This post may contain affiliate links. Please read our disclosure for more information.

I’m a big fan of Barry Ritholtz. For those of you who are unfamiliar with him, he’s the Chief Investment Officer of an asset management firm he founded and a frequent contributor to Bloomberg View and the Washington Post. He also has a blog called, The Big Picture.

In his most recent WaPo contribution, he discusses the difference between investing by outcome and investing by process. Those who invest by outcome are very driven by returns—they gotta beat the market. And because they’re fixated on returns, they become very reactive investors. When the market gets ugly, they rush for the exits. When the market is careening toward new highs, they pile in. And when they’re not trying to time the market, they’re chasing the hot fund manager, the hot stock, or the hot investing fad.

Investing by outcome is an exercise in futility. No one knows when the market will peak or when it will bottom out. Those who try to time the market are more apt to get it wrong than right; that is, they’re more apt to buy when stocks are overpriced and sell when stocks are undervalued. Chasing what’s hot doesn’t work too well either. The hot fund managers of 2015 will almost assuredly not be the hot fund managers of 2016. And the same goes for stocks. Just a couple of years ago, 3D printing stocks were all the rage. But those who bought into the hype got creamed. Stratasys, for instance, one of the companies at the center of the 3D printing hoopla, has seen its stock price fall nearly 90 percent since January 2014 ($136.46 per share to $16.30).

So forget about investing by outcome. Invest by process. “Okay,” you’re no doubt saying, “I’m all for investing by process. What the heck is it?” In a nutshell, it’s a plan. You devise action items a, b, c, and d, and you follow these action items no matter what the market is doing. If the market’s crashing, you’re still doing a, b, c, and d. If the market’s on a tear, ditto—a, b, c, and d. You’re behavior doesn’t change. You follow the plan. But here’s the key. The plan you devise must do the following:

- Keep you invested in the market for the long haul.

- Increase the likelihood that you’ll buy low and sell high.

- Protect your investments from your irrational self (e.g., trying to time the market, chasing the hottest fund, etc.).

If your plan accomplishes the above, you got a good process. You won’t earn spectacular returns. You’ll only get average returns (6-7%). But average returns produce awesome results if allowed to accumulate over time. And, besides, you’ll do far better than the guys investing by outcome.

Mrs. Groovy and I didn’t invent our process overnight. It took a while for us to get out from under the investing-by-outcome mindset. But, with the help of such luminaries as Jack Bogle, Dave Ramsey, and David Bach, we managed to cobble together a process that works for us. And here it is. I hope it can help you formulate your own.

The Groovy Investing Process

Invest a certain amount every month (dollar-cost averaging)

Every month, Mrs. Groovy and I dedicate a certain percentage of our paychecks to fund our 401(k), 403(b), and Roth IRAs. This is a great way to instill discipline and make sure we continue to buy stocks and bonds when they’re on sale. Market down + same monthly contributions = more shares purchased.

Automate monthly contributions

By automating our contributions to our retirement accounts we do two things. First, we force ourselves to live on less. Contributions come right out of our paychecks like a mortgage payment or an electric bill. We have no choice but to make due with what’s left over. Second, we give our discipline muscles a break. Once automation was set up, making our monthly contributions became effortless.

Maintain a 60/40 asset allocation between stocks and bonds/cash.

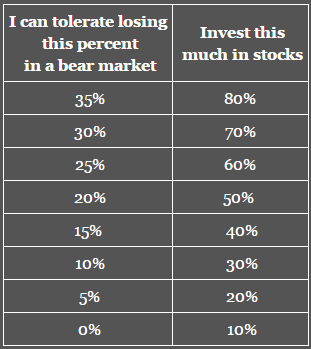

This action item is key. The more stocks you have in your portfolio, the more it will be subject to dramatic drops. How much of a drop could you handle before crying uncle and frantically clicking the sell button? Dirk Cotton over at the Retirement Cafe recently posted this chart from William Bernstein’s, The Four Pillars of Investing. It shows how much of your portfolio should be in stocks based on your tolerance for market dips. If you would freak out if your portfolio’s value dropped 35%, your portfolio shouldn’t be comprised of 80% stocks.

I’m a wuss. I’d like to go to a 50/50 or a 40/60 split by the end of this year. But Mrs. Groovy is very comfortable with a 60/40 split. She has ice in her veins when it comes to investing. And that’s fine. We’ll stick with 60/40. As long as she can handle it, I’ll suck it up during the next market crash.

Maintain the following asset class percentages in our portfolio.

The goal here is to minimize risk by diversifying. We think we have a nice mix of asset classes. Our only concern is the lack of an emerging market stock fund and a short-term US bond fund.

Stocks

- US Large Cap: 40%

- US Mid Cap: 10%

- US Small Cap: 10%

- Energy: 10%

- REITs: 10%

- International Developed: 20%

Bonds/Cash

- US Intermediate: 60%

- Corporate High Yield: 16%

- Emerging Markets: 8%

- Cash: 16%

Don’t watch CNBC and the daily fluctuations of the market.

Just before the new year we stopped watching financial news. We couldn’t have chosen a better time to shun the media. We hear the market has dropped ten percent or so since January 1. But because we don’t partake in financial news anymore, we really don’t know. And we don’t care.

Check portfolio every December for tax-loss harvesting opportunities.

This past December we sold a number of shares of our energy fund for a loss. This loss, in turn, reduced our 2015 tax liability. A month and a day after we sold those shares, we used the money from that sale to buy back as many shares as possible of the same energy fund. And because oil prices continued to fall in the interim, we were able to buy more shares than we sold.

Rebalance every January.

This is another great way to systematically buy low and sell high. If our stock funds have a great year and our portfolio goes from a 60/40 split to a 70/30, we sell enough stocks and buy enough bonds to get back to the 60/40 split. By following the plan, we’re selling stocks when they’re high and buying bonds when they’re low. This is quite possibly the only free lunch in the investing world.

Have at least three years of expenses in cash.

This is the main reason why I don’t push back against Mrs. Groovy’s preference for a 60/40 portfolio (and you thought it was because I wear a dress!).

Make sure we have enough bonds and REITs in our non-tax advantaged brokerage accounts to generate $12-15K annually in dividends.

The $12-15K in dividends we’ll get from our brokerage accounts will be used primarily to fund our health saving accounts (HSA) in retirement.

Do not reinvest our non-tax advantaged brokerage account dividends. Use to max out HSA contributions.

The current HSA contribution limit is $4,350 (if you’re 55 or over). Mrs. Groovy and I will thus need $8,700 to max out our HSAs.

If we do invest in an individual stock, we only invest an amount we can afford to lose (no more than two percent of our portfolio).

Mrs. Groovy and I are currently invested in a stock called Western Lithium. It’s supposedly developing lithium mines in Argentina and Nevada. Now, in all likelihood, this penny stock will crash and burn. And if that’s the case, no biggie. We only invested an amount of money we could afford to lose. But if its management somehow pulls it off and manages to become the principle lithium supplier to Tesla’s gigafactory, I’m having groovapalooza at my house, and you’re all freakin’ invited.

Any stock purchased must be held for at least a year.

This action item is used to instill discipline and avoid the tax rate of short-term capital gains.

After the waiting period, we should only consider selling the stock if its price has at least doubled.

Western Lithium is our lottery ticket. Selling it for anything less than twice our purchase price will not materially alter our financial picture. So we’re going to hold out at least until 2020 and see if we can bag a mega profit with this puppy ($200-$300K).

Final Thoughts

There you have it groovy freedomists. That’s our process. What do you think? What about your process? Would you like to share it?

Leave a Reply