This post may contain affiliate links. Please read our disclosure for more information.

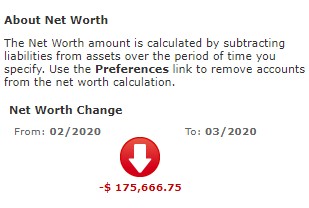

Our financial groin has been getting stomped on by the coronavirus. Since 2/19/2020, our net worth is down $289,000. And for this month thus far, our net worth is down a staggering $175,000. Check it out.

And, yet, Mrs. Groovy and I smile. Stocks are on sale and we’ve already exchanged $90,000 worth of bonds for stocks. If the Wall Street sale continues, we’ll happily buy more stocks. It’s just what you do when you got a big monstrous pair dangling between your financial legs.

But Mrs. Groovy and I are hardly the only bloggers with a big monstrous pair. Surely, there are other bloggers who have suffered a greater ding to their net worth and who have thrown more money at stocks. And I want to know who. So I’m issuing the Coronavirus Challenge. The numbers to beat are $289,000 and $90,000. If your net worth is down more than $289,000 and you have bought more than $90,000 worth of stocks during this selloff, I’ll happily concede that your pair is even bigger and more monstrous than our pair. Peace.

| Blogger | Net Worth Drop During Coronavirus Crisis | Amount of Stocks Bought During Coronavirus Crisis Sale | Coronavirus Challenge Score | As of Date |

|---|---|---|---|---|

| Root of Good | $673,000 | $100,000 | $773,000 | 3/18/2020 |

| Steveark | $550,000 | $200,000 | $750,000 | 3/18/2020 |

| Retire By 40 | $400,000 | $250,000 | $650,000 | 3/16/2020 |

| Retirement Manifesto | $433,000 | $130,000 | $563,000 | 3/18/2020 |

| Freedom Is Groovy | $289,000 | $90,000 | $379,000 | 3/17/2020 |

Leave a Reply