This post may contain affiliate links. Please read our disclosure for more information.

Imagine you’re in the following predicament. You’re 55-years-old. You don’t own your home, you rent. You also have less than $1,000 in the bank, no retirement savings, and no pension. On the bright side, though, you’re employed, have little consumer debt, and are relatively healthy.

Is a decent retirement possible given these circumstances?

It is. But in order to pull it off, you have to make some drastic changes in your life, and you have to be ready for a little adventure. Here’s my game plan.

Focus on the Things You Can Control

For our purposes, a decent retirement is defined as follows.

- Enough income to cover basic necessities (food, clothing, shelter, transportation, and healthcare).

- Enough savings to cover modest bucket list items and modest emergencies.

- Good health and good relationships.

I believe you can begin a decent retirement starting at age 67 (eligibility age for full Social Security benefits). To do that, though, you need to control three critical things: your health, your personality, and your spending.

Health

It’s hard to enjoy retirement if you can’t walk a hundred yards, climb a flight of stairs, or get into a car; in other words, absent rudimentary mobility, your retirement will suck. Seeing the Grand Canyon in person is much more rewarding than looking at it on your iPad.

The good news is that you don’t need permission from Congress to eat better and exercise. Nor do you need a board-certified nutritionist and a fancy gym to get in shape.

Your health is dramatically correlated to what you eat and how you move. So let’s tackle nutrition and exercise.

On the nutrition front, I want you to do one thing: drastically reduce your sugar intake. You don’t need soda, ice cream, candy, and cake to live. The more sugar you consume, the more you will subject yourself to the ravages of obesity, diabetes, and, in the eyes of some doctors and scientists, heart disease. But here’s the rub. Sugar is everywhere—not just in the usual suspects. It’s in your cereal, bread, spaghetti sauce, yogurt, salad dressing, peanut butter, and ketchup. It’s even in (or on) your McDonald’s french fries. So if you want to lose weight and increase your chances of being mobile well into old age, get as much sugar out of your life as possible.

And you don’t have to go cold turkey. Start by removing sugary drinks from your diet. Just drink water. It won’t be fun. I was a sugar addict up until a few years ago, and chucking my sweet tea was brutal. But after a few weeks, my body adjusted and I no longer “needed” brown sugar water to slake my thirst.

Once you’ve conquered sugary drinks, try to keep the de-sugarfication going. It’s amazing how good a hamburger tastes all by itself. There’s no need to slather it with ketchup or barbecue sauce. Salads too taste fine without dressing. After condiments, try removing cereal and white toast from your breakfast routine. The key is to treat sugar like alcohol. Having a few beers every now and then is perfectly okay. Having a case of beer every night is a crime against your liver. So leave ice cream, candy, cake, and the rest of mankind’s sucrose-laden creations for the weekend or every other weekend. Make sugar a treat, not a staple.

On the exercise front, I’m a big fan of Mark Sisson. Mark blogs at Mark’s Daily Apple, and his exercise philosophy can be distilled down to two rules: walk a lot and, on occasion, lift heavy things. That’s it. Not very complicated. So at the very least, you need to do the following exercise regiment. It’s free, and it’s not very time-consuming. If you can do more, bully!

- Walk a mile (every day)

- Do 25 push ups (5 sets of 5 reps every Monday, Wednesday, and Friday)

- Do 50 squats (5 sets of 10 reps every Monday, Wednesday, and Friday)

Need a little motivation? Check out this dude from New York. No fancy gym or equipment. No fancy workout clothes. Just bodyweight exercises down at the neighborhood park. And the guy’s freakin’ ripped.

Personality

People are more inclined to help and befriend angels rather than devils. And since you’re a broke quinquagenarian, you’re going to need all the help and goodwill you can get to secure a decent retirement. So don’t be a jerk. Be kind to everyone, especially those who have “menial” or dirty jobs. Don’t share your politics with anyone—unless you’re asked. And even then, tread lightly. Don’t be peevish, cross, or negative. In the immortal words of Monty Python, “always look on the bright side of life.” And, finally, keep the entitlement mentality at arm’s length. No one wants to be around someone who feels his very act of breathing is enough to warrant favors and privilege.

Spending

There’s no getting around it. In order to have a decent retirement, you’re going to have to save. To save money, in turn, you need to spend less than you earn. Housing and transportation usually take the biggest bites out of a person’s budget. So try economizing there if you can. Downsize to a smaller house or apartment. Move to a working-class neighborhood. Ditch your car for public transportation or a bicycle. Be bold. Be creative.

Once you’ve exhausted every way to reduce housing and transportation costs, move on to other budget items. Utilities? More sweaters and less heat in the winters. More fans, more open windows, and less air-conditioning in the summer. Food? More Walmart, more bagged lunches, and less eating out. Clothing? More Goodwill and less Macy’s. Entertainment? More Netflix and less cable. Fun? More playing cards at a friend’s house and less bar-hopping. There is no shortage of ways to save money if you’re determined to do so.

Need ideas? Need inspiration? Here are some great websites to help you flex your saving muscles.

Save for Your Bucket List and Emergencies

This past October, I went to Green Bay with over a dozen of my high school buddies to see a Packers game. It was our first bucket-list adventure, and it was a blast. Beer, brats, and good-natured mockery are surely the stuff of life.

This bucket-list adventure cost me around $1,200. Not cheap, but certainly not extravagant. Having such adventures in retirement is doable as long as you save.

How much?

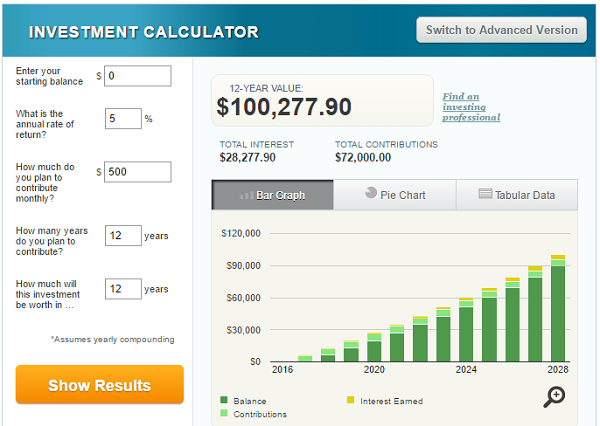

To cover, say, ten bucket-list adventures and basic emergencies (car repair, refrigerator replacement, new eyeglasses, etc.), I estimate that you’ll need $100K. To have $100K by the time you’re 67, in turn, you will need to save at least $500 a month (see screen shot of Dave Ramsey’s Investment Calculator below).

If you can’t save at least $500 a month, game over. If you can, put your savings in two places. First, put $1,000-$3,000 in a savings account for emergencies. Second, open a Roth IRA with Vanguard and put the rest of your savings there. Sixty percent of your monthly contributions should go into Vanguard’s total stock market ETF (VTI) and forty percent should go into Vanguard’s total bond market ETF (BND). Re-balance your portfolio every year on your birthday to maintain that 60/40 allocation.

Move to a Low-Cost State

The only income you will have for basic necessities in retirement will be Social Security. Right now, the average Social Security benefit is $1,348. That amount of income isn’t going to cut it in high-cost states such as California, Massachusetts, and New York. But it will cut it in low-cost states.

In North Carolina, for instance, you can rent a decent trailer in a decent trailer park for $450 a month. Now assuming for the moment that Social Security keeps pace with inflation, the average Social Security benefit is large enough to cover basic necessities (see the table below). It’s also large enough to cover a little hell-raising. One hundred and three dollars doesn’t buy a lot of vice (beer, pizza, lottery tickets, etc.), but it buys enough to keep life interesting.

Low-cost states aren’t for everyone, of course. I get that. But if you’re a broke quinquagenarian who wants to retire at 67, low-cost states are your only hope. If you’re adamant about remaining in a high-cost state, you can kiss retirement good-bye. You will work until you die or until you’re carted off to a nursing home.

| Income | Source | Annually | Monthly |

| Social Security Benefit | $16,176.00 | $1,348.00 | |

| Total Income | $16,176.00 | $1,348.00 | |

| Expenses | Item | Annually | Monthly |

| Federal Taxes | $0.00 | $0.00 | |

| State Taxes | $0.00 | $0.00 | |

| Medicare Part B ($104.90/month) | $1,258.80 | $104.90 | |

| Medicare Part D, Plus Maximum Deductible of $360 | $769.20 | $64.10 | |

| Rent (Water, Sewer, and Lawn Maintenance Included) | $5,400.00 | $450.00 | |

| Food | $2,400.00 | $200.00 | |

| Electricity | $738.00 | $61.50 | |

| Cell Phone | $552.00 | $46.00 | |

| Internet | $960.00 | $80.00 | |

| Cable | $600.00 | $50.00 | |

| Car | $1,600.00 | $133.33 | |

| Clothing | $300.00 | $25.00 | |

| Cleaning Supplies/Toiletries | $300.00 | $25.00 | |

| Total Expenses | $14,878.00 | $1,239.83 | |

| Amount Left for Fun/Miscellaneous Expenses | $1,298.00 | $103.32 | |

Final Thoughts

I devised this “prepare for impact” retirement plan because, sadly, America is chock full of 55-year-olds who have no savings and are living paycheck to paycheck. As far as I can tell, their only shot at a decent retirement is depressingly straightforward: get healthy, get affable, save $100K over 12 years, and move to a low-cost state so you can live on Social Security. Is this plan perfect? Of course not. You may not be able to save $500 a month. You may not be able to work until 67. There’s no contingency for nursing care. If you don’t die before your $100K is spent, you’ll be relegated to whatever nursing facility Medicaid can afford. But despite my plan’s obvious shortcomings, it has one quality that is particularly attractive: it’s doable.

Okay, groovy freedomists, that’s all I got. What advice would you give a broke quinquagenarian who hopes to retire one day? I’d love to hear your thoughts. Peace.

Leave a Reply