets you most of the way there. Financial independence is the cherry on top, not a huge difference.

Agreed. Twenty percent is a fair target. And if you can do that at the gross pay level, you’re golden.

Mr. G, clearly, we all need to be married to Mrs. G to achieve true happiness. I’m happy (and fortunate) to be married to a Mrs. G, as well.

Oh, and yeah, the rest of your post is spot on, as well! I had to ponder a bit on the pre- vs post- FI happiness index. I’m giving myself a 25% improvement, 10% of which is attributable to getting out of my need to commute to my small City apartment alone for 3 nights a week. Maslow, indeed!

You are so right, my friend. Your Mrs. G is pretty damn awesome. And I may have to reconsider my post-FI happiness improvement. I forgot all about the commuting and traveling. Not having to deal with those petty annoyances does remove a lot of stress from one’s life. Great freakin’ comment!

In my opinion, the real happiness is you have a financial freedom. You don’t need to go work for money because you have a passive income from different business. You can spend your time for yourself and family.

You’re not wrong, my friend. Here’s one for you. The best wine my wife and I have is our Sunday night wine. And it’s the best wine we have because we never drank wine on Sunday when we were working for The Man.

I like the simple 20% savings metric but perhaps that should be scaled. For me, the happiness meter started to rise when our income meant we no longer had to worry about how much was left in the checking account before writing a check. Later on we were able to save more. As our income rose, our % of savings went up. Sure we spent more and enjoyed more things and experiences, but we soon realized that we had the freedom to save much more. Living in an oversized house that takes lots of time and money to maintain, driving an oversized SUV that uses lots of gas, spending money on eating out many times a week and routine luxury travel doesn’t mean you are happier, just spending more. Sometimes scaling back to what is really important to you and not worrying about the Joneses is the answer. I believe that in the next year or two, we will see the FIRE movement changing so the emphasis is on living well for less and retiring a bit earlier (perhaps 55-60) as the goal rather than extreme RE. With the right job, you can enjoy many years of working. Being financially independent gives you the freedom to choose where you will work and to walk away when things don’t work out. When my office moved and increased the commute for the job I loved from 3 to 5 hours a day, being FI meant I could retire before I turned 60. I couldn’t have made the happy decision to retire early if I didn’t have FI. Thanks for another great post!

“I believe that in the next year or two, we will see the FIRE movement changing so the emphasis is on living well for less and retiring a bit earlier (perhaps 55-60) as the goal rather than extreme RE.”

Couldn’t agree more. And you are so right about the psychological serenity one experiences when one can write a check and not have to worry about it. Here’s one for you. Mrs. Groovy and I just had a new concrete driveway installed. We wrote our contractor a check for $13,500 and we didn’t bat an eye. Ah, the power of financial security!

I think you’re on to something Mr. Groovy! Saving is certainly key to financial security but if you don’t grow personally by moving up the pyramid, financial independence may be a lonely unhappy existence. I believe the journey requires work from both sides to be meaningful in the long run.

Mr. P2F recently posted…Reflections

“Saving is certainly key to financial security but if you don’t grow personally by moving up the pyramid, financial independence may be a lonely unhappy existence.”

You, my friend, are very wise.