This post may contain affiliate links. Please read our disclosure for more information.

One of my favorite books on economics is a book titled Economics in One Lesson. It was written by Henry Hazlitt in 1946, and it has done more for my critical thinking skills–pound for pound–than any other book I have ever perched before my haunting blue eyes with my firm rugged hands.

Mr. Hazlitt’s lesson is presented in a mere five pages. But for those oppressed souls who can’t spare ten minutes to read five pages, he boils his one-lesson explanation of economics down to one sentence. Here it is:

The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups.

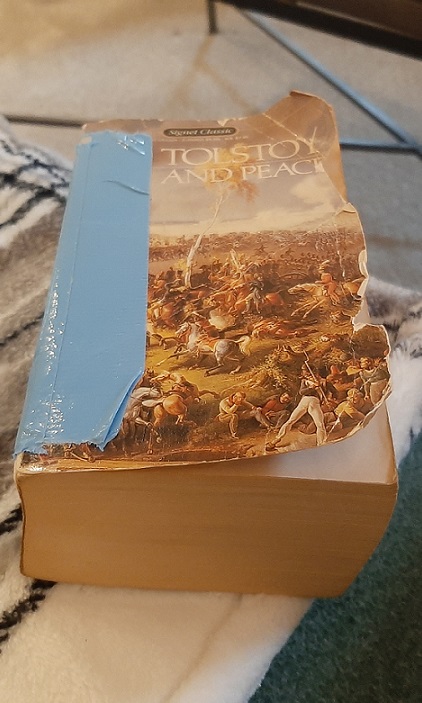

Oddly enough, I was recently reminded of Mr. Hazlitt’s one-sentence lesson as a result of my New Year’s resolution for 2022. I always wanted to read War and Peace, so I dedicated myself to achieving that goal this year. And my resolution regarding War and Peace was simple: read at least one page of War and Peace every day for the entire year.

My copy of War and Peace is 1,455 pages. Reading one page a day would leave me over 1,000 pages short of my goal. But I wasn’t concerned with the immediate effects of my miserly reading quota, I was concerned with its long-term effects. And I wasn’t concerned with the consequences my miserly reading quota would have on one of my more base joys (the joy of doing nothing), I was concerned with the consequences it would have on some of my more noble joys (the joy of learning, the joy of contemplating, the joy of being productive, etc.). In effect, the goal of my miserly reading quota was twofold: 1) to habituate the reading of War and Peace—to make the perching of it before my haunting blue eyes as natural as brushing my teeth or scratching my ass, and 2) to substitute a base joy with more noble joys—to pursue happiness with less sloth and more learning, contemplating, and being productive.

So did my miserly reading quota work? Yes. I am not only thoroughly engrossed in the lives of Andrei, Pierre, Nickolas, Anatol, Marya, Natasha, and Sonya but I am also well on my way to finishing this delightful tomb in the allotted time. We are now mid-March and I have consumed 768 pages of War and Peace.

Tailoring Mr. Hazlitt’s One-Sentence Economic Lesson To Make a One-Sentence Wealth-Building Lesson

Sure, Mr. Hazlitt’s lesson is very applicable to the goal of reading a monstrously long book. But is it applicable to the goal of building wealth?

I say it is. And to prove it, we first have to tailor Mr. Hazlitt’s one-sentence economic lesson to make it a one-sentence wealth-building lesson. Here we go:

The art of wealth-building consists in looking not merely at the immediate but at the longer effects of any economic action; it consists in tracing the consequences of that economic action not just for one aspect of your wealth but for all aspects of your wealth.

Now let’s apply our one-sentence wealth-building lesson to two classic economic actions—current consumption (i.e., living paycheck to paycheck) and future consumption (i.e., saving and investing). Your current car is old and forlorn. In fact, it’s a POS by any reasonable standard. So you decide to buy a new car. The terms of your loan are as follows: $650 a month for 72 months. Here are the immediate and long-term effects of your current consumption:

| Immediate Effect | Long-Term Effect |

|---|---|

| None. You're still living paycheck to paycheck. Your new monthly debt is offset by less spending on car repairs, new clothes, eating out, and travel. | You're edging closer to financial disaster. The number of years you'll have to build a suitable nest egg for retirement are fewer. |

And here are the consequences of your current consumption for all aspects of your wealth:

| Aspect | Effect |

|---|---|

| Physical Comfort | Win. New cars drive better and have more safety features. |

| Status | Win. People commonly judge others by what they drive. |

| Psychic Comfort | Loss. On the one hand, you'll have less worries about your car breaking down. But on the other hand, you still don't have an emergency fund, and you now have a $650 monthly loan payment. This means more stress. Hate your job? Tough. Your car payment makes you your boss's bitch. Break a bone or lose your job? You're screwed again. |

| Human Capital | Loss. You're not learning how to delay gratification, and you're not learning how to invest. |

| Net Worth | Loss. New cars are a depreciating asset. |

But what if you chose future consumption over current consumption? You decide to forego the new car and cut your discretionary spending by $500 a month. You’re no longer going mashugana on travel, new clothes, and dining out. For the first time in your life, you’re not living paycheck to paycheck. Here are the immediate and long-term effects of your future consumption:

| Immediate Effect | Long-Term Effect |

|---|---|

| Little. You're no longer living paycheck to paycheck, but saving and/or investing $500 a month doesn't move the needle on your economic fortunes a lot. | Wow. Invest $500 a month for 10 years at 8% and you'll have $78,714. Invest $500 a month for 20 years and you'll have $266,191. Invest $500 a month for 40 years and you'll have $1,605,982. |

And here are the consequences of your future consumption for all aspects of your wealth:

| Aspect | Effect |

|---|---|

| Physical Comfort | Loss. Old, junky cars drive poorly and have antiquated safety features. But how often are you in your car? An hour a day? And as long as you obey the speed limit and don't drive drunk, your old, junky car will be perfectly safe. |

| Status | Loss. People commonly judge others by what they drive, and your old, junky car will identify you as a "loser." But do you really care what strangers think? |

| Psychic Comfort | Win. On the one hand, you still have to worry about your car breaking down. But on the other hand, you have the means to build an an emergency fund and open a brokerage account. This means less stress. Hate your job? No worries. If you have a fully-funded emergency fund, you can tell your boss to lump it. Break a bone or lose your job? Again, no worries. If you have money in the bank and a growing stock portfolio, you can handle minor or modest financial setbacks. |

| Human Capital | Win. You're learning how to delay gratification, and you're learning how to invest. |

| Net Worth | Win. Habitual saving will always increase your net worth from the previous month. But habitual investing is where the magic is. Invest $500 or $1,000 a month in an S&P 500 index and after 15 or 20 years, you'll marvel at your net worth. |

I’m just a little ol’ country blogger, but it seems to me that Mr. Hazlitt’s lesson is very applicable to the process of building wealth. Anyone who embraces Mr. Hazlitt’s lesson will doubtlessly see the folly of slavishly submitting to one’s wants and living paycheck to paycheck.

Final Thoughts

Okay, groovy freedomist, that’s all I got. What say you? Is Mr. Hazlitt’s lesson as applicable to wealth-building as I assert? Let me know what you think when you get a chance. Peace.

Years ago I signed up to an email that sent a tiny portion of War and Peace to me every morning.

I rarely give up on books but this one got the better of me. Too many long Russian names that all look the same!

Haha! Same thing happened to me. About 25 years ago I picked up my paperback version of War and Peace. And it didn’t take long before the long Russian names and the French dialogue totally humbled my enthusiasm. I put it down and didn’t pick it up again until this past January 1. What’s helped this time around is the internet. I can now translate the French and hear how the Russian names are pronounced. And learning about the Napoleonic Wars has also added a lot of context and made my reading more enjoyable. Any chance you might attempt War and Peace again? I’d love to hear your take on it. Cheers.

I love your writing, and how your mind works. And you made me laugh. And good luck with War and Peace – a worthy goal (to quote you: “the joy of learning, the joy of contemplating, the joy of being productive, etc.”). This is my most favorite post of all time – I’ve learned a lot from it. Thank you.

Thank you, Dale! Your comment made my day. Peace.

I’m a big fan of “Economics in One Lesson.” Read it Freshman year in college and it radically changed my thinking.

Amen, brother. I read it in my late 20s, and while it immediately resonated with me, I didn’t embrace its wisdom until my late 30s. Breaking the sturdy bonds of American culture is no easy task. Thanks for stopping by, my friend. Cheers.

Perhaps you’ll enjoy this interpretation of a small part of War and Peace coming to your area in October… it was a hit on Broadway with Josh Groban in the lead.

https://www.visitraleigh.com/event/natasha-pierre-%26-the-great-comet-of-1812/81984/amp/

How do you find this stuff? You’re amazing JK. I’m definitely interested, but I don’t know if I’ll be able to drag Mrs. Groovy to it.

Me? You lie! I don’t know what would torture you more, watching that or sitting through Rent again. Don’t believe a word he says.

PS. JK, according to sources, off stage Josh Groban loves talking about his c*ck.

Mrs Groovy recently posted…Wealth-Building in One Lesson

Okay, you spilled the beans on me. But Josh Groban? Is he really a perv behind the scenes?

No worries… josh groban won’t be performing in NC.

I’m no longer disiappointed by the foibles of famous people. They are as flawed as anyone.

Our friend Barry saw it on Broadway and said it was the best thing he ever saw. He also had tickets on stage which enhanced the experience. Perhaps the seating in Raleigh will be the same. How does the stage manager ensure that no audience member stands up in the middle of the performance and start singing along?

When I saw Equus on Broadway and sat on stage no one dared to stand up. Probably shock from seeing a naked actor, up close at that, on stage. I sense a running theme here.

All I know is if Mr Groovy posts a photo of himself sitting naked atop Billy Bob the Bison, please hire a divorce lawyer for me.

Mrs Groovy recently posted…Wealth-Building in One Lesson

No nudity in Natasha, Pierre and the Great Comet. So you’re safe to sit onstage.

Sitting on the bison looks like it will be painful, clothes or not.

Haha! Definitely.

Mr. G, great application of a simple lesson. It’s amazing how many things this applies to…exercise was the first thing that came to my mind.

Good luck with War And Peace!

I love it. Great minds think alike. I also thought of informal education–as in the difference in fortunes between watching a re-run of The King of Queens or taking a half hour to hone a job skill. Hope all is well, my friend. Really looking forward to our talk next week. Cheers.