This post may contain affiliate links. Please read our disclosure for more information.

For the last half of 2022, I had a very undisciplined mouth. My one cheat day per week on the no sugar, no refined carb front became my three or four cheat days per week. The result of this gastro profligacy was all too predictable. I ended 2022 thirteen pounds over my preferred weight—193 versus 180.

To get back to my preferred weight of 180, I rededicated myself in 2023 to my one cheat day per week on the no sugar, no refined carb front. From Sunday through Friday, no sugary drinks, no bread, no snacks, and no fast food would pass down my gullet. My diet would be confined to the following:

- Meat

- Poultry

- Eggs

- Cheese

- Vegetables

- Bone broth

- Water

Saturday, of course, would remain my day to forego the Groovy diet and go mashugana. No food item would be barred. Cookies, burritos, pizza, ice cream—you name it—any decadently foul concoction of sugar and carbohydrates under the sun would be fit for consumption.

The Results

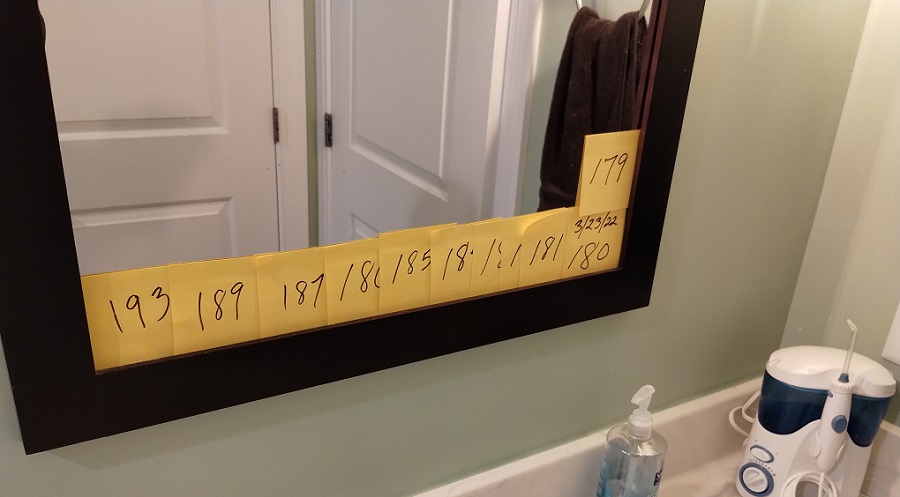

I wish I could say my struggle to return to 180 was hard. That way I could strut around and gush over my superhuman discipline. But it wasn’t hard. I reached 180 on March 23. And all I had to do was abide by a ketogenic diet for six days a week. I didn’t count calories. I didn’t ramp up my exercise. I didn’t starve myself. I just limited my consumption of sugar and refined carbs to one day a week. And for me, that isn’t hard. I don’t find a six-day-a-week diet of fat and protein and a smattering of complex carbohydrates to be a sacrifice.

Quick aside: I tracked my 2023 weight loss using my bathroom mirror and Post-it notes. I learned this trick from Andrew Huberman. He says it’s a great way to stay motivated. I used it, not for motivation, but to see how quickly I would get to 180. And now I’m using it to see how quickly I can get to 175.

My Diet Story and FIRE

My embrace of FIRE principles was very similar to my embrace of a largely ketogenic diet. It wasn’t a struggle at all. Prior to marrying Mrs. Groovy, I practiced standard American money management, not because I wanted to, but because it was all I knew. Normal people had debt. Normal people grabbed as much lifestyle as their take-home pay would permit. To be human was to be fully devoted to the rat race.

But then Mrs. Groovy introduced me to Dave Ramsey in 2003, and for the first time in my life, I had an alternative to standard American money management. Dave put forth the radical notion that debt was a choice—and a dumb one at that. Life would be infinitely better for anyone who got on a written budget, spent less than he or she earned, and used his or her monthly gap money to build wealth—first by getting out of debt, then by building up a 3-6 month emergency fund, and then by investing at least 15 percent of his or her income in the stock market.

And all while I was reading Dave’s Total Money Makeover, I remember being consumed by one overarching thought: That’s it? All I need do to turn my financial life around is put together an Excel worksheet, cut the cord, eat out less, drive a crappy car, and eschew expensive clothes, vacations, and amusements? Count me in.

Final Thoughts

When Mrs. Groovy and I began Dave money management in 2003, we were living paycheck to paycheck and had a negative net worth. But within a couple of months, we had $200-$300 of monthly gap money. And not long after that, before we had one year of Dave money management under our belt, we were generating $600-$700 of monthly gap money. By the time we left for North Carolina in 2006, our monthly gap money reached the dizzying height of $2,000, and our net worth was north of $250,000.* Not a small accomplishment for two ham-and-eggers living on Long Island with two modest-paying jobs.

* Quick aside: Our remarkable net worth turnaround was only partially the result of embracing Dave money management and getting rid of consumer debt. It was mainly the result of dumb luck. We sold our Long Island condo at the height of a real estate bubble.

Again, my point here isn’t to laud my superhuman discipline. In fact, I don’t consider our embrace of Dave money management, and our subsequent embrace of FIRE money management, to be anything special. For some reason, Mrs. Groovy and I never needed to appear more accomplished than we really were. We have always been perfectly happy with our own internal validation. We don’t need the validation of others. So it was easy for us to focus on a surefire formula for subduing wanton materialism and building a lot of gap money: needs before wants and functional before fabulous.

But how many Americans can follow the needs-before-wants-and-functional-before-fabulous formula? Obviously, not many. And I don’t think it’s because they are dumb or indifferent to their long-term financial health. I just think they lack a FIRE gene, if you will. What they have instead is a FOMO gene or an I-Crave-Status gene. Following the needs-before-wants-and-functional-before-fabulous formula would cause severe psychological discomfort.

And that’s why the rich keep getting richer and the FIRE movement will never be more than a cult. Man, generally speaking, isn’t built for building wealth.

Okay, groovy freedomist, that’s all I got. What say you? Let me know what you think when you get a chance. Peace.

Leave a Reply