This post may contain affiliate links. Please read our disclosure for more information.

My first stint in college began over 40 years ago. From 1979 to 1984, I attended Buffalo University.

During the course of those five years, I made a lot of road trips back and forth between Buffalo and my home on Long Island. And little did I know then, a lot of those road trips were cloaked in profound personal finance wisdom. Here are five examples of what I mean.

Go East Young Man

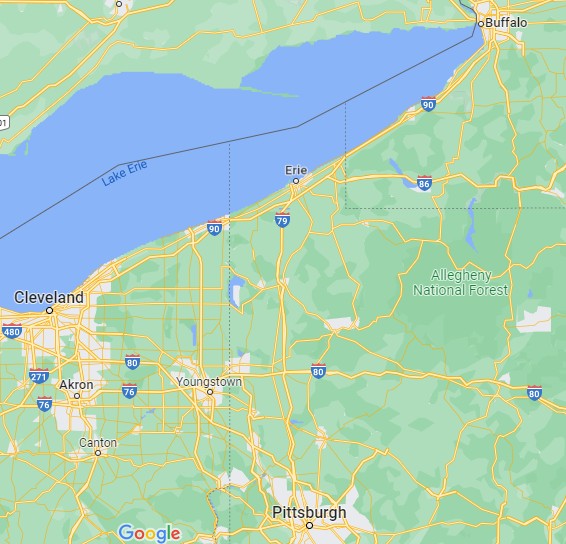

Driving from Buffalo to Long Island was fairly straightforward. Head east on Interstate 90 until you come to Syracuse. Then head south on Interstate 81 into Pennsylvania until you hit Interstate 80. Hang a left on Interstate 80 and forge ahead to the George Washington Bridge and eventually Long Island. Easy-peasy, right? My friends and I had done it dozens of times.

Wrong. In my super-senior year, I joined Joe and Tim for the Thanksgiving road trip back to Long Island. It was my first time making the trip with either of them. Joe was one of my current housemates and the owner of the car, and Tim was a mutual friend that Joe and I had known for several years. Both were far smarter than I was. Joe was pre-law and Tim was a finance major. And with them at the helm, I felt secure enough to leave the navigation to them and sleep off a hangover in the back seat.

I awoke a couple of hours later when Joe stopped for gas. And I immediately knew something was off. The location just didn’t have that familiar New York vibe. But I kept my mouth shut and gazed out the backseat window as we lumbered from the gas station back to the interstate. And sure enough, the interstate we lumbered back to wasn’t 90, it was 79.

For some unknown reason, Joe and Tim headed west on Interstate 90 when leaving Buffalo rather than east. They didn’t realize their mistake until we were halfway to Cleveland (no GPS and internet back then). And because of this blunder, they turned an eight-hour journey into a twelve-hour journey, and I got to enjoy a Pittsburgh rock station for the first (and only) time in my life.

Lesson: The smart aren’t infallible—and this axiom holds true whether the smarties in question are driving from Buffalo to New York or managing the portfolio of a retail investor. In other words, you can outsource the management of your investments to a financial advisor but you can’t outsource the responsibility. Trust but verify. You and you alone are responsible for your financial health. Your job is to become as knowledgeable about investing as possible. How else will you know if your financial advisor is driving you toward financial nirvana or driving you toward financial armageddon?

Release the Vomiteers

What did college guys in the early 80s do when they were passengers on a road trip and were relieved of all driving responsibilities? They pounded down beers, of course. Well, at least that’s what my degenerate college buddies and I did. And I’ll never forget one particularly egregious example of this tomfoolery. I was sitting in the backseat of Dan’s ’69 Nova as it chugged from Buffalo to Spring Valley, New York, under the direction of him and his co-pilot Jeff. To my left was a fellow named Chris, and between us sat a case of Genny Cream Ale. And without saying a word, Chris and I instinctively concluded that our mission was to ruin that case of Genny Cream Ale as quickly as possible.

The body doesn’t have an unlimited capacity to process alcohol. At some point, the body reaches its alcohol-capacity threshold and it has no choice but to signal its surrender. For me, that threshold was reached as we neared Syracuse, and my surrender manifested itself in my stomach. Whatever Cream Ale was sloshing around in there was no longer welcome. So I informed Dan that my “ralphing” was imminent. And at that point, Chris chimed in and announced that he too was on the precipice of “ralphing.” Dan then proceeded to make his way to the interstate’s shoulder as quickly and as safely as possible, but it was a futile gesture. Neither my stomach nor Chris’s would allow highway etiquette to halt the eviction process. So we both frantically rolled down our respective backseat windows and thrust our heads into the cold night air.

I can only imagine what it looked like to see two heads simultaneously emerge from a speeding ’69 Nova and spray the interstate with vomit. I’m sure it wasn’t pretty. And I’m sure most of the witnesses of that debauchery feared for America’s future. All I remember is that the 18-wheeler behind us put on his brights and honked his horn. I guess he approved.

Lesson: Money like alcohol tolerance is finite; wants like untrammeled beer consumption are infinite. You’ll never be able to save and invest until you learn to subdue your wants. If you’re in the thrall of your wants, you will inevitably destroy the saving capacity of your income, regardless of how high your income might be. The first rule of personal finance is thus: learn to find happiness in less—the combined carrying costs of your needs and wants should at most be 85 percent of your take-home pay.

Susquehanna Hat Company?

Back in the day, very few businesses were open on Sunday—especially in rural America. Americans took their Christianity more seriously back then and Sundays were reserved for church and rest. This, in turn, made Sunday road trips a little more adventurous. Finding an open gas station was far from a sure thing. And we learned this the hard way in the fall of 1981.

We began our road trip to New York on Saturday. But we dropped off our friend Bill in his hometown of Lyons, New York, and spent the night there (we loved the Tom Jones Bar and Grille). The next morning we got up early and hit the road. And everything was fine until we reached Pennsylvania. We were getting low on gas, and every time we exited the interstate, we failed to find an open gas station. Finally, we drove a little out of our way and found an open gas station in Susquehanna, Pennsylvania.

And here’s where the fun begins. Gary, the owner of the ’81 Mustang shuttling us home, drove up to the pump, turned off the car, and instructed the fine attendant to “fill ‘er up.” We then chatted amongst ourselves while the attendant did his thing, and after the tank was filled and Gary paid the bill, Gary attempted to start the car. But the car wouldn’t start.

The starter gave up the ghost and we were screwed. Finding an open gas pump was near impossible, never mind finding an on-duty towtruck and an open garage. But thankfully the gas station attendant took pity on us and called his mechanic friend. And thankfully his mechanic friend took pity on us and agreed to come open the garage and replace our starter. I spent the next three hours walking around Susquehanna looking for the Susquehanna Hat Company.

Lesson: If you turn something off, it won’t always turn back on. And this is especially true when it comes to the crucial task of providing for your future self. Don’t leave your retirement to chance. Show me a man who manually moves money from savings to a brokerage account or an IRA and manually buys stocks or shares in a mutual fund, and I’ll show you a man who will have a puny nest egg come retirement age. Life has an uncanny knack for mocking good intentions. Automate your savings and investments so you have no choice but to save and invest.

MacGyver Meets MacCareless

Here’s another ’69 Nova and Dan story. Dan was perhaps the smartest and most studious person I’ve ever met. He was a chemical engineering major who maintained a 3.5 GPA—which was quite lofty relative to his peers. Most chemical engineering majors had to work their tails off just to maintain a 2.8 GPA. And because he was so dedicated to his studies, other aspects of his life didn’t always get the attention they deserved. A great example of this was car maintenance. Dan’s ’69 Nova never got its oil changes and tune-ups as promptly as it should have, and small but irritating defects were allowed to linger for months (e.g., a glove compartment door that wouldn’t close, a door that couldn’t be opened from the inside, a makeshift car antenna fashioned from a metal coat hanger, etc., etc.).

Well, in 1981, on a road trip back to New York for spring break, we discovered another one of those small but irritating defects that Dan neglected to address. We were on Interstate 90 approaching Rochester when it started to rain. And rather than turn on his wipers, Dan pulled over to the interstate’s shoulder and stopped. He then informed us that the wipers were broken.

Our first instinct was to sit there on the side of the interstate and wait out the rain. But that might take hours. I then suggested we tie a shoelace on the tip of each wiper blade, feed the shoelaces through the appropriate front door windows, roll the windows all the way up to accommodate the thickness of the shoelaces, and then have Dan and his co-pilot Jeff alternate shoelace pulls to mimic the behavior of functioning windshield wipers. Dan then turned to Jeff and said, “It’s worth a shot.”

Did my MacGyver shoelaces work? Yes, they did. And it was a good thing because it rained the entire trip back to New York. Dan and Jeff did five hours of alternate shoelace pulls.

Lesson: Markets are as unpredictable as road trips. At one moment they’ll be smiling on stocks. In another moment, they’ll be smiling on bonds. And the only way to “MacGyver” this uncertainty is to befriend rebalancing. Select an allocation that is appropriate for your age and risk tolerance (e.g., 70% stocks, 30% bonds) and then rebalance once or twice a year to maintain your desired allocation. When stocks are on a tear, you’ll end up selling stocks and buying bonds. When bonds are on a tear, you’ll end up selling bonds and buying stocks. Rebalancing makes you a financial genius: you’ll be the master of buying low and selling high.

Equine Disaster

This is the one notable road trip that occurred in a westerly direction rather than an easterly direction. It was 1983, and I was returning to Buffalo after the winter break with my housemate Bobby and a couple of mutual friends. We were about an hour and a half outside of Buffalo on Interstate 90 near a town called Canandaigua. It had just begun to snow but traffic was moving well. And then, out of nowhere, we hit a wall. Traffic stopped to a crawl and we inched our way along Interstate 90 for several miles. We knew a serious accident had taken place but were nonetheless unprepared for what we were about to see. A tractor-trailer carrying a large number of horses was involved in a multi-car accident and flipped over. There were at least a half dozen dead horses lying in the median and a handful of dead horses lying on the shoulder. A horrific sight, indeed.

Lesson: Neither the tractor-trailer driver nor the owners of those horses expected a visit from the fickle finger of fate on that tragic day. But the fickle finger of fate came—as he does—without warning. And rest assured, the fickle finger of fate will be coming for you at some point in the future. The fickle finger of fate ain’t a bigot. It’s an equal-opportunity abuser. It comes for young and old, black and white, gay and straight, rich and poor, and smart and dumb. So you best be prepared. A six-month emergency fund and a decent health insurance policy are the bare minimums on the preparedness—a.k.a shit happens—front.

Final Thoughts

Okay, groovy freedomist, that’s all I got. What say you? I say my college road trips were a font of hidden financial wisdom, and if only my brain had been wired to see those cues and piece them together into a unified framework, my financial life post-college would have been much more fruitful than it turned out to be. Do you agree? Were my college road trips a font of hidden financial wisdom? Or are my road-trip memories being shoehorned into supposed financial relevancy because I’m a half-assed financial blogger, and a half-assed financial blogger can’t help but look at every aspect of his rather uneventful life and see some kind of a “teachable moment?” Let me know what you think when you get a chance. Peace.

Only you can compare your degenerate youth to personal finance. At least in my degenerate youth I made it to the side of the road.

Mrs Groovy recently posted…What My College Road Trips Should Have Taught Me About Personal Finance

I knew I was going to hear something from the peanut gallery.

Great article post. Good wisdom paid for by years of experience. Too bad our current government regime has apparently NONE of this. 🙁

Yep. They have the answer to everything and the solution to nothing. Hope all is well on Long Island. Talk to you soon.

I’m so excited, because I’ve never read a story that I didn’t write myself that had a fellow chemical engineer in it. Even if he was an example of mechanical negligence. Mr. G, can you believe that all through high school and college I never had a beer or a drink until the day I turned 21? That’s the life of a compulsive rule follower. I have made up for it somewhat in the subsequent years.

Steveark recently posted…Back in the Game

I hear ya, my friend. I never came across one chemical engineering student at Buffalo University who was a habitual partyer. Most of them never drank. Dan and his roommate Jeff, another chemical engineering student, basically confined their drinking to when we were playing Risk. Their lack of partying was no doubt due to time constraints and the rigor of their majors (it’s hard to stay on top of your studies when you spend hours partying and dealing with hangovers). But I think it was also due to them instinctively knowing that a developing brain shouldn’t be subjected to a lot of alcohol. Some rules are put in place for a good reason. Glad you didn’t befuddle your brain with alcohol as a student. There’s plenty of time to do that while you’re an adult in the real world. Thanks for stopping by, my friend. Great comment as always.

Yours is a creative mind, Mr. G. Great job weaving those old college stories into metaphors for personal finance. Great application, and solid lessons.

Had to laugh at your Genesee story, I went to college with a few guys from Upstate NY, and we drank many a Genesee together (and yes, we’ve experienced those infamous “Genesee Screamers”). My vomit story was on Chicago’s Michigan Avenue, my rain story was on a motorcycle, and going the wrong way on I-90 happened after I was in Corporate America (I was also the passenger), and my Dad grew up along the Susquehanna River. We’ve shared some similar experiences, my friend (glad to say I can’t come up with any “dead horse” tales, tho…)

LOL! I forgot all about those infamous “Genesee Screamers” that I too suffered way too often. Now I know why we’re such kindred spirits. You’ll have to share your vomit story, your rain on a motorcycle story, and your wrong way on I-90 story in a future post. I’m sure your readers will love it. Thanks for stopping by, my friend. Made my day.

Mr. Groovy recently posted…What My College Road Trips Should Have Taught Me About Personal Finance

fun stuff, mr. groovy. i just so happen to be sporting my finger lakes gaming and racetrack t-shirt in the workplace today. that’s in canandaigua and those were likely racehorses. i hope all is well with you and mrs. groovy.

freddy smidlap recently posted…Smidlap 2022 Mid Year Stock Update

Hey, Freddy. I can’t believe someone in my blogging circle is familiar with Canandaigua. And thanks for the scoop on the racetrack. That equine tragedy now makes a little more sense. I never saw an industrial-sized horse trailer before that day. I had only seen horse trailers that transported two horses. Hope all is well on your end. Thanks for stopping by, my friend. Peace.