This post may contain affiliate links. Please read our disclosure for more information.

Prior to my fortieth birthday (I’m 55 now), I was a financial moron. I wasn’t good at making money, and I wasn’t good at saving money. My financial IQ was appalling. Rudimentary financial concepts such as “pay yourself first,” “build an emergency fund,” “automate your savings,” and “invest in low-cost index funds” were utterly alien.

And the truly sad part is that I was only vaguely aware of my financial inadequacies. Nearly all of my friends were doing better than I was, but I chalked this up to dumb luck. They just happened to stumble upon jobs and careers that were more remunerative. There was really nothing wrong with me.

Or was there? Enter my coworker Anthony.

Anthony was the same age as me and held the same job title. He wasn’t a rocket scientist, but he certainly wasn’t a dolt. And he certainly wasn’t a dolt when it came to finances. He had a landscaping side-hustle and a voracious appetite for saving. Buy the time his fortieth birthday rolled around, he was a millionaire.

Now here’s a rather inconvenient question. Since Anthony and I both made the same amount of money at our principal jobs, and since I had just as many opportunities as he did to improve my financial position, why was he a millionaire and I a nothingaire? There’s just no getting around it: I was a full-blown financial moron.

So what about you? Are you a financial moron? You might be. But then again, you might not be. The only way to know for sure is to first gather the information needed to diagnose a case of financial moronity. Let me show you how.

Gather the Key Data

To diagnose a case of financial moronity, we need four pieces of information. Here they are.

1. Monthly income. This is the income you bring in every month. Because Mrs. Groovy and I are retired, our monthly income is derived from a small government pension and a very conservative safe withdrawal rate from our portfolio. It amounts to $3,600 per month.

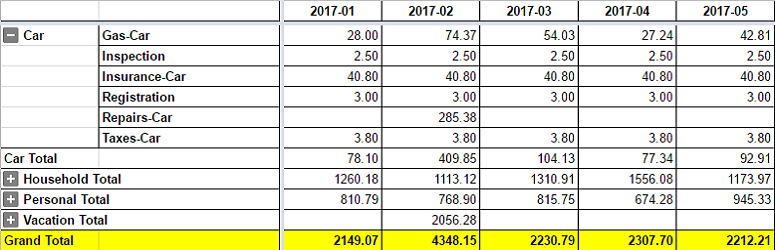

2. Monthly expenses. This is what you spend every month. To track our spending, Mrs. Groovy and I use a simple spreadsheet in Google Docs. (If you want to try it, here’s the link to download it.) I provided a screen shot of our spending spreadsheet below. Notice how the Car category’s subcategories are displayed? I did this to show how annual bills, such as our car registration bill, are broken down into their monthly equivalents. I suggest doing this with all your annual bills for two reasons. First, it gives you a more accurate accounting of your monthly spending, and, second, it helps you account for all of your spending. Bills you only pay once or twice a year are easily forgotten.

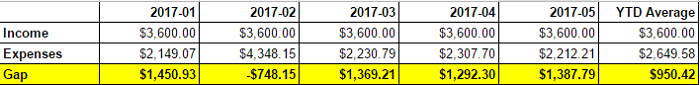

3. The gap. This is the difference between your monthly income and your monthly expenses. Our gap this year is averaging $950 per month (see screen shot below). If this keeps up, we’re going to have one hell of a Groovypaloosa at the end of the year.

4. Net worth. Add all of your assets (savings, investments, car, boat, house, etc.) and subtract all of your liabilities (credit card debt, car loan, mortgage, etc.). The difference is your net worth.

Track Your Progress

Now that you know the data necessary to diagnose a case of financial moronity, start tracking this information. Every month calculate your income, your expenses, your gap, and your net worth, and put those calculations into a spreadsheet. At first, this bookkeeping will be annoying. But as you develop your tracking spreadsheet, and as you tailor your tracking spreadsheet to your peculiar needs and circumstances, this chore will becoming easier and easier. I spend less than an hour a month tracking this information.

Okay, you set up your tracking spreadsheet and you’re faithfully recording your key financial data every month. What does it all mean? How will all this help you determine if you’re a financial moron?

In general, as you track your data from one year to the next, you want your monthly income to be growing, your monthly expenses to be stable or shrinking, your gap to be positive and growing, and your net worth to be growing. If this is what actually transpires in your financial life, leave things alone. Whatever you’re doing, it’s working. You’re as far removed from being a financial moron as possible.

On the other hand, if this isn’t what actually transpires—you can’t seem to make any financial headway when it comes to your income, expenses, gap, and net worth—then something’s wrong. You may not be a financial moron, but you should be worried.

Be Brutally Honest with Yourself

Life is messy. Housing markets collapse. Jobs migrate across the country and across the world. Cars break down. Illnesses devour emergency funds. So it’s highly unlikely that your income or net worth is going to increase every year for decades on end. You will have setbacks. And that’s okay. The trick is to avoid several years of setbacks in a row.

To gauge how you’re doing, I recommend scoring just your gap and your net worth. Compare the current six or twelve month period to the previous one and use the following point system.

| Comparison of the Current Period to the Previous Period | |||

|---|---|---|---|

| Got Worse | Remained the Same | Got Better | |

| Gap | -1 | 0 | 1 |

| Net Worth | -1 | 0 | 1 |

Next, keep a tally of how your gap and net worth did during each period going forward. In the below example, I show the the gap and net worth scores of a hypothetical individual for the years 2014-16.

| Combined Score of Gap and Net Worth Scores Over Several Consecutive Years | |||

|---|---|---|---|

| Year | Gap | Net Worth | Combined Score |

| 2014 | -1 | -1 | -2 |

| 2015 | 0 | -1 | -1 |

| 2016 | 1 | 1 | 2 |

Armed with this scoring system, your goal is to have more positive combined scores than negative. If you manage to do that, you’re doing a lot of things right. If you don’t, you got problems. And if you manage to string together negative combined scores for three consecutive years, you need to seriously question your financial IQ.

Again, life is messy. I get it. Suffer a brutal car accident and your combined score could easily be negative for several years in a row. The same fate could await you if you happen to be a college student taking out student loans. But for our purposes here, you will be deemed a financial moron if, absent some clearly mitigating circumstances, you manage to get a negative combined score for three consecutive years.

Okay, using our key data and scoring system, you’ve determined that you’re a financial moron. What do you do?

First, check your financial ego. Admit to yourself that your current approach to money isn’t working. You need a better money philosophy.

Second, to get a better money philosophy, you need to educate yourself. Read ten personal finance blogs a day. And read one personal finance book a week. Then, third, as your financial education unfolds, start applying what you’ve learned. Get a part-time job to increase your income. Downsize to a smaller home or apartment to reduce your expenses. Open a Roth IRA and contribute $400 a month to an S&P 500 index fund. In short, start the process of financial de-moronification—do whatever it takes to increase the gap and become a first-rate investor.

No Excuses

“But wait a second,” I hear you howling. “What if you were born into a family and community that was awash in financial ignorance? What if you were never taught the fundamentals of personal finance? How, then, are you supposed to improve your condition and rise above the sorry state of financial moronity?”

Good question. The chains of culture are extremely hard to break. Financial moronity begets financial moronity.

But here’s why we should be very leery of this excuse.

Suppose you come across a bigot, someone who loathes those who are not part of his tribe. And let’s further suppose that this said bigot was never taught the fundamentals of brotherly love. He grew up in a family and community full of bigots. Would you give this bigot a pass? Would you say his bigotry is not his fault, and society can’t expect him to mend his foul views?

Don’t allow financial morons to use the culture card. Yes, you can’t choose the financial culture you’re born into. But financial cultures are free. If your financial culture sucks, you can choose a better one for no charge. You know what else is essentially free? Information. For practically nothing, one can go online or go to the library and quickly learn how to make more money, reduce household expenses, and become a better investor. In this day and age, there is simply no excuse for being a financial moron.

Final Thoughts

Okay, groovy freedomists, that’s all I got. What say you? Is my test for financial moronity valid? Or am I overlooking something. Let me know what you think when you get a chance. Peace.

Leave a Reply